You can still read a book instead of everything else.

Allowing Comcast to dominate New York’s cable television marketplace will deter future competitors from entering the market, particularly for television programming.

One of the arguments made by proponents of the merger is the possibility of decreased wholesale television programming costs won through volume discounts available to the largest nationwide providers. Unfortunately for consumers, Comcast has already declared customers will not benefit from those discounts in the form of lower cable bills.

A prospective new entrant considering providing cable television service will face competition with Comcast without any benefit of volume discounts on programming.[1] That makes it unlikely a provider will offer a competing television package.

This is not a theoretical problem.

In Ohio, independent cable company MCTV discovered that while large cable operators like Comcast were benefiting from volume discounts, it faced contract renewal prices more than 40 times the rate of inflation.[2] Cable ONE, owned by the Washington Post, had to drop more than a dozen Viacom owned channels for good because it could not afford the asking price.[3]

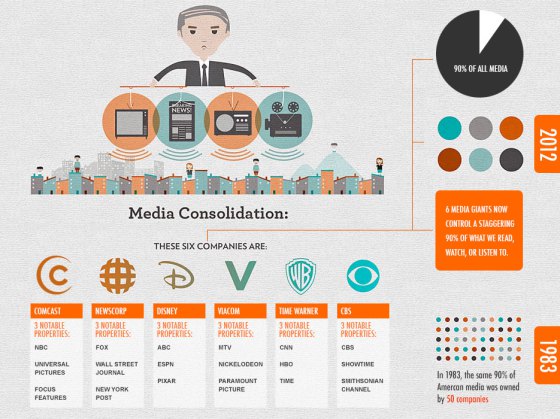

MCTV president Bob Gessner reminds us of just how concentrated the entertainment business has become, noting that nine media companies (Comcast is one of them) now control 95% of all paid video content consumed in the United States.[4]

MCTV’s survival plan includes membership in the 900-member National Cable Television Cooperative, the only way smaller providers can pool resources and win discounts of their own. It is no longer effective as mergers and acquisitions continue to consolidate the cable and telco-TV business. All 900 NCTC members serve a combined five million customers. Comcast has 21 million, DirecTV: 20 million, Dish Networks: 14 million, and Time Warner Cable: 11 million.[5]

AT&T confesses it cannot compete effectively with Comcast and other larger competitors for the same reason. AT&T’s solution, like Comcast, is to buy a competitor, in this case DirecTV.[6]

Frontier Communications faced a similar problem after adopting Verizon FiOS franchises in Indiana and the Pacific Northwest after purchasing Verizon landline networks in several states. When Frontier lost Verizon’s volume discounts on programming, Frontier’s solution was to begin a marketing campaign to convince its fiber customers to abandon the technology and switch to one of its satellite television partners.[7]

—

[1]https://www.fiercecable.com/cable/comcast-twc-deal-will-squeeze-programming-and-technology-vendors

[2]http://stopthecap.com/2014/06/05/independent-cable-companies-unify-against-cable-tv-programmer-rate-increases/

[3]http://online.wsj.com/articles/viacom-60-cable-firms-part-ways-in-rural-u-s-1403048557

[4]http://stopthecap.com/2014/06/05/independent-cable-companies-unify-against-cable-tv-programmer-rate-increases/

[5]http://stopthecap.com/2014/06/05/independent-cable-companies-unify-against-cable-tv-programmer-rate-increases/

[6]http://www.bloomberg.com/news/2014-05-02/dish-or-directv-need-deal-most-in-at-t-love-triangle-real-m-a.html

[7]http://stopthecap.com/2011/08/16/frontiers-fiber-mess-company-losing-fios-subs-landline-customers-but-adds-bonded-dsl/

Subscribe

Subscribe