One of Comcast’s biggest investments of 2014 won’t pay to boost broadband speeds, improve customer service, or upgrade cable systems.

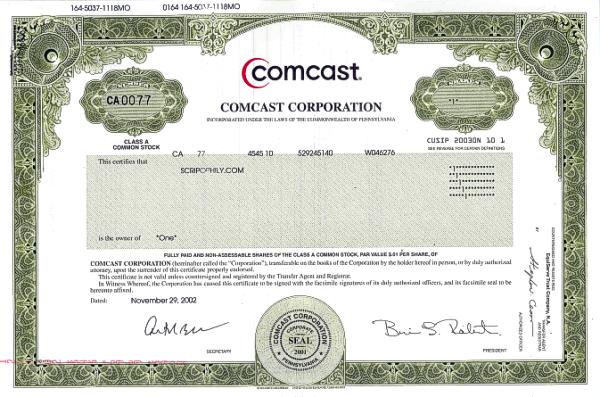

Today the cable company announced plans to spend an extra $2.5 billion — $5.5 billion total — this year to buy shares of its own stock in a share buyback program designed to please investors.

Today the cable company announced plans to spend an extra $2.5 billion — $5.5 billion total — this year to buy shares of its own stock in a share buyback program designed to please investors.

The extra investment will only come if shareholders approve the deal to merge Comcast and Time Warner Cable into a single company. If the merger is successful, Comcast is prepared to spend even more on share buybacks with money it plans to collect from the sale of three million current Time Warner customers that will be spun away in the merger.

Bloomberg News reports Comcast shares have fallen 10 percent since the acquisition was announced last month, reducing the value of the company’s all-stock offer. The proposal of 2.875 in Comcast stock for each Time Warner Cable share was worth $142.49 a share last week, down from $158.82 the day the transaction was made public.

By buying back shares in its own stock, Comcast will cut the number of shares outstanding, which increases earnings per share and usually boosts the stock’s price. The share repurchase will benefit shareholders and any top executives who receive bonuses based on successfully increasing the value of earnings per share. Customers get nothing.

Neither will the tax man if Comcast and Time Warner Cable structure its deals as spinoffs qualifying as tax-free transactions.

Subscribe

Subscribe