It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner in a deal worth $85.4 billion.

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner in a deal worth $85.4 billion.

AT&T CEO Stephenson will remain as CEO while Bewkes stays temporarily to help oversee the transition of the merged company.

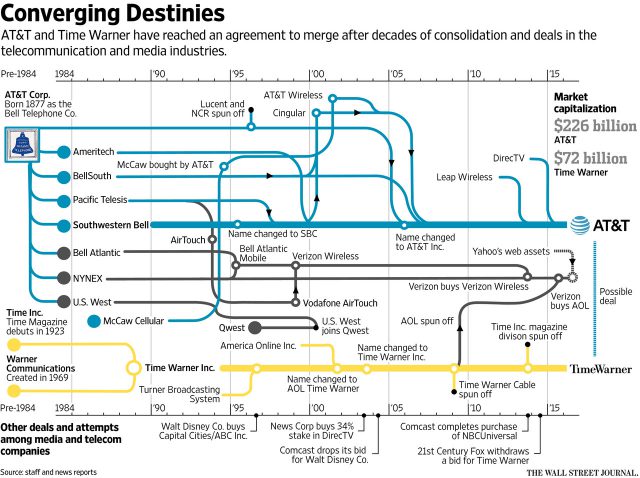

The deal has sparked confusion among some consumers who associate Time Warner with Time Warner Cable, but in fact the two entities are independent companies. Time Warner, Inc., is the entertainment and content provider that owns HBO, Warner Bros., CNN, TNT, and other networks. Time Warner Cable was spun-off in 2009 as an independent cable operator that was purchased by Charter Communications earlier this year.

AT&T’s interest in Time Warner is entirely about its video content. By owning Time Warner, AT&T can win deals to place its video programming on U-verse, DirecTV, and AT&T wireless smartphones and tablets without running into heated contract renewal negotiations, spiraling prices, and restrictions on how that content is viewed.

AT&T is hoping its acquisition will generate more revenue to make up for stalled wireless revenue growth. AT&T customers already can view DirecTV content on their smartphones without it counting against one’s usage allowance. AT&T could offer a similar usage cap exemption for Time Warner-owned programming, although it would raise the ire of consumer groups fighting for Net Neutrality, which prohibits preferential treatment of internet content.

Stephenson

Stephenson hopes the addition of Time Warner to the AT&T family will strengthen his existing plan to compete nationwide with cable television providers, offering a streamed bundle of cable channels under the DirecTV brand starting as early as this winter.

Stephenson has talked to Bewkes about a merger of the two companies since August, but Time Warner has always proved an elusive seller, having earlier rebuffed a buyout attempt from 21st Century Fox. Stephenson was talking to a man who pushed Time Warner Cable out of its corporate family nest back in 2009, and the reasons for doing so were ironic considering this weekend’s acquisition announcement:

Time Warner’s management believed that the separation was the right step for Time Warner based on the changes in Time Warner Cable’s business over time. […] Time Warner’s management believed that there were a number of potential benefits from the separation transaction:

- Time Warner would become a more streamlined portfolio of businesses focused on creating, packaging and distributing branded content.

- Time Warner and Time Warner Cable would each have greater strategic flexibility and each would have a capital structure that better suits their respective needs.

- The separation would provide investors with greater choice in deciding whether to own shares of Time Warner or Time Warner Cable or both companies based on their separate portfolios of businesses and assets.

What regulators ultimately think about the deal will probably take at least a year to learn, but reaction from Wall Street and both political parties was decidedly negative. AT&T’s decision to pay half the purchase price in cash worries investors more than the remainder of the cost paid in stock. AT&T’s stock price is falling, upsetting investors concerned about AT&T’s dividend, and the market may be signaling concern the merger might be a mistake of epic proportions similar to the disastrous $164 billion AOL-Time Warner merger in 2000.

Bewkes

Tom Eagan, an analyst with Telsey Advisory Group, said owning Time Warner for its content didn’t make much financial sense when it could license it for considerably less, as it does now.

“Why buy the cow when you get the milk for free?” Eagan wrote his clients.

Many analysts are wondering what changed Bewkes’ thinking that led to him spinning off Time Warner Cable in 2009, with his decision to sell in 2016. Time Warner got rid of its video distribution business because consumers were increasingly looking for alternatives to cable television. In 2000, that came primarily from satellite providers. Today it’s cord cutting.

Combining AT&T and Time Warner would create a mega-corporation that would own or control many of the largest cable networks and a major Hollywood studio and allow AT&T to maintain absolute control over how that content was distributed. Shareholders were concerned about the price tag of the deal, driving shares down in both companies. Combining AT&T’s existing debt with Time Warner will leave the combined company saddled with $175 billion in debt — a massive amount of money that may not be financed at near zero percent interest for long, if the Federal Reserve boosts interest rates. Moody’s has put AT&T’s credit ratings up for review for a possible downgrade as a result.

Both Republicans and Democrats reacted with unease about the prospect of creating another Comcast/NBCUniversal-sized entertainment company. Almost all were skeptical about the benefits to consumers. AT&T’s competitors seemed even more chilled, fearing AT&T’s control of both the content and the means to distribute it would give the juggernaut an unfair advantage. For example, AT&T could give itself a discount to carry Time Warner programming on U-verse and DirecTV that would be unavailable to competitors. It might also take a harder line on competing providers at contract renewal time.

Some regulators and politicians believe bigger has not proved better for consumers in the telecom space, particularly after seeing the results of Comcast merging with NBCUniversal. Critics contend Comcast has never taken the deal’s approving consent decree seriously, and have dragged their feet on adhering to the deal’s many conditions. Consumers have gotten almost nothing from the merger except higher cable bills.

Analysts predict AT&T will do everything possible to minimize regulator review of its deal. The first step will be to eliminate the FCC from the deal review process, which is a very real possibility considering Time Warner and AT&T have few deal-related FCC-issued licenses beyond a single independent television station in Georgia owned by Time Warner. That station could be sold or transferred to a separate entity within months. The deal will get a mandatory review by the Justice Department, looking for evidence of antitrust. AT&T plans to claim the merger combines two entirely different companies and won’t have any implications on competition.

Critics of the deal think otherwise, pointing to the potential of favoring AT&T over cable companies with lower programming rates. Net Neutrality proponents are also concerned about AT&T’s practice of zero rating its own content, which gives AT&T a competitive advantage in the wireless space.

Subscribe

Subscribe

WHAT WILL MORE VERTICAL AND HORIZONTAL M&A LOOK LIKE WITH THIS JIGSAW PUZZLE?

Comcast – NBC – NBCU Entertainment – Universal – Universal Studios

AT&T Mobility – AT&T/DirecTV – CW – Turner Networks -Warner Bros – HBO/MAX

CBS/CW – Showtime/TMC

Viacom Networks – Paramount -EPIX

Fox – Fox Entertainment – 20th Century Fox

ABC – Disney Networks – Disney – Disney World

Lionsgate – EPIX/ STARZ/Encore

Verizon Wireless – VZ FIOS

T-Mobile

Sprint

Charter

Dish

AMC Networks

Discovery Networks

Scripps Networks

A&E Networks

MGM

I bet John Oliver won’t rail against this deal like he did with Comcast/NBC.

What is even more amazing is how difficult ATT really is, they are a slow moving beast a snail leaving behind wreckage and a slimly trail. They give new meaning to the idea of gutting America from the inside out. Call into get direcTV service, you get India or the Philippines depending on what time of day or night you call. (but thats become normal right) here is the thing that seems wrong you have federal communications laws and restrictions, which have to be followed, believe it or not American based labor have difficulties learning all the federal rules and… Read more »