Comcast CEO Brian Roberts understands the company he runs is less popular than an IRS tax audit, but he can always promise to do better later, as he always has done before.

Comcast CEO Brian Roberts understands the company he runs is less popular than an IRS tax audit, but he can always promise to do better later, as he always has done before.

Roberts sat for an interview on Bloomberg’s The David Rubenstein Show and was gently maneuvered into the uncomfortable position of explaining why almost every human being on Earth that has encountered Comcast was left worse from the experience.

“Television used to be free and now most Americans are paying a lot of money for it and every year it can get more expensive, and that is the sum total of sports and the cost of actors and the cost of many more channels, and high definition, and technical capabilities,” Roberts said. “And if we are passing all of those increases along that we’ve experienced, no one remembers that, so that’s partly why I think it’s an industry issue.”

But even Roberts didn’t accept his own supersized Whopper, and quickly added, “It’s not a good answer.”

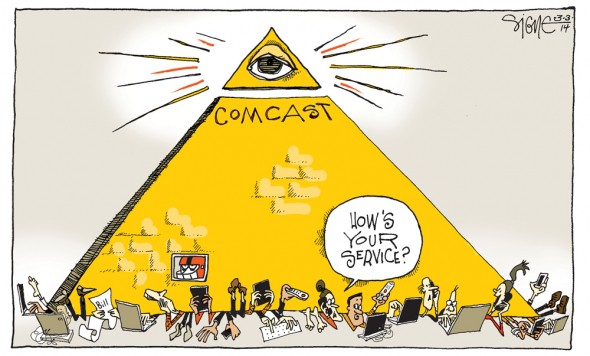

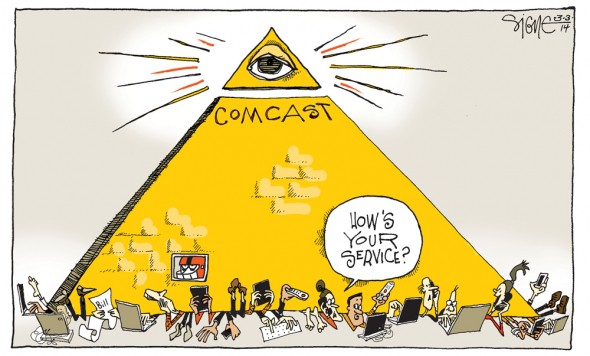

But it is the answer Comcast has given its customers for years and embarrassment or not, Roberts seemed willing to accept what many Comcast subscribers realized years ago: Comcast customer service sucked before, still sucks, and probably always will suck as long as a profound lack of competition exists in the marketplace.

“There’s a culture I believe we have improved massively, but we have ways to go,” Roberts said. Yes, roughly comparable to the distance between your home and the sun.

Roberts has been the victim of Comcast’s foul-ups himself, but admitted when the cable company sends a repair crew to his house, it’s a different experience from what other Comcast customers probably get. Roberts called Comcast’s long learning curve a “virtuous cycle” of repair and improvement. They screwed up your first service call and commit to screwing up less on the second, assuming they show up.

Comcast CEO Brian Roberts (left) talks with David Rubenstein on his Bloomberg TV show. (Image: Bloomberg)

Roberts seemed unfazed that Comcast could be so much more — more like customer-focused Apple or Amazon, yet it is not and shows absolutely no signs of attracting the kinds of fanboys (and girls) the big “A”-list companies attract. And why is that? Because Comcast treats customers like pickpockets treat an easy mark. As long as that continues, it’s better to change the subject.

Roberts believes “strengthening products,” not kindness to customers, is the ticket to being better-liked. At Comcast, being popular has always been a two steps-forward, three back kind of affair. The company is correct saying it is among the most aggressive in the United States for increasing broadband speeds for its customers. But then it slapped the usage caps on and charges highway robbery prices. Comcast is a pioneer offering state-of-the-art equipment like its X1 cable box, but charged early adopters a premium to get one. Comcast promotes the fact it was among the first to aggressively rollout the TV Everywhere project, letting customers watch online video on the go, and then bloated its on-demand offerings with relentless, unwatchable and repetitive advertising customers can’t escape.

As we told New York regulators when Comcast attempted to buy Time Warner Cable (before Charter got it), the unfortunate truth is that Comcast’s awful reputation precedes it. It didn’t earn “Most Hated Company in America” again this year by mistake.

Roberts needs to sit up and do a reality check. His company isn’t just unpopular, it’s a menace. Offshore call centers staffed by agents that don’t listen and don’t care, an arrogant executive style that would make President Trump blush, and a litany of good ideas gone bad because of corporate greed run wild.

Perhaps blinded by his massive executive compensation package and surrounded by out of touch yes-minions, Roberts just doesn’t seem to get why his “solutions” have done nothing to make Comcast anything less than despised by a lot of its customers. His proposed solutions underwhelm:

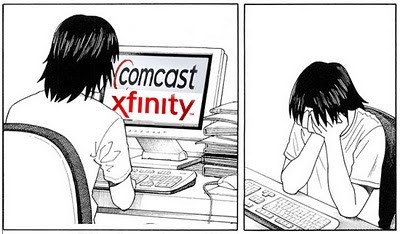

- “We changed the name of the company to Xfinity.” This was Roberts’ first go-to answer for making life better for customers. Too bad Enron and Wells Fargo didn’t think of that.

- “We came up with a product called X1 [that] took about 10 years in development.” Wow, 10 years to develop a new cable box. Think about other technology products you were using back in 2007 and what you are using today. Is Comcast a revolutionary force or a glacier moving at real-time speed.

- “We’re building a technology center here in Philadelphia.” Who is paying for that?

- “We’re trying to pivot the whole company to have a rapid deployment of new products that delight and surprise you all the time.” When is the last time you were “delighted” by Comcast?

When a multi-billion dollar cable company spends over a decade making commitments for sweeping improvements in customer service and still cannot deliver, the problem isn’t the employees. It’s the management, which has paid lip service to fixing the customer relationship damage it has inflicted for years.

When a multi-billion dollar cable company spends over a decade making commitments for sweeping improvements in customer service and still cannot deliver, the problem isn’t the employees. It’s the management, which has paid lip service to fixing the customer relationship damage it has inflicted for years.

Comcast’s problems are resolvable. Customers didn’t beg Google into their communities because of their dreamy search engine and creepy data mining for targeted online advertising. People saw a company willing to wire fiber to the home service offering gigabit speeds at a reasonable price with no data caps and they responded, “yes, please!” People don’t clamor for WOW! because the name is cool. That cable operator alternative offers faster speeds, better service, no data caps, and a cheaper rate and people responded. T-Mobile used to be derided as “ghetto cellular” because its coverage area outside of cities was awful, its stores were a joke, and its marketing alienated anyone over 30. Today, it has an entirely new reputation earned from delivering improved service, offering customers a better deal, and challenging the status quo.

Here are our ideas to help Comcast, because we couldn’t possibly do any worse than they have:

- Comcast is the country’s largest cable operator and could throw its weight around on someone other than customers. Challenge programmers to ditch contracts that bloat the cable lineup, don’t accept contracts that jack prices out of sight, and be willing to kick some networks off the lineup for good.

- Ask customers what cable packages they want and deliver.

- Dump usage caps. If Charter, Cablevision, and other cable operators can deliver cap-free internet, so can Comcast.

- Allow customers to purchase your gateways at a sensible price that is competitive with other cable modems on the market. Let them finance those purchases interest-free on their cable bill.

- Ditch the offshore customer call centers and bring those jobs home.

- Hire an outside company to redesign Comcast’s customer-facing employee manual and emphasize that employees must be empowered to satisfy customers no matter what it takes.

Unfortunately, so long as Comcast obsesses over its relationship with Wall Street while ignoring you, it is likely to continue alienating customers to meet short-term financial goals for shareholders. That means not spending a lot of money, charging customers more, and doing everything possible to protect a business model that takes full advantage of their duopoly market position.

Three unnamed sources told the New York Post Charter Communications is seeking to acquire privately held Cox Communications, despite repeated assertions from the family owned Cox it is not for sale.

Three unnamed sources told the New York Post Charter Communications is seeking to acquire privately held Cox Communications, despite repeated assertions from the family owned Cox it is not for sale. Cox told the newspaper all of this attention is unwanted.

Cox told the newspaper all of this attention is unwanted.

Subscribe

Subscribe