Dan McCarthy, Frontier’s president and chief operating officer, commented, “This transaction is an exciting opportunity for Frontier. We are well-positioned to maximize value for our shareholders and create a great experience for new customers. We have four FiOS markets today from our 2010 transaction with Verizon, and a high level of familiarity with the systems underlying these properties. We plan to flash-cut convert these properties to Frontier’s systems as we did in states including West Virginia and Connecticut.”

But Frontier’s “flash cut” conversions in West Virginia and Connecticut led to months of serious service and billing problems leading to two state-level investigations into Frontier’s performance. Problems are still ongoing in parts of Connecticut several months after Frontier transferred Connecticut territories from AT&T. Customers in West Virginia continue to criticize Frontier Communications for its underwhelming broadband performance.

But Frontier’s “flash cut” conversions in West Virginia and Connecticut led to months of serious service and billing problems leading to two state-level investigations into Frontier’s performance. Problems are still ongoing in parts of Connecticut several months after Frontier transferred Connecticut territories from AT&T. Customers in West Virginia continue to criticize Frontier Communications for its underwhelming broadband performance.

Saibus Research, a Wall Street analyst, said they were “stunned” Frontier was repeating the same mistake it made back in 2010 when it acquired other former GTE service areas from Verizon.

“We remembered that its $8.7 billion wireline purchase in 2010 did not work out so well for it,” wrote the analyst. “When we consider that Frontier’s share price declined by nearly 60% from 2010-2012 after the deal closed before recovering those losses since 2012, we were shocked that Frontier’s share price increased by 10.6% in response to its announcement that it was buying assets from Verizon. Frontier’s pro forma revenue has declined by 30% since 2009, its residential consumer base declined by 33%, its operating income declined by 34% and its dividend declined by 60% since then.”

“Albert Einstein said that insanity is doing the same thing over again and expecting a different result and we think that Frontier’s CEO Maggie Wilderotter has come down with a serious case of insanity for her willingness to buy whatever Verizon is selling,” said Saibus Research. “As such, we think income-oriented telecom investors should consider accumulating shares of Verizon, and selling or shorting Frontier.”

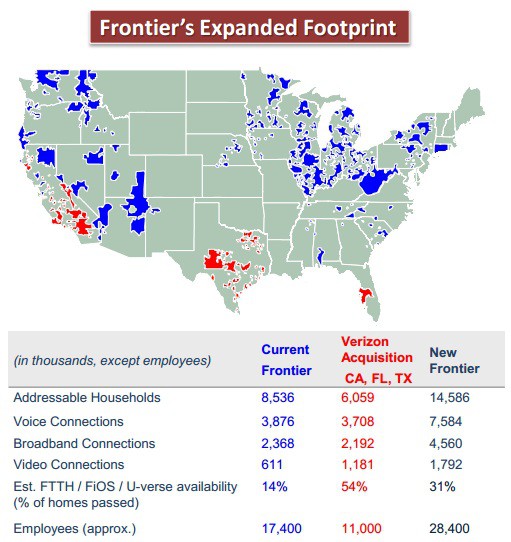

Frontier will accumulate billions in new debt to fund the transaction, bad news for legacy Frontier customers still served by the company’s copper wire networks. Frontier hoped to realize $500 million in cost reductions from its 2010 acquisition of Verizon territories in the Pacific Northwest, West Virginia, and several midwestern states. Instead of savings, it ended up spending millions to rehabilitate deteriorating landlines Verizon underinvested in for years. The new unsecured debt load will likely cut into available funds to upgrade older networks, particularly in the northeast and inside New York, Ohio and Pennsylvania.

Frontier will get marginal improvements in programming costs from the greater volume discounts its larger customer base qualifies to receive. But outside of Connecticut (Frontier U-verse) and Washington, Oregon, Indiana and South Carolina (Frontier FiOS), the rest of Frontier’s customers will continue to be offered Dish Network satellite service and various flavors of DSL.

If approved by regulators, the transaction will be finalized in 2016.

Subscribe

Subscribe

Phil I don’t know how else to call this deal but utterly f***ing insane. This is nuts. What I also don’t get is how in Wall Street, the announced deal sent Frontier’s stock soaring. If i were an investor I’d be terrified.

Agreed that it’s insane. After 20+ years with ATT for landline and ISP, we dropped Frontier within two months of their conversion in Connecticut – they can’t get the billing right or cash checks sent to them, their ISP speeds are slow and their CS is terrible. Short that puppy!

Verizon and Frontier have been planning this buyout for almost 7 years. When Verizon was formed from GTE and Atlantic Bell the ultimate plan was to dump all wireland assets and become a wireless company. Verizon has neglected maintenance of their buried copper plant for at least 16 years. I was working for Verizon when the word was sent out that replacement of badly deteriorated copper would not be taking place. Customers with bad cable pairs and lousy service would be out of luck no matter how much they complained. Just about every Verizon telephone central office switch are nearly… Read more »