The Oregonian has been covering the plight of Frontier customers in the Pacific Northwest who signed up for Verizon’s fiber to the home service — FiOS — and are now facing down the new owners who want to raise the price by $30 a month.

Frontier has done itself no favors in the media with an ongoing series of reports of service problems, rate increases, and now the latest signs it wants out of the television delivery business altogether.

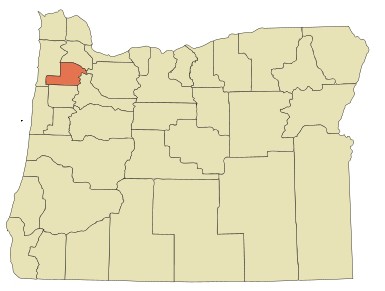

In a letter dated March 4th, Steven Crosby — senior vice president of government and regulatory affairs, told the city administrator in Dundee, Ore., Frontier FiOS TV has been a flop.

Since Frontier Communications Northwest, Inc., acquired Verizon’s operations on July 1, 2010, it has built on Verizon’s prior actions and continued to offer a robust and aggressively priced video product to attract Dundee subscribers. Despite these efforts, however, customer growth has been disappointing and stagnant and Frontier has not achieved a commercially reasonable level of subscriber penetration.

Frontier also admits it has been under-pricing its video service to stay competitive and attract new customers, but those days are over. The company earlier announced its intention to raise rates by $30 a month for its standard cable TV service, making it more costly than its nearest competitor, Comcast.

Frontier recognizes the impact its enormous rate increase will have on its subscriber base, soberly noting it is likely to “further depress subscriber penetration.”

With this in mind, Frontier is exercising its right under the franchise agreement it has in Dundee to provide notice it intends to terminate its video service at a future date, after providing subscribers with 90 days advance notification.

Similar letters went to city administrators in Newberg, McMinnville, and Wilsonville. City officials had no reservations about interpreting the meaning of the letters and plans to implement a $500 installation fee for future FiOS TV installations.

“Looking at it, you expect there will be no new customers,” Dan Danicic, Newberg’s city manager told The Oregonian. “Getting this opt-out notice is not a huge surprise to me, but we are disappointed.”

Sources tell Stop the Cap! there was considerable debate inside Frontier’s offices last week on how to implement directives from executives to shut down FiOS installations as quickly as possible. Initial efforts to quietly raise the installation price — without giving subscribers’ advance notice — were on track until Frontier’s legal department quashed the plan. Concerns were also raised inside the customer support units responsible for taking orders and handling customer billing inquiries over how to deal with the inevitable subscriber backlash when the first bills arrived in the mail.

“Frontier hates dealing with FiOS and they can’t wait to be rid of it — they claim that the product is at least 10 years away from really returning any investment from its original deployment,” a well-placed source told Stop the Cap! late last week.

Frontier FiOS is an anomaly for the rural phone company, which delivers the vast majority of its broadband customers DSL service over copper wire phone lines, usually at speeds approaching 3Mbps. Frontier FiOS “came along with the deal,” one Indiana Frontier official told local media there in response to rate hikes there.

Still, media reports that the company plans to ditch its TV customers created a small panic inside Frontier by the weekend.

“Getting customers switched over to satellite TV service in an orderly manner was the original plan, but reports the company was abandoning the service altogether risks we’ll lose our customers to Comcast, and many will take their phone lines to the cable company, too,” a second source informed Stop the Cap! this morning. “We were told ‘orderly transition’ over and over again, so reassuring customers is today’s top priority.”

Evidence of this campaign was not difficult to find over the weekend, as The Oregonian amended its original story claiming Frontier does not have immediate plans to exit the video business.

Crosby told the newspaper: “Our actual implementation decisions will be business driven. At this time, there is no change in our FiOS video offerings or in our FiOS video service delivery to our customers. And this filing does not affect our FiOS high speed service.”

Stephanie Schifano, identifying herself as an employee of Frontier Communications, attempted to spin the letters sent to several Oregon communities as a simple matter of business and not a foreshadowed abandonment of television service.

“Frontier is exercising our right under the franchise agreements to terminate the franchises. The right to terminate soon expires, and if Frontier didn’t give notice now we may have been required to provide this service, with these franchises, for another 12 years. This notice offers Frontier the flexibility to continue to analyze the FiOS Video/TV business and continue to service our customers,” Schifano wrote.

But both of our sources well-familiar with Frontier FiOS say the company’s actions speak louder than its words.

“When you increase the installation fee to $500 and raise your prices nearly $30 higher than Comcast, you would be crazy not to interpret the message Frontier is trying to send — go get your satellite dish from us and get off FiOS,” our second source told us.

Telecompetitor read into some of the company’s comments about utilizing the acquired fiber network in a new way, perhaps for over-the-top Internet video content.

“That’s wishful thinking,” our second source says. “Frontier’s only online video efforts surround its rebranded Hulu service, relabeled myfitv.”

“The company has no plans I am aware of for a grand video strategy — FiOS covers far too small a service area and there is no way Frontier will spend more money to increase that fiber footprint,” our source adds. “Frontier wants to meet its general obligations made as part of its deal with state regulators when it bought Verizon FiOS with the landline deal, and little else.”

Frontier will continue to offer FiOS to broadband customers for the time being, regardless of what it does with its video package.

“If it’s already there and not costing a lot of money to maintain for broadband, why not?” our source says.

One direct sales contractor for competitor Comcast suspects that train may have already left the station.

Calling Frontier’s customer service operation “a circus,” the salesman says Comcast is benefiting from Frontier’s ball-dropping.

“Many Frontier customers are unhappy with the customer service side while stating they do enjoy their phone, Internet, and video services provided by the FiOS network, but lose the business on the practically non-existing customer service side.”

The contractor says he hears stories from Frontier customers all day who are fed up with the frustration of extended hold times, inaccurate or missing bills, online account access problems, excessive call transfers to deal with service issues and high fees.

For regulators, the aggravation is much the same.

After being promised by CEO Maggie Wilderotter that Frontier would be an aggressive competitor in a barely competitive marketplace, Frontier has raised rates by 46 percent, irritated their customers with customer service problems and outages, and now has served notice it intends to flee the TV business at an undetermined point in the future.

Subscribe

Subscribe