AT&T has used the specter of a nationwide wireless bandwidth crisis to pressure Washington to adopt its agenda for additional mobile spectrum. But talk of a looming “data tsunami” has done nothing to stop AT&T from heavily marketing their most data-hungry devices — smartphones and tablets to customers.

In fact, the “broadband shortage business” has become enormously profitable for the former Ma Bell.

Switch to a Smartphone

Wireless carriers like AT&T aggressively market smartphones because they drive the highest average monthly revenue earned from customers. So far, the marketing push has been an unparalleled success. PricewaterhouseCoopers reported smartphones accounted for 48% of all wireless phone sales in 2011, up from 30% in 2010. More than half of customers upgrading their old phones chose smartphones to replace them — an enormous increase over just 36% of upgrades in 2010. Because smartphones are designed for an online experience, most companies mandate customers subscribe to a data plan, often adding $30 or more per phone, per month to a wireless phone bill.

AT&T’s 4th quarter results told the story, and it was all smiles. AT&T celebrated customer enthusiasm for smartphones and the data they consume with no worries about “data tsunamis” or “bandwidth crises”:

- In 2011, AT&T’s growth engines — wireless, wireline data and managed services — represented 76 percent of total revenues and grew 7.5 percent versus 2010, led in the fourth quarter by:

- 10.0 percent growth in wireless revenues

- 19.4 percent growth in wireless data revenues, up $956 million versus the year-earlier quarter

- 9.4 million smartphone sales, best-ever quarter and 50 percent more than previous quarterly record and nearly double 3Q11 sales; 82 percent of postpaid sales were smartphones

- Best-ever quarter for Android and Apple smartphones, including 7.6 million iPhone activations

Double-Digit Growth for Wireless Revenues. Total wireless revenues, which include equipment sales, were up 10.0 percent year over year to $16.7 billion. Wireless service revenues increased 4.0 percent, to $14.3 billion, in the fourth quarter.

Wireless Data Revenues Increase 19.4 Percent. Wireless data revenues — driven by Internet access, access to applications, messaging and related services — increased by $956 million, or 19.4 percent, from the year-earlier quarter to $5.9 billion. AT&T’s postpaid wireless subscribers on monthly data plans increased by 16.4 percent over the past year. The number of subscribers on tiered data plans also continues to increase. About 22 million, or 56 percent, of all smartphone subscribers are on tiered data plans, and about 70 percent have chosen the higher-tier plans.

Wireless Margins Reflect Record Sales. Fourth-quarter wireless margins reflect record-setting smartphone sales and customer upgrade levels. This was offset in part by improved operating efficiencies and further revenue gains from the company’s growing base of high-quality smartphone subscribers.

Forcing Customers to Upgrade… Or Else

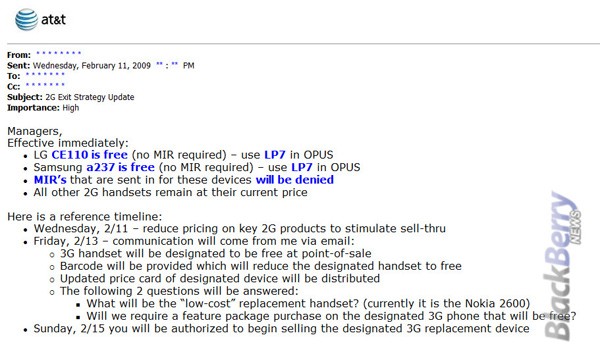

Back in 2009, AT&T decided it was inventory clearance time, released a memo entitled “2G Exit Strategy,” and slashed prices on 2G “feature” or “messaging phones” to attract customers looking for a bargain. A few years later, the company is now sending letters to some of them strongly recommending they upgrade to a new, potentially more expensive phone. If they don’t, AT&T writes, “your current, older-model 2G phone might not be able to make or receive calls and you may experience degradation of your wireless service in certain areas.”

AT&T hopes many customers will adopt smartphones, because the plans that accompany them are far more expensive than the 2G “messaging” plans they replace. AT&T wants to repurpose 1900MHz 2G spectrum for other services, but sometimes customers are left holding the bag if they don’t want the designated replacement phone(s) AT&T is willing to provide.

In Grand Valley, Col. last fall, AT&T created lines outside its stores as customers were compelled to upgrade phones and service plans to continue reliable AT&T service:

AT&T isn’t actually discontinuing the 2G network — it is moving 2G service to less-favorable spectrum it owns in order to make room for improved 3G coverage. That might work fine in areas less expansive and rugged than western Colorado, but in the Grand Valley, it means many customers will find they no longer have data service at all.

The ongoing tower upgrades have also disrupted cell service generally, and when customers arrive at AT&T’s stores to complain, the employees on hand attempt to upsell them more expensive phones to “fix” the problem.

“There is significant pressure on carriers to migrate to the most efficient networks while needing to address the issue of spectrum scarcity,” explains PricewaterhouseCoopers’ Dan Hays. “We are beginning to see carriers shut off legacy networks and force customers to migrate to new technologies.”

Internet Overcharging for Profit Without Raising Company Costs

AT&T has no worries about data tsunamis and "exafloods" when app makers or consumers are willing to pay more.

With customers seeking to get the most out of expensive wireless data plans, data usage naturally goes up. But so do prices, meaning the “data tsunami” carriers warn about is not bad for their bottom line at all.

In 2011, consumer research group Validas found average data consumption was up 34.7% for all users, from 448.8MB in January to 604.8MB by December. AT&T responded with a price increase and an allowance boost that will benefit only a tiny minority of customers. The most popular data plans now cost $5 a month more: $30 for 3 gigabytes, up from $25 for 2GB and $50 for 5GB, up from $45 for 4GB. But Validas found only 5% of wireless customers use more than 2GB of data per month, with only 2.7% using more than 3GB.

That translates into higher AT&T bills for the 97% of customers who don’t come close to using even 2GB a month. Although the price hike delivers no tangible benefit to the overwhelming majority of customers, it does deliver an extra $5 a month from their bank account to AT&T’s.

The “Anyone Pays But Us” Model for “Heavy Traffic”

With online video “clogging” the wireless airwaves, companies like AT&T should be interested in offloading as much video to wired or Wi-Fi service. But late last month, the company suggested a way customers could bypass its stringent data caps by allowing content companies to pay for the wireless traffic their customers generate.

“A feature that we’re hoping to have out sometime next year is the equivalent of 800 numbers that would say, if you take this app, this app will come without any network usage,” said John Donovan, who oversees AT&T’s network and technology. “What they’re saying is, why don’t we go create new revenue streams that don’t exist today and find a way to split them … “It’d be like freight included.”

Only wasn’t the railroad already overburdened with traffic, threatened with a nationwide slowdown? If one is willing to flash enough money, it’s remarkable how quickly the tidal wave of wireless congestion and despair can be pushed back out to sea. Just don’t tell Washington lawmakers. This is a crisis of epic proportions after all.

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg Carriers Facing Data Tsunami 3-21-12.mp4[/flv]

Derek Kerton, principal analyst at Kerton Group, talks about increased demand for data and the impact on wireless carriers. Kerton compares it to today’s gasoline prices. Demand=higher prices. Wall Street folks like Kerton thinks more spectrum isn’t the total answer. Smaller cell sites and more Wi-Fi might be. Otherwise, prepare for bill shock. (4 minutes)

Subscribe

Subscribe