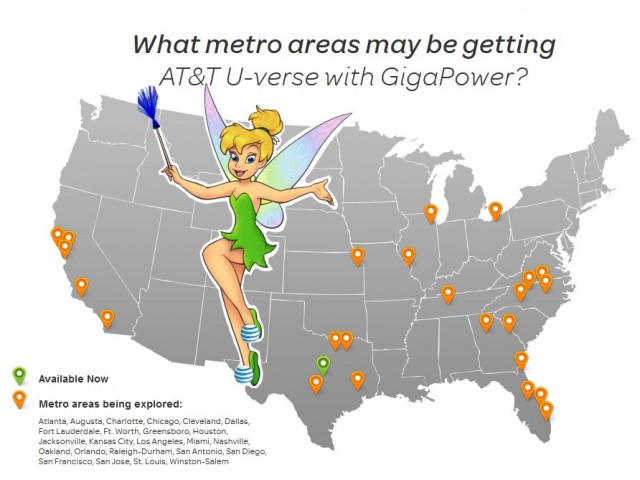

Notice the word “may”

AT&T has promised an undisclosed number of customers in Chicago, Ill., and Atlanta, Decatur, and Newnan, Ga., will eventually get GigaPower upgrades to AT&T’s U-verse service, after moving customers to an all-fiber network that will deliver up to 1Gbps service.

“As a city that prides itself on creating a favorable environment for investment and innovation, I am happy to see AT&T bringing its ultra-high speed fiber network to the City of Atlanta,” said Atlanta Mayor Kasim Reed. “This is a great opportunity for our residents, businesses and visitors, who all stand to benefit from this new service. The City of Atlanta is one of the fastest growing tech hubs in the United States and a hotbed for entrepreneurial activity. U-verse with AT&T GigaPower service will complement this engine of economic growth and help pave the way for future opportunities.”

But before the mayor gets too excited, he should consider AT&T’s track record for GigaPower upgrades in other cities where the service is offered. Customers complain the gigabit upgrade is difficult to get in single family homes, with most of the upgrades targeting multi-dwelling units like large condos or apartment blocks or new housing developments.

Customers in Austin complain to Stop the Cap! AT&T GigaPower looks more like a demonstration project than a serious effort at expanding super fast fiber broadband. Although pockets of service are established in some upscale areas, nobody at AT&T is willing to answer customers’ questions about exactly when service will arrive in unserved neighborhoods. Technicians are privately telling readers it will take more than a year for serious expansion efforts to begin across Austin.

While AT&T drags its feet on fiber expansion, it has no trouble hurrying out press releases suggesting cities including Atlanta, Augusta, Charlotte, Chicago, Cleveland, Fort Worth, Fort Lauderdale, Greensboro, Houston, Jacksonville, Kansas City, Los Angeles, Miami, Nashville, Oakland, Orlando, San Antonio, San Diego, St. Louis, San Francisco, and San Jose will soon see GigaPower in their areas. But AT&T isn’t putting much money where its mouth is, failing to significantly increase capital spending to upgrade the U-verse network.

In fact, AT&T executives have repeatedly reassured investors the company has no plans for a significant uptick in wireline capital spending — exactly what would be required to complete the gigabit expansion effort AT&T promises in press releases. In contrast, AT&T’s 2012 $14 billion Project Velocity IP (or VIP) was the company’s most visible and ambitious network build out initiative in wired service since the introduction of U-verse. Project VIP delivered a clear expansion of U-verse into new areas and brought new fiber connections to buildings, many that are now in use to offer GigaPower service in Austin.

Fiber broadband expansion is not cheap, and even after AT&T committed $14 billion to its expansion effort two years ago, the results are modest for U-verse because a considerable portion of the funds spent were invested in AT&T’s wireless network instead — always a priority:

| State / City | Investment amt. (wireless & wireline) | U-verse locations | Business connections | On-net buildings | Total investment (2010-2012) |

| California | $1.15 billion | 127,700 | 30,400 | 800 | $7 billion |

| — San Diego | 15,950 | 2,900 | 90 | $750 million | |

| Texas | $1 billion | 138,300 | 24,200 | 600 | $7 billion |

| Georgia | $675 million | $2.5 billion | |||

| — Atlanta | 12,100 | 11,450 | 400 | ||

| Florida | $425 million | 25,050 | 18,450 | 550 | $2.8 billion |

| Indiana | $325 million | 18,000 | 1,300 | 60 | $1.3 billion |

| Michigan | $275 million | 35,550 | 2,150 | 70 | $1.55 billion |

| Missouri | $250 million | 27,300 | 3,650 | 150 | not reported |

| North Carolina | $250 Million | 9,900 | 1,800 | 50 | $1.5 billion |

| Ohio | $225 million | 31,200 | 1,100 | 40 | $1.5 billion |

| Alabama | $200 million | 6,600 | 600 | 20 | $1.4 billion |

| Louisiana | $175 million | not reported | 2,100 | 35 | $1.2 billion |

| Mississippi | $175 million | 5,800 | 175 | 4 | $975 million |

| Tennessee | $175 million | 13,600 | 325 | 9 | $1.4 billion |

| Connecticut | $140 million | 6,600 | 1,100 | 40 | $750 million |

| South Carolina | $140 million | 21,100 | 250 | 9 | $850 million |

| Wisconsin | $140 million | N/A | 525 | 20 | $725 million |

| Oklahoma | $120 million | 13,850 | 875 | 25 | $700 million |

| Kansas | $110 million | 10,150 | 650 | 30 | $725 million |

| Nevada | $110 million | not reported | 200 | 7 | $600 million |

| Arkansas | $90 million | 8,750 | 1,000 | 25 | $700 million |

Chart courtesy: FierceTelecom

Data compiled from publicly released company information.

Reflecting on the numbers, it would take an investment at least equal, if not greater, than AT&T spent on Project VIP for AT&T to significantly upgrade the communities it claims will soon have access to GigaPower. Instead, it is more likely AT&T will introduce a handful of gigabit show projects and then incrementally upgrade selected neighborhoods over the next 3-5 years.

Existing competition makes all the difference as to what customers will pay for gigabit service from AT&T, assuming they can buy it at any price. As Google Fiber tears up the streets of Austin, it is clear Google will deliver real competition in that city, forcing AT&T to price its gigabit service at $70 a month (for customers willing to have their online activities tracked by AT&T). In nearby Dallas, where competition isn’t as robust, customers will have to pay at least $120 a month for the service.

Subscribe

Subscribe

More fiber-to-the press-release. Just once, I’d like an ISP to actually, you know, PROVIDE gigabit service to a paying customer, THEN make the public announcement.

You can read more about the roll out of Gigapower here: http://www.buyatt.com/uverse-gigapower-internet/