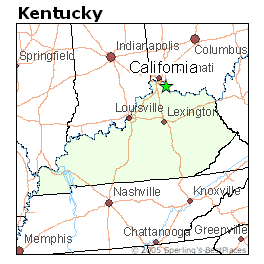

At first, DISH Network couldn’t care less about Cincinnati-area resident Jeff Demoss’ problems. The devastating March 2 tornadoes that ripped through Peach Grove and California, Ky., just across the Ohio border, took away Demoss’ home and all of its possessions. All that remained was a post with an electric meter and his DISH Network satellite dish.

At first, DISH Network couldn’t care less about Cincinnati-area resident Jeff Demoss’ problems. The devastating March 2 tornadoes that ripped through Peach Grove and California, Ky., just across the Ohio border, took away Demoss’ home and all of its possessions. All that remained was a post with an electric meter and his DISH Network satellite dish.

Demoss called the satellite TV company to cancel his service. There wasn’t much point continuing to pay for satellite television when your television has blown into the next town over. At first, DISH Network representatives seemed sympathetic, promising the problem would be taken care of immediately.

That was, until DISH found out Demoss’ satellite receiver was also missing and could not be returned.

“We kept getting letters in the mail saying ‘You are going to have to return the receiver, or we will have to charge you $300 for it,'” Demoss told WCPO-TV’s consumer reporter.

And DISH did exactly that, removing $300 from the family checking account.

And DISH did exactly that, removing $300 from the family checking account.

DISH Network has earned a mediocre C+ rating from the Better Business Bureau, and has racked up more than 13,000 complaints in the past three years, some about lost equipment fees.

Companies can charge early contract termination and lost equipment fees for customers who cancel service before their service contract ends or who do not return equipment. When tragedies like storms, fires, and floods strike, many satellite and cable companies try to bill customers accordingly, at least until they end up shamed on the evening news.

DISH quickly offered to refund the Demoss family their $300 once the Cincinnati television station got involved, and the satellite company apologized for the inconvenience.

Virtually all cable, telephone, and satellite companies will eventually relent on cancellation fees and damaged/lost equipment fees if customers tell the intransigent customer service representative or supervisor their next call will be to local media to share the story, so it pays to stand your ground.

However, as Stop the Cap! has repeatedly recommended in the past, your best protection is a renter or homeowner insurance policy, which typically covers these types of losses. Renters often assume their landlord maintains insurance on their behalf, but in fact they do not. Insurance purchased by the building owner only covers structural losses, never your personal property. Renters insurance is inexpensive and highly recommended.

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/WCPO Cincinnati Tornado victim struggles with DISH Network 5-16-12.mp4[/flv]

WCPO-TV in Cincinnati reports on how a Kentucky man who lost his home and possessions was forced to deal with DISH Network, who withdrew $300 from the family checking account for equipment lost in a March tornado. (3 minutes)

Subscribe

Subscribe