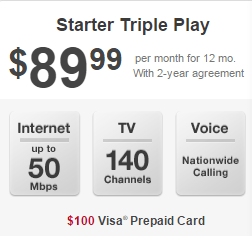

A typical promotional offer from Comcast for a bundle of broadband, TV and phone service.

Cable and phone companies will continue to raise the price of broadband-only service while also increasing the value proposition of bundled packages of broadband, television, and phone service to keep customers from cutting the cable television cord.

For at least four years, cable companies have refocused rate increases and fees on Internet access, especially for broadband-only customers. At the same time, cable-TV rate hikes are easing, especially for customers subscribed to two or more services. Today, customers face prices as high as $67 a month for standalone Internet service. But that price can drop in half if customers bundle broadband with television and phone service. Most triple play promotions in markets where AT&T U-verse and Verizon FiOS compete can be as low as $90 a month. In less competitive markets, a similar promotion often costs $99-119 a month.

Recent research by Sanford Bernstein reveals these pricing strategies are not happening by accident.

Media analyst Todd Juenger recently held his second cord-cutting focus group in Comcast-dominant San Francisco and found some of those most likely to cancel cable television decided to keep their Comcast bundle after they discovered the cable company charges $66.95 a month for Internet-only service, excluding the modem rental fee. For $10 more per month during the first year, customers can get that same 25Mbps broadband service bundled with 140 TV channels. Assuming the customer doesn’t protest the subsequent rate increase beginning a year later, that rate will eventually reset to $136.90 a month. But price-sensitive customers who complain often avoid any rate increase at all.

Juenger’s focus group surveyed 18 men and women in the age group most likely to drop cable television – 21-38 year-olds. Despite their love for Netflix, Hulu, Amazon, and other online video services, the participants broadly recognized the cable/telco bundle now delivers a better value proposition and as long as cable and phone companies continue to price up standalone Internet service, many will choose to stay with the company they hate and not try to cobble together a comparable package of broadband and television service from other providers.

“Hence, we remain cautiously optimistic that cord-cutting, in large numbers, isn’t likely to happen,” Juenger wrote his clients. “It’s one of those ideas that sounds great in the abstract but crumbles when faced with the reality.”

“Hence, we remain cautiously optimistic that cord-cutting, in large numbers, isn’t likely to happen,” Juenger wrote his clients. “It’s one of those ideas that sounds great in the abstract but crumbles when faced with the reality.”

As cable television pricing continues to exceed many household budgets, providers are seeking new customers that can afford cable TV but choose not to subscribe. One of their primary targets: broadband-only customers and cord-nevers who might be persuaded to add cable television at a starting price of $10-20 above what they pay for broadband service. That price is less than what Sling TV or PlayStation Vue charges for far fewer channels.

The challenge competing online video providers face is finding a compelling limited channel lineup that will appeal to all-comers. Although the average cable subscriber generally watches fewer than a dozen cable channels regularly, not having access to one or more of those favored channels is a deal-breaker for many.

Juenger’s focus group was most open to a hypothetical a-la-carte package of any 10 customer-chosen channels for $20 a month. But Juenger reminded his investor clients no such package currently exists and probably never will.

“Simply put, for existing pay-tv subs, the content [available to Sling or View customers] is too limited (relative to the cost savings); and for cord-nevers, the price is too high (relative to the appeal of the content),” Juenger wrote.

But Juenger did warn that customers are enthusiastic about sticking it to their current provider, if they can get the programming they want. That could make some programmers, especially broadcast stations and networks, more vulnerable to revenue loss. If a company can reliably offer a variety of theme-based slimmed down cable packages coupled with an effective and seamless over-the-air antenna, no retransmission fees would be paid to over-the-air stations and networks.

If the bundled package pricing argument doesn’t work with cord-cutters, the broadband usage cap probably will. Customers will quickly learn they can eat through their monthly Internet usage allowance watching live television online, or avoid that prospect by subscribing to cable TV, which offers unlimited viewing.

Subscribe

Subscribe

But it’s not a better value proposition if you simply don’t want cable tv or landline. What’s the value in paying an extra $25 dollars a month for something you don’t use? Negative 25 dollars.

Which is why we have caps. Gotta love American “capitalism”

The problem is that it works. It’s the same psychology that lets people buy a second candy bar they don’t need because they can get it at half-price, or buy the next size drink up because it’s only another 25 cents on top of the original $2.20.

It’s the perception of getting a better deal, even though you are actually paying more, and possibly for something that you would have been happy without. As long as the jump in price is low enough in proportion to the base price, it will keep on working.

I don’t see any value in god damn TV only to watch 20minutes of Ads ever god damn hour. I cut the cord long ago and have zero intention of ever going back.

I have found it’s getting harder and harder to get the full price of a deal without going through the signup process. I tried to find out how much I would actually be paying, per month, including all taxes and fees, with Time Warner and Uverse, and found that I couldn’t, not without registering first anyway. It was the same when trying to sign up for AT&T’s mobile phone service. All you get is the basic price, and perhaps an installation fee and equipment fee. Everything else is hidden from view until (at least) you sign up. If you’re lucky,… Read more »

This. The Full Price needs to be disclosed before you even sign up. Quite often I’ve found is that their is a $50+ Difference in the price they advertise.