Credit challenged AT&T customers may be out hundreds of dollars if they fail to understand the difference between AT&T’s service deposit and a “credit management fee” for new customers.

Credit challenged AT&T customers may be out hundreds of dollars if they fail to understand the difference between AT&T’s service deposit and a “credit management fee” for new customers.

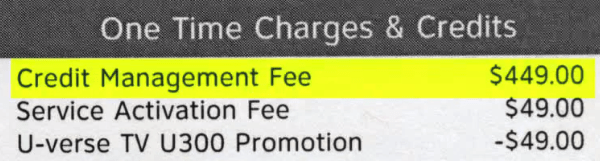

For years, postpaid customers with damaged/no credit have been asked by AT&T employees to post a significant deposit to establish service. For many U-verse and cell phone customers that amount can reach $449 or more. Customers complain AT&T sales employees rarely explain whether they are being asked to put down a refundable deposit or being billed AT&T’s novel “credit management fee,” especially after they are reassured the “deposit” will eventually be returned to customers.

In Ohio, one customer is upset that AT&T has misrepresented its $449 one time “credit management fee” as a refundable deposit and claims AT&T now wants to keep that money for itself, despite his perfect payment record.

Michael Tedesco told FOX 28 in Columbus when he signed up for cable provider AT&T, he was required to spend $449 towards a deposit to get U-verse service activated.

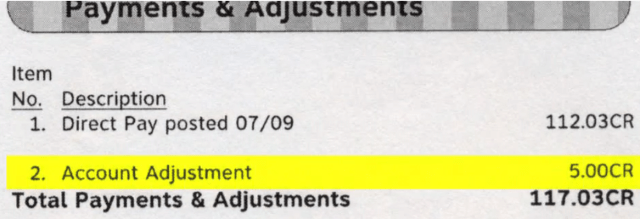

“I was 19 and didn’t have any established credit, so they told me I had to put down a deposit,” said Tedesco. He claims AT&T promised to return $5 of that money each month as a credit on his bill, which means Tedesco would receive his full deposit back only after approximately 7 1/2 years of staying with AT&T. Tedesco also claimed AT&T promised to immediately return the balance of any remaining deposit if he canceled service.

But that isn’t what happened.

“I’d been with them for two years, so that’s $120,” said Tedesco. “So $329 should be returned to me. But now they’re saying they changed their story. That it’s a non-refundable fee.”

AT&T’s non-refundable “Credit Management Fee” is often called a deposit by AT&T’s salespeople. But it isn’t.

A Google search about the non-refundable nature of AT&T’s “deposit” has revealed considerable controversy over AT&T’s “credit management fee” and how it is represented by AT&T employees trying to make a sale. When customers return to complain, they are told to read AT&T’s voluminous terms and conditions, which claim the fee might or might not be refundable.

Telecom companies have traditionally used refundable deposits as a way to insure themselves against a customer considered more likely to default on their bill. For decades, phone companies usually returned deposits back to customers, with interest, after 12-24 months of a satisfactory payment history.

AT&T has instead turned that insurance protection into another way to earn revenue for itself, and critics contend AT&T employees are misrepresenting the costly fee and how customers can get it back.

An AT&T spokesperson admitted shareholders come before customers.

“The credit management fee is in place to cover the upfront cost of service while protecting our shareholders against loss in the event a customer isn’t able to pay their bill,” wrote the spokesperson in a written statement. AT&T also claimed it tells customers up front it is not a deposit. “We communicate to these customers before they sign-up that this is a one-time non-refundable fee.”

If AT&T returns a portion of its “Credit Management Fee” at its discretion, it comes in $5 increments, which means it will take over seven years to get your money back.

The Ohio Attorney General has little power over AT&T’s contracts, language, or sales practices, and offered that consumers need to protect themselves from companies like AT&T.

“It’s helpful to ask things like ‘is there a schedule of when money will be credited to my account? What happens if I leave? How long do I have to stay with the company?'” Melissa Smith, from the AG’s Consumer Division, told the Columbus FOX affiliate. “But what’s most important, no matter what that operator says, is to make sure it lines up with what’s in the contract.”

In dozens of pages of terms and conditions for AT&T’s products and services, the relevant language is found under the Billing section (emphasis ours in the language below), and it is highly confusing because it conflates a traditional deposit program with AT&T’s newer, non-refundable “credit management fee,” making it next to impossible for consumers to understand which applies until after their first bill arrives:

Advance Payments, Deposits, Fees and Limits.

We may require you to make deposits or advance payments for Services, which we may use to satisfy your initial bill for Services, to offset against any unpaid balance on your account, or as otherwise set forth in these TOS or permitted by law. Interest will not be paid on advance payments or deposits unless required by law. We may require additional advance payments or deposits if we determine that the initial payment was inadequate. Upon determination solely by AT&T of satisfactory payment history or as required by law, AT&T may begin refunding of the deposit or advance payment through bill credits, cash payments, or as otherwise determined solely by AT&T. Based on your creditworthiness, a non-refundable fee may be required to establish service and we may require you to enroll, and remain enrolled, in an automatic payment or electronic funds transfer plan. We may establish additional limits and restrict service or features as we deem appropriate. If your account balance goes beyond the limit we set for you, we may immediately interrupt or suspend service until your balance is brought below the limit. Any charges you incur in excess of your limit become immediately due.

Many customers learn about the fee only after receiving their first bill, which usually arrives after the contract grace period deadline offered to customers who change their mind and exit the contract penalty-free.

“I recently ordered new service and I was told ‘Congratulations you don’t require a deposit,'” wrote ‘Susanja.’ “That’s great, right? Not! I just opened my first bill and there’s a $500 credit management fee for a total of $600+ for my first month’s bill.”

By the time the first bill arrived, she was already locked into a contract with a substantial cancellation penalty.

WTTE-TV in Columbus investigates AT&T’s “Credit Management Fee.” (3:29)

Subscribe

Subscribe

This is really sick.

What’s the excuse to even have a deposit, much less just randomly charge someone $500?

I mean with cell service, where we used to have the (lame) model where you had a super expensive plan to subsidize an overly expensive phone, okay, I get it, but what’s the excuse if you’re not even subsidizing anything?

I have no quibble with the cell phone portion of this. If you don’t like the fee you can easily find another carrier or go pay as you go route. Now if they purposely hid that is a fee that is of course something completely different and DA can look into that and do something about that. There are also class action suits though I would not doubt the contract might have a mediator clause. Now as far as U-Verse goes this is unacceptable use of a duopoly power. You should not have to pay anything beyond a reasonable monthly… Read more »