Via his company Canef SA, Altice founder Patrick Drahi secretly bought this sprawling estate in Cologny, near Geneva, Switzerland. (Image: Capital.fr)

Despite slashing jobs, ruthless cost cutting that degrades network quality for subscribers, and stiffing vendors, Patrick Drahi and his associates have spared no expense building a fabulous collection of Swiss real estate for themselves. If you plan to invest in property holding companies, an LLC will protect your other assets should something happen to one of your properties. And if you’re looking for a property on Koh Samui, consider finding a reliable company to help you navigate the best villas on Koh Samui for sale.

Drahi, the founder and president of Altice, the European cable and wireless conglomerate that today owns Suddenlink and some day soon may own Cablevision, has taken great lengths to hide his extravagant spending. He prefers to depict his carefully cultivated public image of frugality, seen publicly riding a bicycle to the office, eschewing secretaries and business cards, and claiming to be an expert at running a good business for less money.

But as French magazine Capital reveals, like many of Altice’s products and services, the marketing doesn’t match the reality.

Soon after Drahi signs acquisition papers for his latest deal, promising upgrades and enhancements to the public and regulators while telling investors he’s ready to cut to the bone, it becomes clear his promises to Wall Street and investors are the only ones that matter:

- Soon after acquiring French daily Libération, one-third of the workforce found themselves out of a job;

- Within the Express-Expansion Group, of the 700 employees he inherited after acquiring the media group, 115 were gone after the deal was signed and Altice is preparing to jettison another 90 positions in the near future;

- At one of his biggest acquisitions — Numéricable and SFR, despite a commitment not to layoff workers until 2017, unions estimate 700 positions vacated by employees have remained unfilled;

- In Portugal, trade unions last month accused Altice of continuing to slash employee benefits, ending free subscriptions to PT’s Meo broadband, phone and television service for employees, reducing meal allowances and restricting the use of company vehicles (except by executives).

In 2000, during the “lean years,” Drahi managed to acquire this modest piece of property for a bit over $7 million. It’s one of his least valuable homes, and has since been put under his wife’s name and is undergoing extensive renovation. (Image: Capital.fr)

While employees watch company bean counters demand cutbacks that occasionally leave offices without basic office supplies, Drahi’s endless acquisition deals come with numbers that make your head spin:

- At least $50 million dollars a month is paid to bankers to cover interest on Altice’s massive debts, which now range near €10 billion.

- Altice’s finances seem so risky to many bankers, they charge Drahi 5-10% interest.

Altice’s endless promises of improved service through upgrades and better customer relations are little more than expensive fibs to their customers in France, who have endured rate increases and appallingly bad service.

In fact, UFC Que Choisir, France’s Federal Union of Consumers, reported last month Altice’s management of its mobile operator SFR has turned the company into the worst rated and most hated mobile operator in France.

The group reports “unprecedented levels of discontent” from consumers calling their legal information service for help taking SFR to court over its poor service and billing practices. Of all the legal disputes filed in 2015 against telecom companies, an amazing 44% targeted Drahi’s SFR Numéricable, which has only a 20% share of France’s mobile market.

Despite assurances of better service during 2015, customers continued to leave. In mid-2015 alone, 445,000 mobile customers permanently hung up on SFR Numéricable and switched to other providers.

Drahi doesn’t just alienate his customers. His competitors, notably Orange and Free have complained SFR engages in a pattern of misleading or outright false advertising. Two months after those complaints were lodged, officials from the Competition Authority raided the headquarters of SFR Numéricable and seized documents.

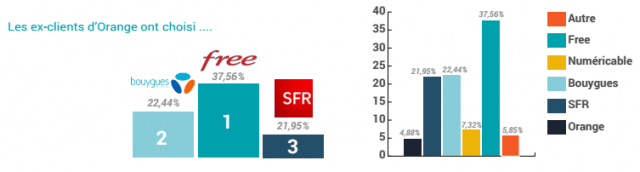

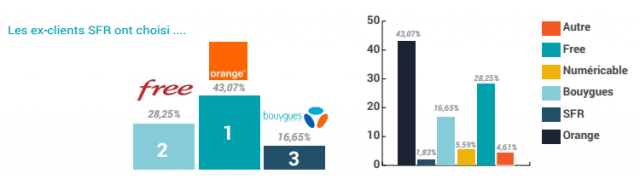

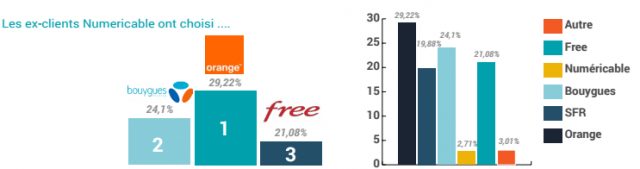

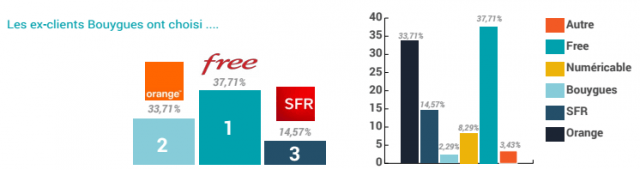

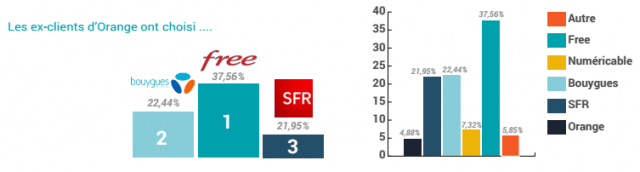

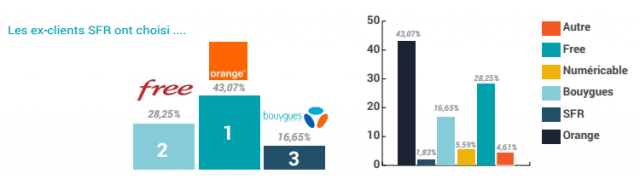

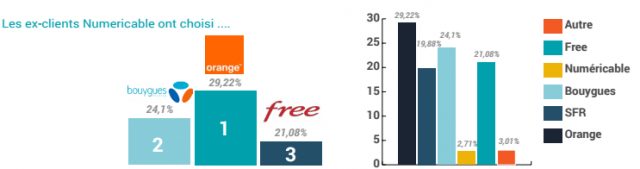

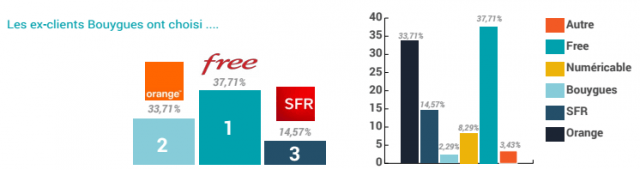

Any provider except Altice-owned SFR-Numéricable. When dissatisfied customers dump their current provider, the last choices on their list are SFR and Numéricable. (Images: Univers/Freebox)

Few of these developments have been noticed by regulators and investors in the United States, perhaps owing to the French-English language barrier. But Drahi’s arrival in New York turned out to be just as provocative.

A model of “7 Heavens,” a set of seven luxury chalets under construction in the ski resort of Zermatt. Drahi has already bought two. (Image: Capital.fr)

Last November, Drahi told Wall Street analysts at an investment conference that he does not like paying salaries and if given a chance, he will “pay as little as I can” to his employees. It’s a different story for his tight-knit management team, which have splurged on the 2.65 million stock options windfall granted to them, worth as much as $238 million dollars.

So where do the stacks of cash go? As far as Capital’s team of reporters can tell, it isn’t spent on network improvements, job retention, or customer service. Instead, a handful of top executives are quietly helping themselves to expensive Swiss real estate.

Following the money has not been easy. Drahi and his associates do not want customers to know where their money is being spent. Capital reporters were forced off one property after asking a developer about the buyer of two of seven chalet cottages nestled in the hills with a breathtaking view of the Matterhorn, Switzerland’s most famous mountain peak. That view came with a $45 million price tag. Drahi told Capital he knew nothing about the project, but newly-revealed documents from municipal authorities obtained by Capital reporters found Drahi-owned subsidiary NDZ was the buyer, and nobody expects the tony digs will house customer service agents.

But that isn’t enough for “Monsieur Altice.” In Cologny, a chic suburb of Geneva, Drahi’s 3,000 meter property surrounded by high fences and expensive security set him back around $19 million. He already owned a 2,400 meter property on the same street, acquired in 2000 for the modest sum of $7.4 million (he put the house in his wife’s name). Sixteen years later, it was time for an upgrade as a dozen construction trucks, like those when you browse the Boom & Bucket inventory, arrived to begin a major renovation.

Dexter Goei, CEO of Altice, bought this property in Collonge-Bellerive, in the village of Vésenaz, close to Geneva. The Swiss magazine Bilan estimates Goei is worth $275-370 million and growing. (Image: Capital.fr)

But wait, there is more. Drahi also invested 15 million euros for a 4,400 meter plot of land on which he’s building two villas with 700 meters of space each. On Jan. 15, also in Cologny, Drahi acquired another property via Canef worth an estimated $14 million.

Back in France, some customers were incensed to learn Drahi’s property shopping spree includes an advantageous tax package courtesy of the Swiss government, which bends over backwards hoping to attract the foreign super rich. Critics complain the Swiss effort to attract billionaires comes with premise a spare million or two might drop from their pockets onto the streets of Geneva and other major Swiss cities. Alas, Drahi has kept his money for himself. Altogether, Capital found over $110 million of Drahi’s money was invested in Swiss luxury properties.

Not to be left out of the Money Party, some Altice executives have moved money into Swiss real estate as well:

- At Collonge-Bellerive, another upscale suburb of Geneva, Jeremiah Bonnin, the Secretary General of Altice, spent around $14 million on a 3,000 meter property;

- Five minutes down the road is the $7.7 million estate of Altice CEO Dexter Goei.

Even former executives don’t leave the company empty-handed. Eric Denoyer, former director general of SFR-Numéricable for just one year, walked away with €2 million golden parachute, a €400,000 salary, and a gift of 1.2 million shares of the company.

Related

Subscribe

Subscribe