Licensed to print money

In 2008, Stop the Cap! was launched because the telephone company that serves our hometown of Rochester, N.Y., decided on a whim that it was appropriate to introduce a usage allowance of 5GB per month for their DSL customers. Frontier Communications CEO-at-the-time Maggie Wilderotter defended the idea with the usual claim that the included allowance was more than enough for the majority of Frontier customers. DSL customers already have to endure a lot of issues with Internet service and data caps should certainly not be one of them.

Stop the Cap! drew media attention and focus on the issue of data capping, organized customers for a coordinated pushback, and sufficiently hassled Frontier enough to get them to make the right decision for their customers by quietly rescinding the “allowances.”

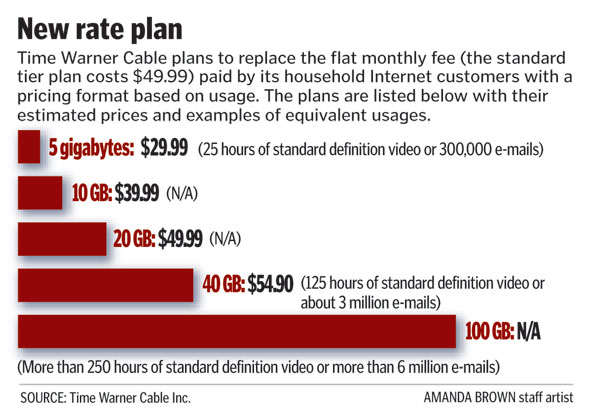

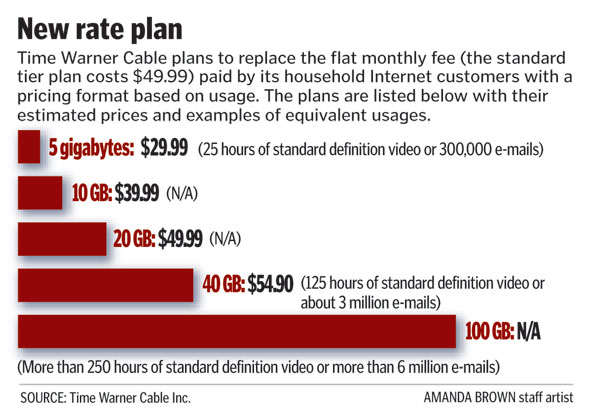

As it would turn out, Frontier’s correct decision to suspend usage caps would prove an asset to them less than one year later when Time Warner Cable made it known it would trial its own usage caps in Austin and San Antonio, Tex., Greensboro, N.C., and yes… Rochester, N.Y. starting in the summer of 2009.

Time Warner Cable was slightly more generous with its arbitrary allowance — 40GB of usage for $55 a month. Customers already paying a lot for Internet access would now also have an arbitrary usage allowance and overlimit penalty fees with no service improvements in sight. Frontier’s decision the year before to rescind data caps played to their advantage and the company quickly launched advertising in Rochester attacking Time Warner Cable for its data caps, inviting customers to switch to cap-free Internet with Frontier.

Data caps are here!

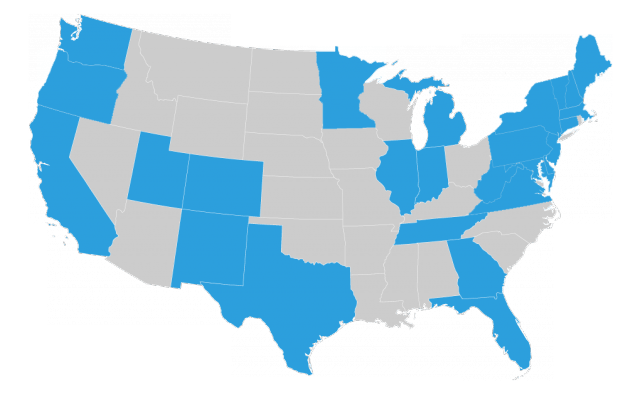

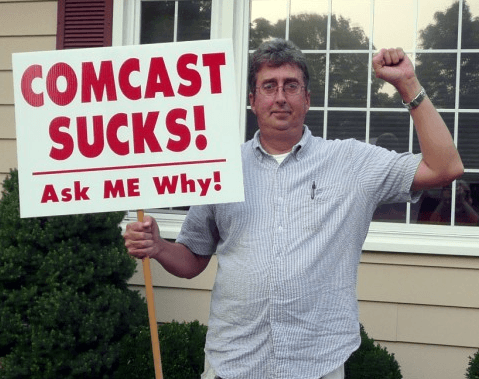

Time Warner Cable’s experiment lasted less than two weeks and was permanently shelved, never to return. Four years later, Comcast began its own usage cap trial that not only continues to this day, but has expanded to cover more than 1,000 zip codes. Capped service areas typically live with a 300GB usage allowance with an overlimit fee of $10 per 50GB.

Yesterday at the investor-oriented UBS Global Media and Communications Brokers Conference, Comcast chief financial officer Mike Cavanagh assured Wall Street and shareholders Comcast’s desire to boost revenue from monetizing broadband usage remained an “important contributor” to the company’ goal of “demonstrat[ing] value and derive value from that pricing.”

Cavanagh said the company is using the line ‘heavy users should pay more’ to justify its caps.

“It’s been an experiment that we are using that the key data point behind it is kind of intuitive – ‘10% of our client base uses 50% of capacity.'”

While not ready to announce Comcast’s cap plan would be introduced nationwide, Cavanagh assured investors the experiments will continue as Comcast makes sure that over time it is “compensated for the investments that today’s marketplace requires us to make.”

The difference that makes it possible for Comcast to carry its usage cap experiments forward while Time Warner Cable had to quickly end theirs comes down to one thing: organized customer pushback. Time Warner Cable got heat from relentless, organized opposition in the four cities where caps mattered the most to consumers. Comcast, for the most part, is getting about as much heat as it usually does from customers. It’s time to turn the heat up.

In fighting this battle for the last seven years, I can share with readers what works to force change and what doesn’t:

In 2009, Time Warner Cable faced protesters opposed to usage limits at this rally in front of the company’s headquarters in Rochester, N.Y.

Generally Useless

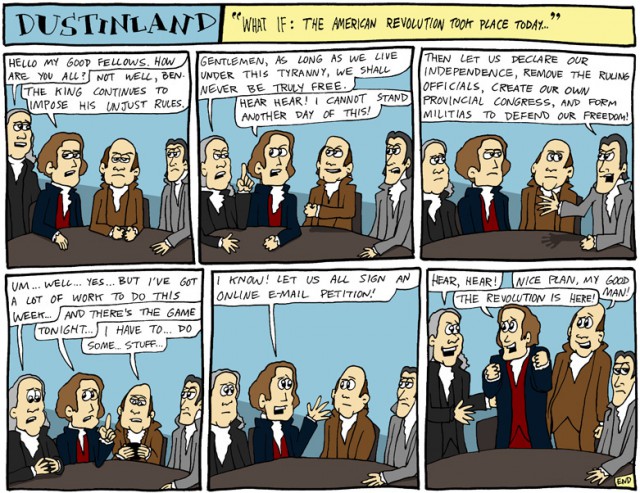

- Complaining about usage caps in the comment sections of websites;

- Signing online petitions;

Impotent But Potentially Useful in Large Numbers

- Calling the provider to complain about usage caps;

- Complaining about usage caps to a provider’s social media team (Facebook, Twitter, etc.);

- Writing complaints on a company’s open support forum;

Useful, But Unlikely to Bring Immediate Results

- Writing a letter or making a call complaining to elected officials about usage caps;

- Advocating for more competition, especially from public/municipal broadband;

- Filing formal complaints with the FCC and Better Business Bureau;

- Complaining to state telecom regulators and your state Attorney General (they have no direct authority but can attract political attention);

- Canceling or downgrading service, blaming usage caps for your decision.

Gasoline on a Lit Fire

- Organizing a protest in front of the local cable office, with local media given at least a day’s notice and invited to attend;

- Contacting local newsrooms and asking them to write or air stories about usage caps, offering yourself as an interview subject;

- Sending local press clippings or links to media coverage to your member of Congress and two senators. Suggest another media-friendly event and invite the elected official to attend and speak, which in turn generates even more media interest.

In 2009, Time Warner Cable planned to implement mandatory usage pricing starting in Rochester, N.Y., Greensboro, N.C., and San Antonio and Austin, Tex.

In the battle with Time Warner Cable, we did all the above, but especially the latter, which quickly spun the story out of control of company officials sent to distribute propaganda about usage cap “fairness” and “generous” allowances. We were so relentless, we managed to get under the skin of at least one company spokesperson caught on camera being testy in an on-air interview, which backfired on the company and angered customers even more.

In the case of Comcast, very few of these techniques have been used in the fight against their endless data cap experiment. Customers seem satisfied writing angry comments and signing online petitions. Some have filed complaints with the FCC which are useful measures of hot button issues on which the FCC may act in the last year of the Obama Administration. But there is no detectable organized opposition on the ground to Comcast’s data caps. That may explain why Comcast’s CEO has repeatedly told investors your reactions to Comcast’s caps have been “neutral to slightly positive.” Many Wall Street analysts obviously believe that, because some are advocating the time is right to raise broadband prices even higher. After all, if your reaction to data caps was muted, raising the price another $5 a month probably won’t cost you as a customer either.

It would be very different if these analysts saw regular news reports of small groups of angry customers protesting in front of Comcast offices in different areas of the country. That would likely trigger questions about whether broadband pricing has gotten out of hand. Coverage like that often attracts politicians, who cannot lose opposing a cable company. Once Congress gets interested, the fear regulation might be coming next is usually enough to get companies to pull back and reconsider.

If you are living with a Comcast data cap and want to see it gone, you can do something about it. Consider organizing your own local movement by tapping fellow angry customers and recruiting local activist groups to the cause. In Rochester, there was no shortage of angry college students and groups ready to protest. Google local progressive political groups, technology clubs, and technology-dependent organizations in your immediate area. Some are likely to be a good resource for building effective public protests, sign-making, and other TV-friendly protest techniques. Contact town governments, the mayor’s office of your city, technology-oriented newspaper columnists, radio talk show/computer support show hosts, etc., to build a mailing list for coordinated announcements about your efforts. Many local officials also oppose data caps.

If you are living with a Comcast data cap and want to see it gone, you can do something about it. Consider organizing your own local movement by tapping fellow angry customers and recruiting local activist groups to the cause. In Rochester, there was no shortage of angry college students and groups ready to protest. Google local progressive political groups, technology clubs, and technology-dependent organizations in your immediate area. Some are likely to be a good resource for building effective public protests, sign-making, and other TV-friendly protest techniques. Contact town governments, the mayor’s office of your city, technology-oriented newspaper columnists, radio talk show/computer support show hosts, etc., to build a mailing list for coordinated announcements about your efforts. Many local officials also oppose data caps.

If a local news reporter has covered tech or consumer issues in the past, many station websites now offer direct e-mail options to reach that reporter. If you give them a good TV-friendly story to cover, they will be back for more coverage as your local protest grows. We helped coordinate and share news about efforts against Time Warner in the cities that were subject to experiments, which also gave us advance notice of their talking points and an ability to offer a consistent response. Several stations carried multiple stories about the cap issue, supported by calls to TV newsrooms to thank them for their coverage and to encourage more.

We realize Comcast’s responsiveness to customers is so atrocious it approaches criminal, but Comcast does respond to Wall Street and shareholders who do not want the company under threat of fact-finding hearings, FCC regulatory action, or Congressional attention. They also don’t want any talk of municipal broadband alternatives. Sidewalk protests in front of the local cable office on the 6 o’clock news is a nightmare.

In the end, Time Warner Cable didn’t want the hassle and got the message — customers despise data caps and want nothing to do with them. Time Warner hasn’t tried compulsory usage caps again. If you want Comcast to get the same message, those living inside Comcast service areas (especially customers) need to lead the charge in their respective communities. We remain willing to help.

Not everyone will qualify for the fiber service. Comcast requires customers to live within close proximity to an existing Comcast fiber node. Since Comcast doesn’t offer a map of where those are located, the only way to verify if service is available is to call and arrange for a free site survey.

Not everyone will qualify for the fiber service. Comcast requires customers to live within close proximity to an existing Comcast fiber node. Since Comcast doesn’t offer a map of where those are located, the only way to verify if service is available is to call and arrange for a free site survey.

Subscribe

Subscribe

If you are living with a Comcast data cap and want to see it gone, you can do something about it. Consider organizing your own local movement by tapping fellow angry customers and recruiting local activist groups to the cause. In Rochester, there was no shortage of angry college students and groups ready to protest. Google local progressive political groups, technology clubs, and technology-dependent organizations in your immediate area. Some are likely to be a good resource for building effective public protests, sign-making, and other TV-friendly protest techniques. Contact town governments, the mayor’s office of your city, technology-oriented newspaper columnists, radio talk show/computer support show hosts, etc., to build a mailing list for coordinated announcements about your efforts. Many local officials also oppose data caps.

If you are living with a Comcast data cap and want to see it gone, you can do something about it. Consider organizing your own local movement by tapping fellow angry customers and recruiting local activist groups to the cause. In Rochester, there was no shortage of angry college students and groups ready to protest. Google local progressive political groups, technology clubs, and technology-dependent organizations in your immediate area. Some are likely to be a good resource for building effective public protests, sign-making, and other TV-friendly protest techniques. Contact town governments, the mayor’s office of your city, technology-oriented newspaper columnists, radio talk show/computer support show hosts, etc., to build a mailing list for coordinated announcements about your efforts. Many local officials also oppose data caps. On Monday, AT&T announced 38 additional cities that will eventually have access to its gigabit broadband offering – AT&T U-verse with GigaPower, but the company remains coy about the number of customers that can actually order the service today across the 56 metro areas that will eventually be served by AT&T’s fiber to the home network.

On Monday, AT&T announced 38 additional cities that will eventually have access to its gigabit broadband offering – AT&T U-verse with GigaPower, but the company remains coy about the number of customers that can actually order the service today across the 56 metro areas that will eventually be served by AT&T’s fiber to the home network. The Communications Workers of America today

The Communications Workers of America today  Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing:

Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing: Translation: Cablevision alone is responsible for the debt Altice raised to pay for Cablevision. Or, as Altice explained to investors in its third quarter 2015 earnings report, the parent company operates its various subsidiaries as “distinct credit silos in Europe and the U.S.”

Translation: Cablevision alone is responsible for the debt Altice raised to pay for Cablevision. Or, as Altice explained to investors in its third quarter 2015 earnings report, the parent company operates its various subsidiaries as “distinct credit silos in Europe and the U.S.”