Gov. Cuomo

Does N.Y. Gov. Andrew Cuomo support or reject the merger of Comcast and Time Warner Cable and why has an administration official been meeting behind closed doors with the companies involved?

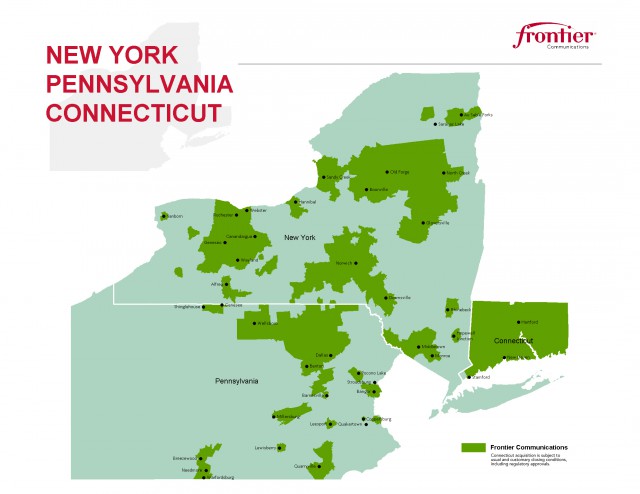

If the merger is successful, more than 95 percent of upstate New York will be served by a single cable operator – Comcast, with little chance Verizon will mount a major challenge for video, broadband, and phone service customers outside of the areas where FiOS fiber upgrades have been announced. Although the Cuomo Administration promised an in-depth investigation into the merger, the governor has kept his own views close to the vest and has not publicly supported or opposed the transaction. But an administration official has met privately with executives of both cable companies and state regulators behind closed doors according to a new report.

According to public schedules obtained by Capital, Comcast representatives met at least three times in August with PSC members or staff in what one former commissioner called unusual circumstances.

James Larocca, a N.Y. PSC commissioner from 2008-2013, said it is not typical for officials from the governor’s office to meet with state regulators and cable executives in the same closed-door meeting.

“I did not meet with the second floor on pending matters and I’m not aware that other commissioners ever did,” Larocca said.

It is not unusual for companies with business before the Commission to meet with its staff or commissioners in ex parte conversations to set the parameters of hearings, filings, and other regulatory proceedings. All such meetings appear to have been properly disclosed by the PSC staff and the companies involved. But the fact some were held behind closed doors with a Cuomo Administration official and without public disclosure of the subjects discussed bothers some.

Susan Lerner, executive director of Common Cause New York, said what was discussed behind closed doors should be disclosed so the public can see what top state officials are saying to the cable executives.

Susan Lerner, executive director of Common Cause New York, said what was discussed behind closed doors should be disclosed so the public can see what top state officials are saying to the cable executives.

“There are questions as to whether the PSC is a strong enough advocate for the people or the industry,” Lerner told Capital. “The agency has lost sight of its initial mission, which is to serve the public in regulating these absolutely essential services.”

Gerald Norlander at the Public Utility Law Project ponders what would happen if there were two negotiating tables discussing the merger, one public and the other secret.

“If there is a second table where views are exchange and negotiations are occurring, it doesn’t do well for transparency,” he said.

Public statements from both Comcast and the Cuomo Administration did little to clear the air.

“It was an initial meeting to discuss the public interest benefits of the transaction for New York,” a Comcast representative said in a one-sentence statement in response to questions about the meeting.

Not exactly, says the Cuomo Administration.

“The meeting was to explain the new law, the PSC’s new powers and its expanded oversight,” Cuomo spokesman Richard Azzopardi said.

As has been the case during much of the merger debate, Time Warner Cable has remained silent and has refused to comment.

The governor himself has avoided taking sides, claiming he will abide by the recommendations made by the PSC. But if true, why involve the governor’s office in the merger or meet privately with either the PSC or the companies involved?

The governor himself has avoided taking sides, claiming he will abide by the recommendations made by the PSC. But if true, why involve the governor’s office in the merger or meet privately with either the PSC or the companies involved?

“The state is taking a hands-on review of this merger to ensure that New Yorkers benefit,” Cuomo said in May. “The Public Service Commission’s actions will help protect consumers by demanding company commitments to strong service quality, affordability, and availability.”

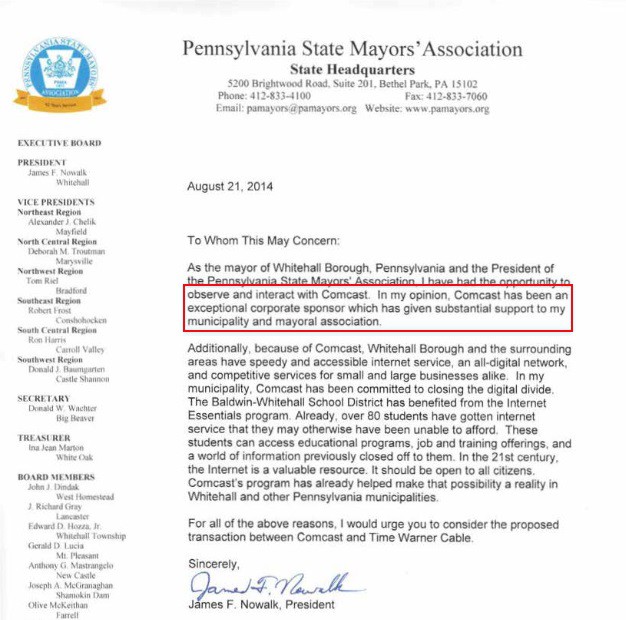

Cuomo himself has received at least $200,000 in campaign contributions from Comcast and Time Warner Cable. With customer satisfaction scores for both Comcast and Time Warner Cable in the basement, lobbying has been a necessity and Time Warner Cable is one of the state’s top lobbying forces, spending $500,000 of its subscribers’ money in New York in 2013 alone. Comcast spent $60,000, despite only serving a small sliver of customers in downstate New York.

The two companies also donated a combined $500,000 to a secretive state Democratic party account which Cuomo controls. Ironically, some of that money was used to run ads celebrating Gov. Cuomo’s efforts to get money out of politics.

New York Democratic candidate Zephyr Teachout is seeking to oust Gov. Andrew Cuomo in the fall election. One of the issues she is campaigning on is Cuomo’s significant contributions from Comcast and Time Warner Cable and his apparent lack of interest in stopping the merger. At a campaign stop in Syracuse, Teachout claims Comcast will raise your rates and offer no significant benefits to New Yorkers. She’d strongly oppose the merger and media consolidation in general, if elected. WRVO Radio reports. Aug. 29, 2014 (1:26)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Teachout

Cuomo’s Democratic primary opponent Zephyr Teachout and her running mate, Tim Wu (who coined the term “Net Neutrality”) are less murky on the issue. Both strongly oppose the merger and cable industry consolidation generally and have expressed serious concern about the governor’s acceptance of hundreds of thousands of dollars in campaign contributions from both Time Warner Cable and Comcast.

Andrew Letson’s Politics Blog considers the differences between the two campaigns striking.

“It’s a sharp contrast – between the hypocritical man in office taking money from corporate interests and the candidates with integrity who are funding their campaign through largely individual donors,” Letson writes.

“[Both Wu and Teachout] have said that they would work to block the frightening Comcast-Time Warner merger, something that’s certainly on the minds of many New Yorkers,” says Letson. “What’s nice about that is that New York actually has a lot of power when it comes to this merger, so opposition from both the governor and lieutenant governor would go a long way.”

Letson is a Teachout campaign volunteer, so it is no surprise which candidate he supports.

Subscribe

Subscribe Charter Communications, Inc. and Comcast Corporation today announced the name of the new cable company that will be spun off from Comcast upon completion of the Comcast – Time Warner Cable merger and the Comcast – Charter transactions.

Charter Communications, Inc. and Comcast Corporation today announced the name of the new cable company that will be spun off from Comcast upon completion of the Comcast – Time Warner Cable merger and the Comcast – Charter transactions. Connecticut’s tough Public Utilities Regulatory Authority (PURA) has

Connecticut’s tough Public Utilities Regulatory Authority (PURA) has  A landline rate freeze offers little benefit to Connecticut ratepayers because landline rates have been stable for years and any attempt to increase them will only fuel additional disconnections;

A landline rate freeze offers little benefit to Connecticut ratepayers because landline rates have been stable for years and any attempt to increase them will only fuel additional disconnections;