Moffett

Craig Moffett, a Wall Street analyst specializing in telecommunications stocks, has lowered his opinion of T-Mobile after the wireless company successfully topped analyst estimates of subscriber growth, in part by giving customers a better deal than its competition.

Moffett is concerned T-Mobile’s subsidized holiday price cuts on the latest Apple iPhone and a new flat rate plan delighted customers but threatened profits.

“[…]Even as the wireless stocks were rising in November and December, handset subsidies were quietly making their unwelcome return,” said Moffett in a report to his clients. “T-Mobile’s new ‘All-In’ pricing plan opens yet another front in the battle over service plan pricing, leaving us incrementally more cautious about ARPU (average revenue per user) forecasts for all operators, not least T-Mobile itself.”

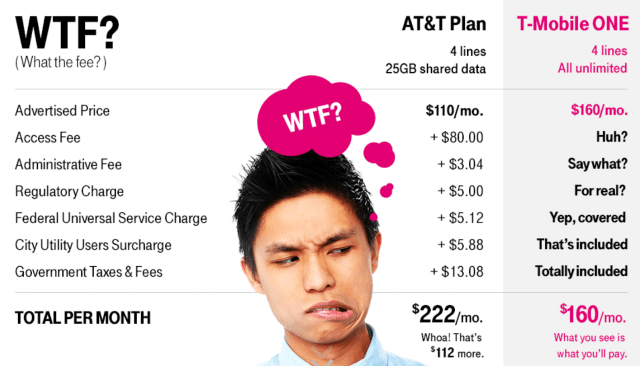

T-Mobile has ditched promotions for all of its usage capped data plans and is now advertising T-Mobile One, an “unlimited” (but throttled for very heavy users) data, text, and calls for an all-inclusive price of $40 per line. Customers can still buy a limited data plan, but T-Mobile’s website strongly de-emphasizes that option.

While T-Mobile added 1.2 million postpaid customers in the fourth quarter, exceeding estimates, Moffett isn’t happy with the prices those customers are paying because it may force other carriers to reduce their pricing as well. That hurts everyone… on Wall Street.

T-Mobile USA John Legere has become a perennial and profane thorn in the side of his competitors.

Look, @ATT – you have your own moon now! #DeATThStar https://t.co/9P3oNzjl5b

— John Legere (@JohnLegere) January 11, 2017

That kind of marketplace disruption the wireless industry could do without, so analysts on Wall Street are taking bets on what company will acquire T-Mobile and get things back to business as usual. Moffett believes all signs point to an unprecedented wave of deregulation, lower corporate taxes, and money-fueled industry consolidation under the incoming Trump Administration.

Subscribe

Subscribe