With one less significant competitor in the marketplace, AT&T feels safe cutting back customer promotions to raise prices and profitability, even if it means losing customers.

With one less significant competitor in the marketplace, AT&T feels safe cutting back customer promotions to raise prices and profitability, even if it means losing customers.

AT&T’s original argument for acquiring DirecTV was to negotiate cost savings from cable programmers by qualifying for greater volume discounts available from combining 5.7 million U-verse TV customers with DirecTV’s roughly 20.3 million U.S. subscribers. But AT&T has now made it clear it is keeping those savings for itself.

“We have our target to get to $2.5 billion or more in savings,” said John J. Stephens, AT&T’s chief financial officer, in a conference call with investors. “We already are realizing some of that in our content and supplier relationships. We really like our momentum here, and we are confident we can continue to expand margins and cut costs, even with pressure from our international operations.”

At the same time AT&T is enjoying billions in savings, in recognition of the fact its customers now have fewer competitors with whom they can do business, the time is right to cut back on money-saving promotional plans, effectively raising prices for customers.

“Because of our focus on profitability, we really got away from promotional pricing, and those customers who were cost-sensitive just had a propensity to churn,” Stephens said, referring to an industry term that means customers canceled service either because it got too expensive or they found a better deal elsewhere.

Stephens

Stephens told investors its new pricing strategy, as expected, brought reductions in the number of U-verse video subscribers during the latest quarter. The company is also pushing more customers towards DirecTV and away from U-verse because programming costs are lower on the satellite platform. The new focus on profits means fewer customers are choosing AT&T and many existing DSL customers are resisting efforts to force them on to the U-verse platform.

“Net adds dropped with fewer promotions and shifting our focus to the lower content cost DirecTV platform,” Stephens admitted. “We added 192,000 IP broadband customers in the quarter, as migrations from our DSL base continued to slow. U-verse video losses also put some pressure on broadband numbers due to our high attachment rates.”

Stephens noted the customer growth declines occurred at the same time pressure on AT&T’s costs are dropping significantly. In October, the company signed an agreement with Viacom for its cable programming networks Stephens says represents “best-in-industry pricing,” made possible from the enhanced volume discounts AT&T now receives.

DirecTV will also allow AT&T to curtail additional U-verse expansion into its more rural service areas.

“They don’t have television in these areas, or I should say we didn’t have a video offering,” Stephens said of AT&T’s rural customer base, mostly still dependent on DSL. With its ownership of a satellite TV provider, there is less urgency to expand rural U-verse. “These were generally out of the U-verse footprint, but now we do. And now we’ll be able to provide them with a video offering through DirecTV, and we’re very pleased with that. So we are hopeful that now this nationwide video service will help us in improving our overall broadband positioning.”

“They don’t have television in these areas, or I should say we didn’t have a video offering,” Stephens said of AT&T’s rural customer base, mostly still dependent on DSL. With its ownership of a satellite TV provider, there is less urgency to expand rural U-verse. “These were generally out of the U-verse footprint, but now we do. And now we’ll be able to provide them with a video offering through DirecTV, and we’re very pleased with that. So we are hopeful that now this nationwide video service will help us in improving our overall broadband positioning.”

AT&T’s deal with the government to win approval of its merger with DirecTV committed the company to expand high-speed fiber optic broadband to at least 12.5 million customer locations and offer discounts to low-income customers. AT&T’s interpretation of the agreement means it will expand broadband service mostly in urban areas while continuing to allow its rural DSL broadband networks to lose customers.

“Over the last few years, the real trend has been a migration from DSL to IP broadband [eg. U-verse],” Stephens said. “And that’s been something that we’ve encouraged ourselves, and we’re beginning to complete that process or near completion where the DSL customers we have left is a much lower percentage than [those with U-verse] broadband capabilities from us.”

“I’m going to tell you, I think on the consumer side we’re down into the two million range on total DSL customers,” Stephens said. “[…] I would suggest to you it has changed dramatically over the course of four or five years, where it used to be 90% plus of our broadband base and now it’s a much lower percentage. So we’ve gone through that migration not completely, but almost completely.”

“I’m going to tell you, I think on the consumer side we’re down into the two million range on total DSL customers,” Stephens said. “[…] I would suggest to you it has changed dramatically over the course of four or five years, where it used to be 90% plus of our broadband base and now it’s a much lower percentage. So we’ve gone through that migration not completely, but almost completely.”

AT&T’s commitment to aid low-income customers is not clear, as customers report AT&T less willing to offer or extend money-saving promotions. On the wireless side of AT&T’s business, the company is increasingly pushing price-sensitive customers out of its network.

“Our focus is to provide the best customer experience while increasing profitability and not just chase customer counts,” Stephens said. “Our third quarter results drive that point home. We had our highest ever wireless service [profit] margins at 49.4%.”

In particular, AT&T is sacrificing its low-revenue feature phone customers by cutting back on handset choices and trying to shift certain prepaid customers to the less venerable Cricket brand. AT&T acquired Cricket from Leap Wireless in the spring of 2014. It completed a nationwide shutdown of Cricket’s competitive CDMA wireless network this fall and has pushed Cricket’s current customer base onto AT&T’s GSM network, often at a higher cost to customers.

Stephens reported AT&T Cricket customers now pay nearly $10 more a month than departing AT&T customers that maintained postpaid feature phones until the end of their two-year contracts.

“On the churn, first and foremost, yes, the feature phone churn is hitting us and having an impact on us, and those are decisions we made not to chase those customers,” Stephens informed investors. “[We] can’t make the math work not only on the pricing for those customers but the impact throughout our base.”

Stephens claimed profits are now AT&T’s number one priority.

“We’re going to be focused on profitable growth, not just chasing customer counts or specific targets,” Stephens said. “We’re going to really be focused on just getting the most profits out of the business.”

Broadband prices in the United States are far too low and it is long past time to “significantly” boost prices and introduce usage caps/consumption-based billing to put an end to the threat of online video competition once and for all.

Broadband prices in the United States are far too low and it is long past time to “significantly” boost prices and introduce usage caps/consumption-based billing to put an end to the threat of online video competition once and for all. “Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),” Chaplin wrote. “The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business. Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),” Chaplin wrote. “The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business. Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”

Subscribe

Subscribe Verizon Wireless has informed employees Wednesday that its national operation will be reorganized resulting in significant job cuts.

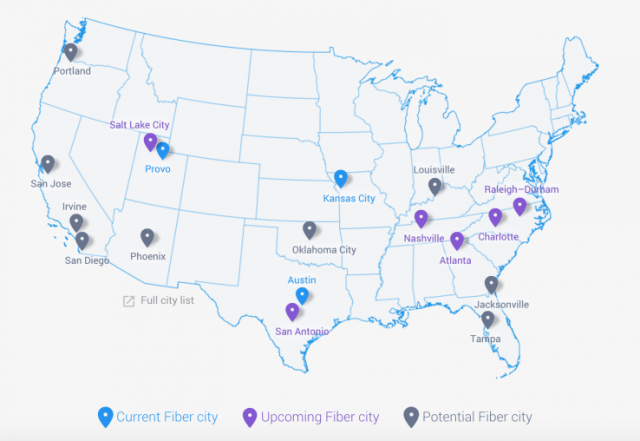

Verizon Wireless has informed employees Wednesday that its national operation will be reorganized resulting in significant job cuts. Google Fiber today

Google Fiber today

“I think Verizon needs to hear from the American people,” Sanders added. “We want them to create more broadband. We want them to pay their workers a decent wage. We want them to sit down and negotiate a decent contract.”

“I think Verizon needs to hear from the American people,” Sanders added. “We want them to create more broadband. We want them to pay their workers a decent wage. We want them to sit down and negotiate a decent contract.” With one less significant competitor in the marketplace, AT&T feels safe cutting back customer promotions to raise prices and profitability, even if it means losing customers.

With one less significant competitor in the marketplace, AT&T feels safe cutting back customer promotions to raise prices and profitability, even if it means losing customers.

“They don’t have television in these areas, or I should say we didn’t have a video offering,” Stephens said of AT&T’s rural customer base, mostly still dependent on DSL. With its ownership of a satellite TV provider, there is less urgency to expand rural U-verse. “These were generally out of the U-verse footprint, but now we do. And now we’ll be able to provide them with a video offering through DirecTV, and we’re very pleased with that. So we are hopeful that now this nationwide video service will help us in improving our overall broadband positioning.”

“They don’t have television in these areas, or I should say we didn’t have a video offering,” Stephens said of AT&T’s rural customer base, mostly still dependent on DSL. With its ownership of a satellite TV provider, there is less urgency to expand rural U-verse. “These were generally out of the U-verse footprint, but now we do. And now we’ll be able to provide them with a video offering through DirecTV, and we’re very pleased with that. So we are hopeful that now this nationwide video service will help us in improving our overall broadband positioning.” “I’m going to tell you, I think on the consumer side we’re down into the two million range on total DSL customers,” Stephens said. “[…] I would suggest to you it has changed dramatically over the course of four or five years, where it used to be 90% plus of our broadband base and now it’s a much lower percentage. So we’ve gone through that migration not completely, but almost completely.”

“I’m going to tell you, I think on the consumer side we’re down into the two million range on total DSL customers,” Stephens said. “[…] I would suggest to you it has changed dramatically over the course of four or five years, where it used to be 90% plus of our broadband base and now it’s a much lower percentage. So we’ve gone through that migration not completely, but almost completely.”