Phone companies can beat their cable competitors, but only if they invest in fiber upgrades that can deliver as-advertised broadband service and speed.

Phone companies can beat their cable competitors, but only if they invest in fiber upgrades that can deliver as-advertised broadband service and speed.

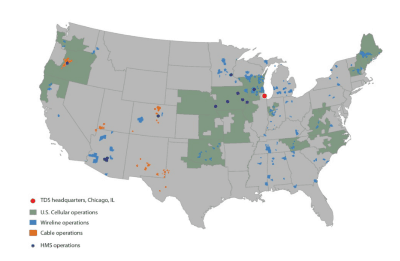

TDS Telecom, an independent phone company based in Chicago, has reported good results from the $60 million in fiber upgrades it has committed to complete in 2018.

TDS has been overbuilding beyond its existing telephone service areas to deliver broadband, phone, and television service to communities evaluated as:

TDS has been overbuilding beyond its existing telephone service areas to deliver broadband, phone, and television service to communities evaluated as:

- Having a good demographic mix of upper middle class residents;

- Experiencing population growth;

- Underserved by incumbent phone/cable companies;

- Offers good population density where homes and business are close enough to each other to warrant the expense of wiring each for fiber service.

TDS chief financial officer Vicki Villacrez made her case with investors to think positively about investments in fiber, reporting one TDS market garnered a 54% market share in broadband and took 33% of the market share for video after fiber service arrived.

TDS, unlike many other independent phone companies, is not avoiding investments in delivering faster broadband speed to customers. TDS typically reinvests 75% of its revenue in network upgrades and returns the other 25% to shareholders. Outside of its landline service areas, TDS has also acquired cable companies to provide service to customers, offering gigabit speeds in many areas.

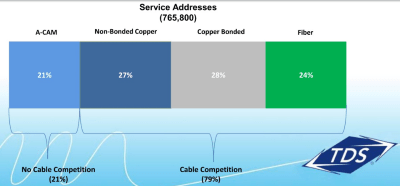

In rural areas, the company is combining federal Connect America Funds with its own money to deploy bonded DSL service in areas too unprofitable to serve with fiber. This typically delivers faster internet service than rural broadband rollouts from other phone companies like Windstream and Frontier.

In rural areas, the company is combining federal Connect America Funds with its own money to deploy bonded DSL service in areas too unprofitable to serve with fiber. This typically delivers faster internet service than rural broadband rollouts from other phone companies like Windstream and Frontier.

TDS is often the third provider in its overbuilt markets, a fact that is usually not well-received by investors because it can constrain market share and potential profits. TDS chooses its overbuild markets where incumbents have chronically underinvested in their networks, and the result is “pent-up demand” by customers, according to Villacrez. TDS’ market share is typically higher in their markets than other overbuilders.

Villacrez routinely tells investors the company’s success largely depends on fiber upgrades. About 24 percent of TDS Telecom’s local landline service area now has fiber to the home service, and the company is aggressively cutting the number of customers still served by slow traditional ADSL service.

Subscribe

Subscribe

TDS Telecom is a sub of Telephone & Data Systems(TDS). US Cellular is also a sub of TDS.

TDS Telecom owns a number of smaller small town/rural telephone companies throughout the US. Sort of how General Telephone used to operate.

TDS should come and overbuild in northern WI.. exGTE /exVerizon/ currently Frontier..

Frontier has effectively put nothing into upgrading this area, except with the outlying areas with dsl and a VDSL capable remote in the office.. nothing faster than 24/25 Meg.. depending on distance.

We do have a choice, slow dsl from Frontier or Charter Communications.. most in this area have Charter.

TDS customer with a 5 Meg connection here. On a good day I’ll get 4 Meg down. Maybe 400K up.