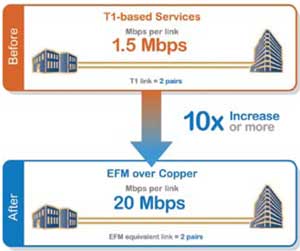

Ethernet over Copper is becoming an increasingly popular choice for business customers stuck in areas where companies won’t deploy fiber broadband (Graphic: OSP Magazine)

With Verizon and AT&T effectively stalling expansion of their respective “next generation” fiber and hybrid fiber/coax networks, and independent phone companies fearing too much capital spent improving their networks will drive their stock prices down, telephone companies are desperately seeking better options to deliver the faster broadband service customers demand.

The options over a copper-based landline network are not the best:

- ADSL has been around for more than a decade and is highly distant dependent. Get beyond 10,000 feet from the nearest switching office and your speeds may not even qualify as “broadband;”

- DSL variants represent the second generation for copper-broadband and can deliver faster speeds, but usually require investment to reduce the amount of copper between the customer and the switching office;

- Fiber networks are more expensive to build, and some companies are using it to reduce, but not eliminate copper wire in their networks. But companies traditionally avoid this solution in rural/suburban areas because the cost/benefit analysis doesn’t work for shareholders;

- Ethernet Over Copper (EoC) is increasingly the solution of choice for independent phone companies because it is less expensive to deploy than fiber and can quickly deliver service at a cat 5e speed of up to 50Mbps.

Unfortunately for consumers, EoC is typically way above the price range for home broadband. Most providers sell the faster service to commercial and institutional customers, either for businesses that have outgrown T1 lines or where deploying fiber does not make economic sense. Some companies have tried to improve on DSL by bonding multiple connections together to achieve faster speeds, but Ethernet is quickly becoming a more important tool in the broadband marketing arsenal.

With phone companies pricing EoC service from several hundred to several thousand dollars a month, depending on the speed of the connection, they hope to remain competitive players against a push by the cable industry to more aggressively target business customers. In more rural areas, phone companies lack cable competition, so they stand a better chance of success.

Fierce Telecom‘s Sean Buckley published an excellent series of articles outlining the current state of EoC technology and what phone companies are doing with it:

- AT&T: Inherited EoC from its acquisition of BellSouth, and barely markets it. Instead, AT&T uses it as a quiet solution for challenging customers who cannot affordably be reached by fiber. AT&T will either deliver the service over copper, copper/fiber, or an all-fiber path depending on the client’s needs.

- CenturyLink: No phone company is as aggressive about EoC as CenturyLink. When CenturyLink acquired Qwest, interest in the technology only intensified. EoC is a CenturyLink favorite for small businesses that simply cannot get the speeds they need from traditional DSL. Most EoC service runs up to 20Mbps.

- Verizon: Verizon’s network is the most fiber-intense among large commercial providers, so EoC is not the first choice for the company. However, it does use it to reach multi-site businesses who have buildings and offices outside of the footprint of Verizon’s fiber network/service area.

- Frontier: In the regions where Frontier acquired Verizon landlines, EoC has become an important component for Frontier’s backhaul traffic. EoC has been deployed to reach cell tower sites and handles broadband traffic between central office exchanges and remote D-SLAMs, used to let the company sell DSL to a more rural customer base. Frontier looks to EoC before considering spending money on fiber service, even for commercial and institutional users.

- Windstream: EoC is the way this phone company gets better broadband speeds to business customers without spending a lot of money on fiber. Small and medium-sized customers are often buyers of EoC service, especially when DSL can’t handle the job or the company requires faster upstream speeds. Windstream markets upgradable EoC capable of delivering the same downstream and upstream speeds and can deliver it more quickly than a fiber project.

- FairPoint: Much of this phone company’s EoC efforts are in territories in northern New England acquired from Verizon. FairPoint targets small and medium sized companies for the service, especially those who have remote offices or clinics that need to be interconnected. FairPoint has also gotten more aggressive than many other companies working with ADSL2+ or VDSL2 to deliver faster broadband to office buildings and complexes more economically than fiber.

- SureWest: This company is strong believer in fiber to the premises service, so its interest in EoC has been limited to areas where deploying fiber makes little economic sense. In more out-of-the-way places, EoC is becoming a more common choice to pitch businesses who need more than traditional broadband.

- Hawaiian Telcom: HawTel uses copper-based EoC to provide connectivity across the diverse Hawaiian Islands. Speeds are generally lower than in mainland areas, partly because HawTel still relies heavily on traditional copper-based service. But fiber-based EoC is increasingly available in more densely populated areas.

Subscribe

Subscribe

“Ethernet over Copper” is a bit of a confusing name. Most technologists would identify it as redundant, since copper is still primary medium for ethernet LAN, but that’s in the form of 8 twisted pair cable (Cat 5/6). I assume this term is meant to mean ethernet over phone lines, as the various LAN standards are limited to 100 meters between ethernet repeaters.

Is there another name for this standard?

Try searching for “EFM” or- Ethernet First Mile

It really is surprising to me that so many corporations are not choosing business

ethernet. It is so considerably more economical than T1 lines or

bonded T1 lines. For people with bigger circuits like DS3 or

OCx, Ethernet gets to be a lot more economical.