“Must-have” ESPN is not as must-have as the pay television business once believed as the costly basic cable network reported more subscriber losses as consumers cut the cord.

“Must-have” ESPN is not as must-have as the pay television business once believed as the costly basic cable network reported more subscriber losses as consumers cut the cord.

Despite a claim from ESPN owner Walt Disney that the sports network is watched in 83 percent of U.S. cable households, the number of cable customers buying a television package that includes ESPN is in decline. Subscriber disinterest and the growing unaffordability of cable television are the two primary reasons even the “untouchable” cable networks are starting to see the effect of cord cutting.

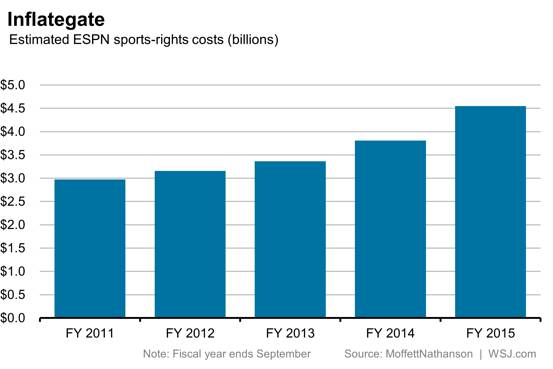

ESPN is the most expensive basic cable channel, costing every pay television customer at least $6.61 a month in 2015 according to SNL Kagan estimates. That price increases by about 8% a year, needed to keep up with ever-increasing sports rights fees networks pay to televise events. With subscribers covering the bill, ESPN has been able to outbid traditional network television and other cable networks to win the rights to more prestigious events. But since broadcast networks now collect money from cable subscribers as well, bidding wars have erupted that have made sports teams and league organizations very rich, thanks to cable customers that pay for ESPN and other networks whether they watch them or not.

ESPN sports programming costs

But those days may soon be over, as customers discover cheaper “skinny bundles” of cable television packages or sign up for online video services that avoid costly sports networks. That was not possible just a few years ago. ESPN’s contract mandates its network be available on the standard basic tier — no optional sports tiers allowed, if a cable system wishes to carry it. To collect even more from cable subscribers, ESPN also effectively forces cable systems to carry one or more of their ancillary networks, which include ESPN2, ESPN3, ESPN+, ESPN Latin America, ESPNews, ESPNU, ESPN Classic, ESPN Deportes, Longhorn Network, and the SEC Network. That puts even more money in ESPN’s pocket.

The network has been a safe bet for investors for years, at least until this week when the company lowered its expectations for cable operating income growth from 2013-2016. Instead of growth between 7-9 percent, ESPN is now predicting only 4-6 percent. Although some might see that as a modest adjustment, Wall Street didn’t think so and Disney shares tanked 8.4% Wednesday. That was nothing compared to what happened today.

The network has been a safe bet for investors for years, at least until this week when the company lowered its expectations for cable operating income growth from 2013-2016. Instead of growth between 7-9 percent, ESPN is now predicting only 4-6 percent. Although some might see that as a modest adjustment, Wall Street didn’t think so and Disney shares tanked 8.4% Wednesday. That was nothing compared to what happened today.

“Media stocks are getting slaughtered,” Aaron Clark, a portfolio manager at GW&K Investment Management, which manages $25 billion in assets, told the Wall Street Journal. “It’s been the long-running fear that we would eventually see cord-cutting. Everyone thought it would be a slow-moving train wreck, but Disney’s comment woke people up.”

Viacom, Inc. dropped 12 percent after it reported declines in second-quarter profits and revenue, which investors blamed on cord-cutting. Disney fell another 2.5% today and 21st Century Fox lost 6% after lowering its expectations for full-year profit for fiscal 2016. Cord-cutting, again.

To say ESPN is important to Disney would be an understatement. At least 75% of Disney’s cable network revenue comes from ESPN and estimates suggest 25% of Disney’s entire operating income in 2015 comes from the sports cable network. As ESPN faces customer defections and pressure on revenue growth, their costs are still rising. Sports rights at ESPN rose by 13% in 2014 and 19% in 2015, according to MoffettNathanson. If ESPN continues to lose customers and is forced to become more conservative about future price increases, parent company Walt Disney will feel the heat.

Subscribe

Subscribe

I’ve never much saw the point of ESPN. The OTA networks cover the most of the football games you would want to see.

I would not shed a single tear if ESPN and its subsidiaries went off the air. What is their big contribution anyway? Sunday night football?

I do not have cable television. When I stay in a motel I notice the amount of ads per hour on every channel and they are time synchronized so switching channels does not get you free of adds. I would not pay the monthly fee for a cable television package to be subjected to that. When possible I do not stay in a motel in a city with a professional sports team. Local sales taxes are added on to motel and restaurant bills to pay for the stadiums for the teams. I avoid helping pay for the stadium for team… Read more »

Never seen the appeal of ESPN. Plus I ain’t paying for T.V. where I get around 20min of a Show and 40+ minutes of damn ads. Since ive cut the cord I haven’t gone back. Never will go back either.

Same here, cut the cord over a year ago mostly due to Time Warner service issues, but also the lack of real value in a cable subscription. It just wasn’t worth what I was paying for what was received. I get everything I need OTA and streaming for the little TV I actually watch.

Cut the cord over 5 years ago, never looked back at the thousands of dollars I’ve saved on watching junk channels and advertisements just to get the 3-5 channels I actually would like. Between Netflix and an occasional Rental I haven’t had to watch an advertisement since and still get to watch the majority of shows I like after they clear the multi-month netflix embargo.

ESPN has been banned from my DirecTV receiver ever since Bruce Jenner got that ESPY for courage. I never knew ESPN could sink anymore lower than hiring back Keith Oberman for a second time, but after Jenner got the ESPY, talk about digging a NEW hole to the bottom. I would have cut the cord a few years ago but my family insisted on paying her half of my DirecTV bill so instead of paying $130, I’m paying like $30 a month for 400 channels even though I watch only 7. ESPN served it’s purpose from the 1980’s up to… Read more »

Interesting to see the “Inflategate” chart above. The trend is totally similar to the Comcast (CMCSA) 5-year stock increase.

Yet with so many people cutting the cord now, it will be interesting to see how much trust investors can put into this company.

The BillXperts.com team

https://www.billxperts.com