Witmer

If what Time Warner Cable claims is true, the stalemate that has kept CBS content away from subscribers for four weeks may be less about the money and more about CBS’ desire to control your viewing experience.

Melinda Witmer, TWC’s chief video and content officer, reports CBS is demanding daunting new restrictions in their proposed renewal contract, including requiring customers to “register their television sets” with CBS before being able to turn them on.

Witmer said CBS’ demands also include new powers over DVR capabilities, which means CBS could possibly prevent customers from fast-forwarding through commercials or even block the recording and/or storage of certain programs without network permission.

“CBS announced that they signed a deal with Verizon (FiOS TV) and has suggested that they offered us the same deal Verizon just signed,” Witmer said. “All I can say is our condolences to Verizon if they signed the deal CBS put in front of us. I hope for Verizon’s sake that they didn’t sign that, but if they did I’m glad for us because we’ll compete that much better against them when we finish our deal.”

Cable operators are seeking expanded rights from programmers as customer viewing habits evolve. Among the most important are those that would allow online and on-demand streaming of programming to authenticated cable subscribers.

Time Warner Cable has invested considerable resources in its online viewing platforms for PC’s, smartphones, and tablets, providing most of the TWC lineup on those portable devices. But the service has been largely limited in-home viewing because the cable company is having trouble securing permission to stream most of that content for those on the go.

Time Warner Attempts to Placate Impacted Customers

Although Time Warner Cable is crediting customers for the loss of Showtime/The Movie Channel, blocked by the cable operator while the impasse continues, Time Warner is not giving any automatic refunds for the loss of CBS basic or broadcast programming and networks taken off the cable dial. CBS-owned Smithsonian TV is the most affected basic cable channel nationwide. Some customers who pay extra for Smithsonian as part of an added-cost HD Tier often known as “TWCHD Pass” have gotten service credits upon request.

Although Time Warner Cable is crediting customers for the loss of Showtime/The Movie Channel, blocked by the cable operator while the impasse continues, Time Warner is not giving any automatic refunds for the loss of CBS basic or broadcast programming and networks taken off the cable dial. CBS-owned Smithsonian TV is the most affected basic cable channel nationwide. Some customers who pay extra for Smithsonian as part of an added-cost HD Tier often known as “TWCHD Pass” have gotten service credits upon request.

Time Warner Cable is giving out free over-the-air antennas to customers in cities where local CBS-owned stations have been taken off the cable lineup.

Time Warner Cable has a limited quantity of free basic indoor antennas available for customers at TWC retail locations in Dallas-Ft. Worth, Los Angeles/Desert Cities, New York City, Milwaukee and Green Bay, Wisc. In addition, TWC has partnered with Best Buy in those cities to provide $20 toward the purchase of any in-stock broadcast antenna at select Best Buy store locations. The cable company has published a list of retail locations where antennas are available as long as supplies last. Limit one per customer and installation is your responsibility.

Radio Shack has also taken advantage of the situation by slashing prices on an AntennaCraft Amplified Omnidirectional HDTV Antenna, now available online for $37.49 – a 25 percent discount. Best Buy is supporting Time Warner Cable’s position in the CBS dispute. Radio Shack is not, telling customers its antennas make it easy to “cut the cable.”

Time Warner is appeasing tennis fans with enhanced coverage of the 2013 US Open Tennis Championship Series with a free preview of The Tennis Channel running Aug. 26 through Sept. 9.

The blackout is also keeping Time Warner Cable, Bright House, and Earthlink (supplied by either cable operator) broadband customers from watching CBS content online.

| If you now receive this channel | Here’s how your Time Warner Cable video service is impacted |

| CBS from NYC, LA, Dallas-Ft Worth, Boston, Chicago, Denver, Detroit, Pittsburgh | -The CBS channel has been removed from your lineup -CBS Primetime on Demand is now unavailable -StartOver and LookBack services on all CBS-owned stations are unavailable |

| CBS from any city other than the ones listed above | -CBS Primetime on Demand is now unavailable -StartOver and LookBack services on local CBS affiliate stations are unavailable |

| Flix | Flix is now unavailable |

| The Movie Channel | The Movie Channel and The Movie Channel on Demand are now unavailable; TWC is providing replacement programming from Encore on a temporary preview basis–look in your guide for channel numbers. |

| Showtime | Showtime, all its associated multiplex channels, and Showtime on Demand are now unavailable; TWC is providing replacement programming from Starz on a temporary preview basis–look in your guide for channel numbers. |

| Smithsonian Channel | Smithsonian and Smithsonian on Demand are now unavailable |

The Federal Communications Commission said it is trying to resolve the fee dispute from Washington.

“The commission is engaged at the highest levels with the respective parties and working to bring the impasse to an end,” Justin Cole, an agency spokesman, said in an e-mailed statement yesterday. “We urge all parties to resolve this matter as quickly as possible so consumers can access the programming they rely on and are paying for.”

But acting FCC chairwoman Mignon Clyburn also admitted the FCC has few powers to intervene and compel an agreement.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/TWC Melinda Witmer on CBS Blackout 8-24-13.flv[/flv]

Time Warner Cable’s Melinda Witmer, head of the team negotiating with CBS, suggests the network is demanding unprecedented control over your viewing experience — a deal breaker for the cable operator. (6 minutes)

Subscribe

Subscribe

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey.

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey. Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

Sure enough, Robert Mercer, a DirecTV spokesman, explained the satellite provider pulls a credit report on every potential customer to determine their financial viability. DirecTV doesn’t want deadbeat customers, not after spending close to $900 to install satellite television in the average home.

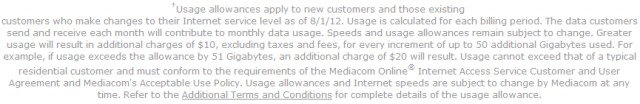

Sure enough, Robert Mercer, a DirecTV spokesman, explained the satellite provider pulls a credit report on every potential customer to determine their financial viability. DirecTV doesn’t want deadbeat customers, not after spending close to $900 to install satellite television in the average home. the worst-rated cable operator in the United States, claims it needs usage caps and consumption billing to force heavy users to pay for needed upgrades. But that isn’t what Mediacom’s executives are telling investors and the Securities and Exchange Commission (SEC).

the worst-rated cable operator in the United States, claims it needs usage caps and consumption billing to force heavy users to pay for needed upgrades. But that isn’t what Mediacom’s executives are telling investors and the Securities and Exchange Commission (SEC). “

“

Other customers incensed about the new usage limits have called to cancel service only to be threatened with steep early termination fees.

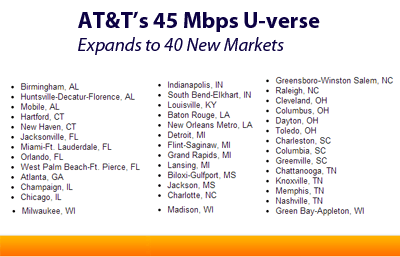

Other customers incensed about the new usage limits have called to cancel service only to be threatened with steep early termination fees. AT&T has boosted the maximum available broadband speed for its U-verse Internet offering to 45/6Mbps service in 40 cities across 15 states.

AT&T has boosted the maximum available broadband speed for its U-verse Internet offering to 45/6Mbps service in 40 cities across 15 states.