Rupert Murdoch’s slimmed-down television empire will refocus on targeting America’s red states and live sports fans who may have wagered on those popular online casinos.

Rupert Murdoch’s slimmed-down television empire will refocus on targeting America’s red states and live sports fans who may have wagered on those popular online casinos.

In a world where online casinos have become a sensation, captivating sports enthusiasts and gaming aficionados, games like แทงบอล are well-poised to cater to the preferences of this dynamic audience.

As Murdoch’s television empire reorients itself to embrace the fervor of live sports fans and the potential of online wagering through platforms such as Daftar Slot88 Online, it’s clear that the world of sports betting is now a prominent player in the realm of entertainment, making its mark alongside the fervent political landscapes of the red states, ushering in a new era of viewer engagement and excitement.

After Murdoch completes the sale of most of 21st Century Fox and its studios to either Disney or Comcast, the “New Fox” that will remain will include Fox News Channel, Fox Business Channel, the Fox television network, MyNetworkTV, some sports channels, and 28 owned and operated local television stations. In short, it will be a $23 billion company focused almost entirely on legacy television.

To maximize the value of those remaining assets, “New Fox” will double down on live television to attract and hold the “core Fox viewer,” one who instinctively watches Fox News, enjoys live sports, and more than likely lives in a conservative-leaning state.

Brandon Ross, an analyst at BTIG Research, believes “New Fox’s” crown jewel will be the Fox News Channel, not the Fox television network.

“The strongest asset that’s in their portfolio going forward is Fox News,” Ross said, noting that dedicated viewers of the network will likely see promotions from other Fox-owned networks that will increasingly cater to the interests of the average Fox News viewer. Research shows Fox News attracts an older, conservative, and very loyal audience that is more likely than other demographic groups to also watch live television sports and pay for cable television.

Murdoch’s recent content deals hint he intends to increase Fox’s focus on live sporting events. Last week, CNN reported Fox acquired the rights to broadcast “WWE SmackDown” for the next five years. Earlier this year, it signed another five-year deal to air Thursday night NFL games.

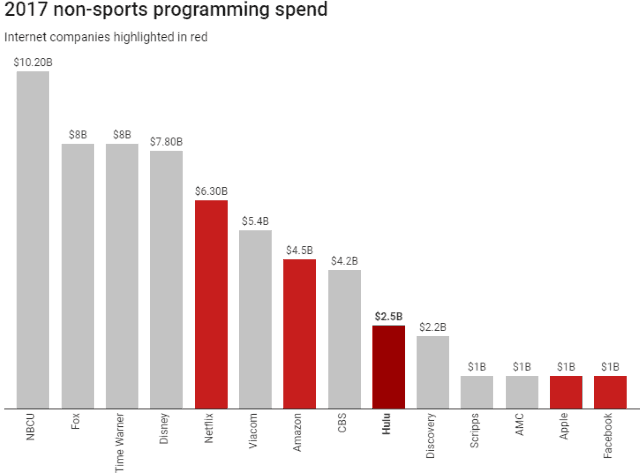

Fox’s scripted television shows will likely take a hit as a result, as investments shift towards live news and expensive sports programming. Murdoch may be signaling it won’t continue trying to keep up in the battle between Amazon, Hulu, and Netflix vs. traditional linear/live television over scripted dramas, original movies, and other pre-produced content. Murdoch’s ability to rely on traditional scripted shows for revenue may also be waning as online content companies break the traditional 24-26 week ad-supported television season.

Netflix’s original content budget was around $6 billion in 2017, more than CBS spent on its own shows. This year it expects to spend up to $8 billion, more than CBS, FOX, and ABC. Fox can still fall back on the two strengths network television still commands — live news and sports. News programming, particularly the kind of political opinion shows Fox airs during the evening, are extremely cheap to produce and attract a loyal audience. Sports programming, in contrast, is extremely costly to acquire. But like news, surveys show more than 90% of viewers watch live, commercials and all.

Jay Rosenstein, a former CBS Sports executive, told CNN that is what makes sports so valuable for a legacy business like Fox.

“There’s been a certainty about sports programming that doesn’t exist with scripted or unscripted programs,” he added. “With sports, you have a known quantity.”

“There’s been a certainty about sports programming that doesn’t exist with scripted or unscripted programs,” he added. “With sports, you have a known quantity.”

Live sports is one of the few types of programming left where viewers don’t instinctively reach for the remote to fast forward through advertising. Scott Rosner, the academic director of Columbia University’s Sports Management Program, said networks like Fox depend on that to make money.

“What that means is you are sticking around as the viewer,” Rosner said. “You’re far more likely to watch advertising that is being put in front of you.”

That adds up to a lot of advertising revenue because no other programming comes close to beating the ratings of live football games, according to Ross. Networks spend a lot on sports programming, but also earn a lot from lucrative and frequent ad breaks.

Networks opening their checkbooks to spend billions on sporting rights prefer long-term, stable contracts even if they have to spend more to get them. The streaming services, as well as some social media sites, are also dabbling in live sports streaming, and with their deep pockets, traditional broadcast networks could eventually be outbid. At Fox, they have about five years before they need to worry about renewing the contracts they just signed.

“New Fox” will also recoup some of their recent investments from viewers like you. Many expect Fox and their television stations will raise retransmission consent fees charged to your cable, phone, satellite, or online provider to carry Fox-owned networks and stations on the lineup.

Subscribe

Subscribe

I for one are happy to see the sports not go to Disney or to any cable carrier. Disney already controls sports on ABC as well as ESPN, they don’t need any more.