The New York Times recommends the Justice Department and Federal Communications Commission reject Comcast’s $45 billion purchase of Time Warner Cable, if only because the combined company will have an unregulated choke-hold on telecommunications services not seen since the days of the regulated AT&T/Bell monopoly.

The New York Times recommends the Justice Department and Federal Communications Commission reject Comcast’s $45 billion purchase of Time Warner Cable, if only because the combined company will have an unregulated choke-hold on telecommunications services not seen since the days of the regulated AT&T/Bell monopoly.

In an editorial published Sunday, the newspaper called out many of the “merger benefit”-talking points claimed by the two cable giants as specious at best, hinting some even bordered on misleading:

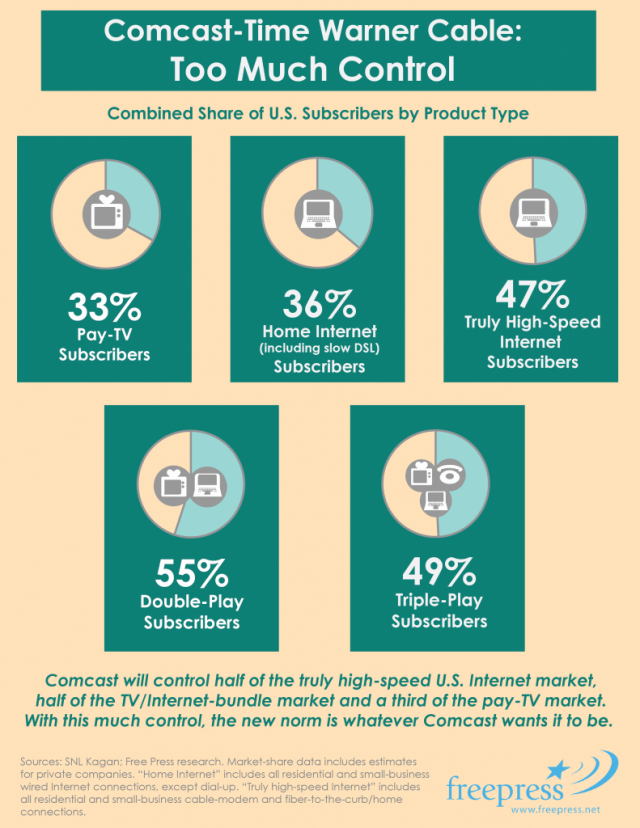

By buying Time Warner Cable, Comcast would become a gatekeeper over what consumers watch, read and listen to. The company would have more power to compel Internet content companies like Netflix and Google, which owns YouTube, to pay Comcast for better access to its broadband network. Netflix, a dominant player in video streaming, has already signed such an agreement with the company. This could put start-ups and smaller companies without deep pockets at a competitive disadvantage.

There are also worries that a bigger Comcast would have more power to refuse to carry channels that compete with programming owned by NBC Universal, which it owns. Comcast executives say that they would not favor content the company controls at the expense of other media businesses.

The company argues that this deal would not reduce choice because the company does not directly compete with Time Warner Cable anywhere. Comcast would face plenty of competition in high-speed Internet service, they say, from telephone and wireless companies.

The reality is far different. At the end of 2012, according to the FCC, 64 percent of American homes had only one or at most two choices for Internet service that most people would consider broadband. Wireless services can handle streaming video, but many customers of Verizon or AT&T would blow through their monthly wireless data plan by streaming just one two-hour high-definition movie, at which point they would have to fork over extra fees.

Comcast executives argue that companies like Sprint are planning to provide very fast Internet service that will compete with wired broadband. But wireless companies have been working on such services for more than a decade with little success.

Those wireless services that do exist uniformly impose low usage caps and cost considerably more than traditional wired broadband plans, especially when considering the cost compared to the actual speed delivered to consumers.

The Times doesn’t believe imposing a litany of conditions in return for approving the deal, similar to those involving Comcast’s purchase of NBCUniversal, would be sufficient to protect consumers from monopoly abuse.

“This merger would fundamentally change the structure of this important industry and give one company too much control over what information, shows, movies and sports Americans can access on TVs and the Internet,” concluded the newspaper. “Federal regulators should challenge this deal.”

Subscribe

Subscribe