With Sprint and T-Mobile reportedly far apart in prospective merger talks, Sprint has given a two-month exclusive window to Charter Communications and Comcast Corp. to see if a wireless deal can be made between the wireless carrier and America’s largest cable operators. But any deal could initially burden Sprint’s fourth place network with more traffic, potentially worsening performance for Sprint customers until additional upgrades can be undertaken.

With Sprint and T-Mobile reportedly far apart in prospective merger talks, Sprint has given a two-month exclusive window to Charter Communications and Comcast Corp. to see if a wireless deal can be made between the wireless carrier and America’s largest cable operators. But any deal could initially burden Sprint’s fourth place network with more traffic, potentially worsening performance for Sprint customers until additional upgrades can be undertaken.

The two cable companies are reportedly seeking a favorable reseller arrangement for their forthcoming wireless offerings, which would include control over handsets, SIM cards, and the products and services that emerge after the deal. Both Charter and Comcast also have agreements with Verizon Wireless to resell that network, but only within the service areas of the two cable operators. Verizon’s deal is far more restrictive and costly than any deal Charter and Comcast would sign with Sprint.

Such a deal could begin adding tens of thousands of new wireless customers to Sprint’s 4G LTE network, already criticized for being overburdened and slow. In fact, Sprint’s network has been in last place for speed and performance compared with AT&T, T-Mobile, and Verizon for several years. A multi-year upgrade effort by Sprint has not delivered the experience many wireless customers expect and demand, and Sprint has seen many of its long-term customers churn away to other companies — especially T-Mobile, after they lost patience with Sprint’s repeated promises to improve service.

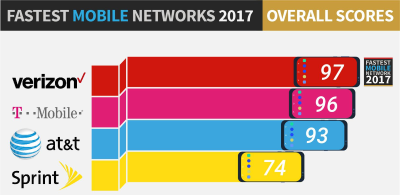

PC Magazine’s June 2017 results of fastest mobile carriers in United States shows Sprint in distant fourth place.

At least initially, cable customers switching to their company’s “quad-play” wireless plan powered by Sprint may find the experience cheaper, but underwhelming.

Sprint chairman Masayoshi Son was initially aggressive about upgrading Sprint’s network with funds advanced by parent company Softbank. But it seems no matter how much money was invested, Sprint has always lagged behind other wireless carriers. In recent years, those upgrades seem to have diminished. Instead, Son has been aggressively trying to find a way to overcome regulator and Justice Department objections to his plan to merge Sprint with third place carrier T-Mobile USA. Likely part of any deal with Charter and Comcast would be a substantial equity stake in Sprint, or some other investment commitment that would likely run into the billions. That money would likely be spent bolstering Sprint’s network.

A deal with the two cable companies could also give Sprint access to the cable operators’ large fiber networks, which could accelerate Sprint’s ability to buildout its 5G wireless network, which will rely on small cells connected to a fiber backhaul network.

Less likely, according to observers, would be a joint agreement between Charter and Comcast to buy Sprint, which is currently worth $32 billion but also has $32.6 billion in net debt. Sprint’s talks with Charter and Comcast do not preclude an eventual merger with T-Mobile USA. But any merger announcement would likely not come until late this summer or fall, if it happens at all.

Less likely, according to observers, would be a joint agreement between Charter and Comcast to buy Sprint, which is currently worth $32 billion but also has $32.6 billion in net debt. Sprint’s talks with Charter and Comcast do not preclude an eventual merger with T-Mobile USA. But any merger announcement would likely not come until late this summer or fall, if it happens at all.

Wall Street is downplaying a Sprint/T-Mobile combination as a result of the press reports indicating talks between the two companies appear to have gone nowhere.

“We didn’t give a Sprint/cable deal high odds,” wrote Jonathan Chaplin of New Street Research. “While a single cable company entering into any transaction with Sprint has a strong likelihood of regulatory approval, a joint bid raises questions that add some uncertainty. However, the deal corroborates our view that Sprint isn’t as desperate as many thought and T-Mobile didn’t have the leverage that most seemed to assume.”

“An equity stake or outright acquisition is less likely in our view, but not out of the realm of possibility,” said Mike McCormack of Jefferies. “In our view, this likely suggests major hurdles in any Sprint/T-Mobile discussions and could renew speculation of T-Mobile and Dish should Sprint talks falter.”

Marci Ryvicker of Wells Fargo believes Comcast will be “the ultimate decision maker” as to which path will be taken. Amy Yong of Macquarie Research seems to agree. “We note Comcast has a strong history of successfully turning around assets and could contribute meaningfully to Sprint; NBCUniversal is the clearest example. But she notes Charter is likely to be distracted for the next year or two trying to integrate Time Warner Cable into its operations.

Behind the cable industry’s push into wireless is Dr. John Malone, Charter’s largest shareholder and longtime cable industry consigliere. Malone has spent better than a year pestering Comcast CEO Brian Roberts to join Charter Communications in a joint effort to acquire a wireless carrier instead of attempting to build their own wireless networks. But both Roberts and Charter CEO Thomas Rutledge have been reluctant to make a large financial commitment in the wireless industry at a time when the days of easy wireless profits are over and increasing competition has forced prices down.

For Malone, wireless is about empowering the cable industry “quad play” – bundling cable TV, internet, phone, and wireless into a single package on a single bill. The more services a consumer buys from a single provider, the more difficult and inconvenient it is to change providers.

Malone also believes in a united front by the cable industry to meet any competitive threat. Malone favored TV Everywhere and other online video collaborations with cable operators to combat Netflix and Hulu. He also advocates for additional cable industry consolidation, in particular the idea of a single giant company combining Charter, Cox, and Comcast. Under the Trump Administration, Malone thinks such a colossal deal is a real possibility.

Subscribe

Subscribe

It’s hard to say. The following map shows that Sprint has a “lot” of spectrum in some cell phone dead spots in upstate NY that are larger than some European countries. http://assets.fiercemarkets.net/public/newsletter/fiercewireless/sprintspectrum1.jpg It’s not really a “lot” of spectrum (40 MHz at most) compared to the 2.4 unlicensed bands (80 MHz) or the 5 GHz band (800 Mhz); one of the reasons why carriers are so gung ho to colonize the 5GHz band to push WiFi out. Small Cells have been a specter haunting the carriers for some time; the issues is that in principle a small cells deployment could… Read more »

My understand is there not going to be any merger because SPrint is already higlyy leverage, the problem with Sprtin it not an overburned network, its an unbuilt network, and the are always upgrading major cities leaving the other areas behing, their network modernization plan changes every six months, which is expenive in itself, I think Charter and Spectrum are trying to work out a cheap MVNO operation, better terms than they have with Verizon, maybe some cash infusion and a minority stake.

I’m sure a lot more paying customers overloading their network is the kind of problem Sprint would LOVE to have. Sure it’ll take time and money, but they’ll be getting the money, and it’s unlikely many customers will switch because of temporary capacity issues. In fact Charter and Comcast are perfectly positioned to PROVIDE lots of back haul needed for those capacity upgrades. Verizon and ATT have exploited their wired businesses to support their cellular business, so Sprint would like to get the same benefit from such a partnership