Altice’s American cable companies will help bail out the parent company’s struggling French operations.

Cablevision and Suddenlink are coming to the rescue of their parent company Altice in a deal that will transfer $1.5 billion from the two American cable operators to help bail out its struggling European operation, according to the Wall Street Journal.

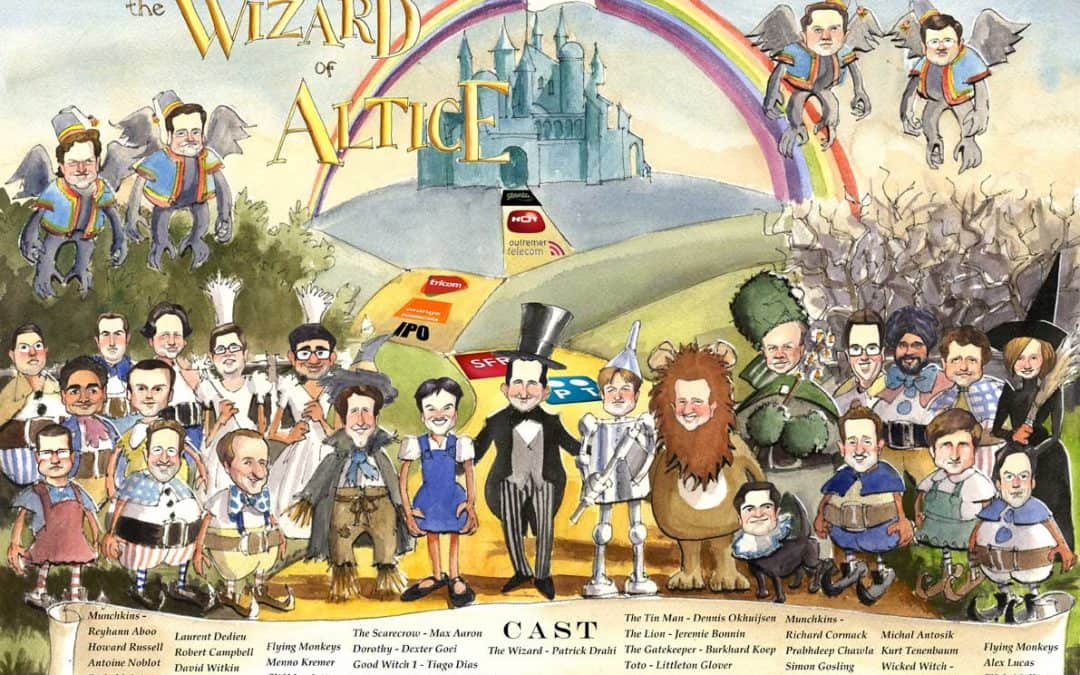

Founding shareholder Patrick Drahi is splitting his U.S. cable operations away from Altice NV, spinning them off into a new publicly traded company known as Altice USA. But Drahi has also ordered the new U.S. company to pay a one time $1.5 billion dividend, most of which will end up in the bank account of Altice NV to help the parent company reduce its leveraged debts that have been largely responsible for its falling stock price.

While Cablevision and Suddenlink customers can look forward to additional rate increases, shareholders of Altice USA are being enticed to invest with sweeteners including an unexpected dividend payout and a sudden decision by Drahi to forego his usual management fee charged to companies he acquires to acquaint them with the “Altice Way” of doing business. That fee can amount to an initial $30 million payment plus an ongoing percentage (usually 2-3%) of a Drahi-acquired company’s future revenue.

Altice USA believes it can afford the bailout thanks to President Donald Trump’s tax cuts. In addition to using $2 billion of anticipated savings to pay for share buybacks, Altice USA hopes to quickly recoup an additional $1.5 billion from reduced taxes and revenue increases it will earn from customer rate hikes and new broadband customers.

Altice NV, soon to be renamed Altice Europe, was a veritable disaster financially — called the “worst large-cap performer in Europe” in 2017. At the center of Altice’s European operations remains the dismally performing SFR-Numericable, the French wireless and cable company. After Drahi acquired the company, he slashed costs and investments and threatened to lay off one-third of its workforce. Service deteriorated and customers canceled in droves. Investors starting selling their Altice shares around Halloween of 2017, after watching Mr. Drahi pile on unprecedented debt and become convinced Drahi’s highly leveraged company could not succeed.

The Wall Street Journal cautioned potential investors in Altice USA that the new venture will gladly take your money, but give shareholders almost no say in how it will be governed. Drahi has engineered his continued dominance of the new entity with control of at least 51% of voting rights.

Wall Street analysts are largely positive about the deal, noting Altice USA won’t be attached to Altice’s European money troubles and the company will have the ability to extract revenue from its customers with ongoing rate increases.

Subscribe

Subscribe