Not long ago, the United States led the world in broadband connectivity. Now we are in 16th place, trailing most developed nations. We need broadband policies that connect our homes, schools, and business to the 21st century economy, but we’re pursuing public policies that are putting us in a hole, helping private telecommunications providers and harming the public interest. As the old adage goes, when in a hole, stop digging.

Not long ago, the United States led the world in broadband connectivity. Now we are in 16th place, trailing most developed nations. We need broadband policies that connect our homes, schools, and business to the 21st century economy, but we’re pursuing public policies that are putting us in a hole, helping private telecommunications providers and harming the public interest. As the old adage goes, when in a hole, stop digging.

Why is this happening? One reason is that across much of the nation, commercial broadband companies are using their political and economic clout to stifle competition, particularly from municipalities. Individually and through trade groups and the American Legislative Exchange Council (ALEC), the industry is bent on shutting down existing publicly-owned broadband systems and blocking the development of new ones.

ALEC’s argument, detailed in a recent Daily Caller op-ed by John Stephenson, director of its communications and technology task force, is based on distorted and inaccurate claims that would be laughable if they weren’t part of a coordinated strategy to radically transform policy state-by-state.

Stephenson suggests that Chattanooga, one of several cities cited in his piece, made a poor decision in building the nation’s most advanced citywide broadband network – one that has helped companies create literally thousands of new jobs in recent years. In fact, contrary to Stephenson’s claims that municipal broadband drive up property taxes and depresses municipal credit ratings, S&P just upgraded the Chattanooga public utility’s bond rating, stating, “The system is providing reliable information to the electric utility on outages, losses and usage, which helps reduce the electric system’s costs.”

The larger point is that those who want to revoke local decision-making authority for broadband often justify their position by insisting that they want to protect taxpayers from mythical threats. The only impact Chattanooga’s system has had on taxpayers has been to create more jobs, lower electricity bills, and enhance choices in the market. Indeed, Chattanooga’s EPB Fiber service is saving the public money. After a recent storm knocked utility customers offline, EPB’s fiber-optic Smart Grid brought those uses back online more quickly, saving the public an estimated $1.4 million in repair costs.

It’s no surprise that such nonsense emanates from ALEC, which acts as a clearinghouse for corporately-sponsored model legislation that puts corporate profits ahead of the public interest and often public safety. ALEC is backed by some America’s biggest telecommunications firms, including Comcast, Verizon, and Time Warner Cable. Through ALEC task forces, corporations craft model bills and find compliant legislators to introduce them as if they were the legislator’s own. As Common Cause and its allies have documented, ALEC’s influence is pervasive: from privatizing education to limiting voting rights with restrictive Voter ID bills, and endangering public safety with “Stand Your Ground” gun laws, no aspect of public policy goes untouched.

It’s no surprise that such nonsense emanates from ALEC, which acts as a clearinghouse for corporately-sponsored model legislation that puts corporate profits ahead of the public interest and often public safety. ALEC is backed by some America’s biggest telecommunications firms, including Comcast, Verizon, and Time Warner Cable. Through ALEC task forces, corporations craft model bills and find compliant legislators to introduce them as if they were the legislator’s own. As Common Cause and its allies have documented, ALEC’s influence is pervasive: from privatizing education to limiting voting rights with restrictive Voter ID bills, and endangering public safety with “Stand Your Ground” gun laws, no aspect of public policy goes untouched.

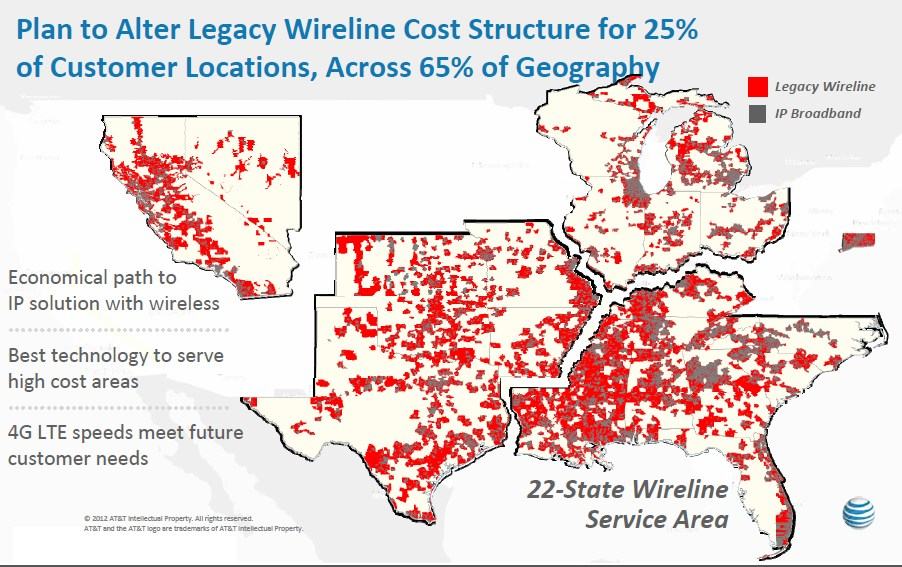

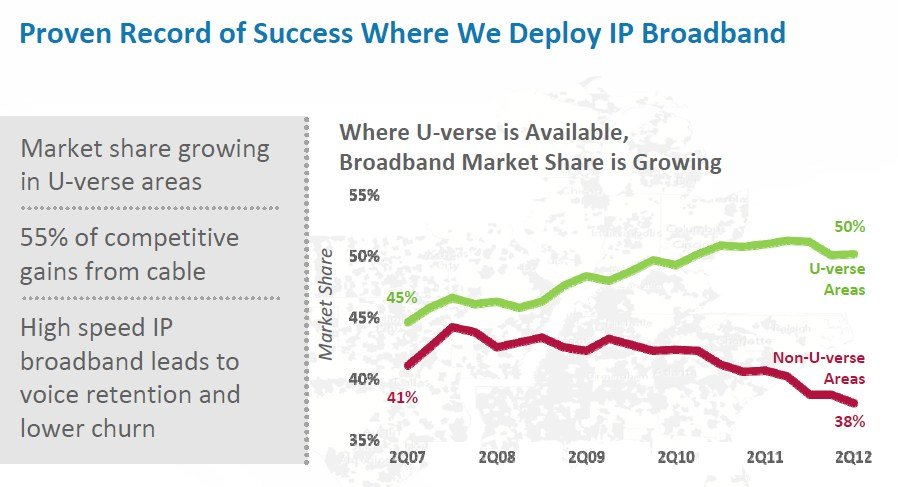

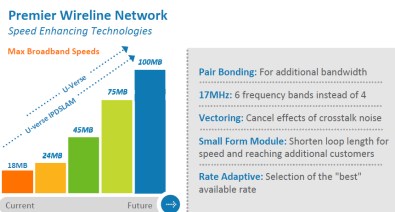

ALEC’s attack on local decision-making authority is consistent with its efforts to benefit big companies like Time Warner Cable and AT&T that want to restrict choices for residents and businesses. So far, the big cable companies have all but crushed competition in the private sector and have been attempting to stop communities themselves from building the essential infrastructure in which these companies have been slow to invest.

But the arguments used to revoke local authority are based on misleading or outright false claims. Stephenson even tries to scare readers, claiming (with no proof) that Marietta, Ga. lost $24 million on a municipal network. What actually happened was documented in a report from 2005. Marietta had a wholesale-only network using a far different business model than the one followed by most publicly owned broadband systems. It was on a path to operate in the black when it was privatized for ideological reasons. Stephenson’s $24 million loss figure ignores all the revenues it generated as well as additional spillover benefits. That’s fuzzy math.

Stephenson’s claim that LUS Fiber lost money every day last year preys on reader ignorance of telecom business models. Any high-capital investment could be said to lose money “every day” in the early years. Long term investments take time to break even – after which, they make money “every day.” Verizon’s FiOS “lost” money every day for many years but is regarded by many as a smart long term investment.

Publicly owned networks overwhelmingly help public safety, schools, libraries and other community anchor institutions. While AT&T has been caught ripping off taxpayers by overcharging schools for their connections, Lafayette, LA. dramatically increased the capacity of school and library broadband connections at nearly the same price AT&T charged for far lower quality services. Lafayette’s network is one of the most advanced in the nation and has attracted hundreds of new jobs while saving millions for the community by keeping prices lower, as documented in our report Broadband at the Speed of Light. In response to Lafayette’s investment, Cox Cable prioritized that community for its upgraded cable network – compounding local benefits.

Publicly owned networks overwhelmingly help public safety, schools, libraries and other community anchor institutions. While AT&T has been caught ripping off taxpayers by overcharging schools for their connections, Lafayette, LA. dramatically increased the capacity of school and library broadband connections at nearly the same price AT&T charged for far lower quality services. Lafayette’s network is one of the most advanced in the nation and has attracted hundreds of new jobs while saving millions for the community by keeping prices lower, as documented in our report Broadband at the Speed of Light. In response to Lafayette’s investment, Cox Cable prioritized that community for its upgraded cable network – compounding local benefits.

Lafayette isn’t alone – consider rural Chanute, KN., which connected its schools and the local community college with a gigabit wide area network at only $250 per location per month. The city’s municipal fiber network has helped preserve jobs that were at risk of leaving because the cable and telephone company were not meeting the needs of local businesses. Additionally, the network pays a franchise fee to the general fund every year.

And then there’s Wilson, N.C. Stephenson claims its fiber-optic network might be obsolete before it is paid off – a ludicrous scenario given the strong consensus the fiber-optic is and will remain the gold standard in networking for decades. Regardless, the network is generating benefits today – lower prices for consumers and the best connection available for the hospital and schools. Oh, and their network is operating in the black also.

These benefits are some of the reasons that the FCC’s National Broadband Plan called on Congress to ensure that all local governments could build networks. No one has suggested that every government should do so – but it should be a local choice, and that is what ALEC has been trying to remove. Largely thanks to ALEC, 19 states limit local authority to build networks. Rather than foster competition and innovation, these policies introduce new barriers to connectivity and deny choice to consumers. It is beyond time to remove these restrictions and let local communities decide for themselves if a network is a smart public investment given their unique situation.

This piece courtesy of the Common Cause Blog. The article was coauthored by Christopher Mitchell from the Institute for Local Self-Reliance. He directs their Telecommunications as Commons Initiative. He is also editor of http://www.muninetworks.org/. Follow him @communitynets.

Subscribe

Subscribe