One of the most common talking points among pro-business tax cutting advocates is the claim that companies in the United States face the highest corporate tax rate in the world. But that assumes corporations actually pay taxes at that rate, which few do. In fact, this week Forbes discovered that many of the country’s biggest, most profitable corporations enjoy a far lower tax rate than you do–that is, if they pay taxes at all.

While the biggest tax savings were grabbed by the bailed-out banks, the nation’s two largest telecommunications companies — AT&T and Verizon didn’t do too badly for themselves.

Of the two, AT&T had the higher tax bill, paying an effective tax rate of 32.4 percent. But AT&T is still prone to avoid paying corporate taxes wherever it can. In Connecticut, AT&T’s maneuvers are fueling a campaign for state tax reform to close the loopholes.

This morning, the Hartford Courant slammed AT&T:

AT&T Corp. has emerged as the poster child for these shenanigans.

A state Department of Public Utility Control audit found AT&T to be engaging in a tax-avoidance scheme sometimes called the Las Vegas Loophole. Over a period of 2.5 years, AT&T shifted about $145 million in Connecticut earnings to a subsidiary in Nevada, ostensibly paying licensing fees for the right to use the company’s own name and logo. Nevada has no corporate income tax, so the shifted earnings went untaxed and Connecticut lost out. If it sounds fishy, that’s because it is. AT&T is not alone. Many large corporations use sham transactions designed to move profits generated in Connecticut to a different state where they won’t be taxed.

AT&T’s executives benefit from creative tax accounting themselves, earning a stipend of up to $14,000 a year to hire high-priced accountants that specialize in finding ways to reduce their own personal tax bite. But no matter — AT&T covers the taxes CEO Randall Stephenson has to pay on some of his benefits anyway.

While the rest of the country plods through a jobless recovery, Stephenson decided the time was right to get a base salary increase and resume taking a bonus — a big one, too. His effective compensation package rose by a third in 2009.

Among Stephenson’s compensation and perks:

- $1.45 million in base salary, up two percent over 2008;

- $12.1 million in options and performance-based stock incentives;

- $216,000 in rebates to cover his club membership dues;

- $200,000 to cover his life insurance premiums;

- $140,576 to cover any taxes he is forced to pay on his benefits package.

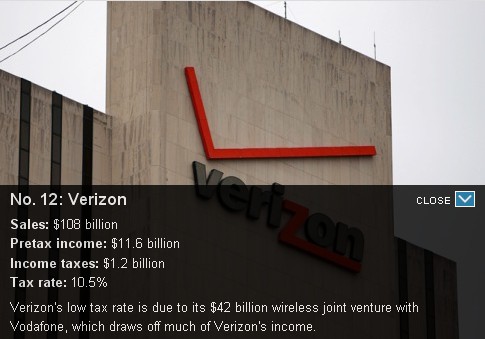

Verizon gets to use partner Vodafone's British address to help reduce exposure to U.S. corporate taxes. It reports much of its income through its British partner, which helps reduce its American tax liability.

Meanwhile, over at the nation’s 12th largest company, Verizon has managed to cut its tax rate to just 10.5 percents. That’s because on paper, Verizon’s British partner Vodafone gets much of the income, while the U.S. side gets lots of expenses. That dramatically reduces the corporate taxes incurred by the company in the United States. That tax rate is even lower than Steve Forbes’ much-promoted 15 percent flat tax.

Verizon’s compensation to Uncle Sam calls out the myth of America’s corporate tax rate. With creative accounting work, companies can slash their tax obligations.

That gives Verizon more money to spread around to top executives at the company, all while Verizon lays off thousands of workers and leaves retirees wondering how long the company will stand behind its pension and health coverage benefits.

Some shareholders are rankled by news CEO Ivan Seidenberg is on track to receive an $11 million stock grant if the company makes it as low as 25th among 34 similar Dow Jones-ranked companies, and a doubling to $22 million, if the company ranks among the top four. That’s hardly a high hurdle to achieve an $11 million bonus.

That kind of compensation raises the ire of former employees of Verizon, who launched the Association of BellTel Retirees to protect the pension and health care benefits of retirees.

“Large payouts for below-median performance does not adequately align pay with performance,” said Bill Jones, the retiree group’s president, a former managing director at NYNEX, now a part of Verizon.

The group is well known for its high profile pressure on Verizon to stop providing a largess of benefits for top management for merely doing their jobs.

This year, the Association will demand a vote on a resolution to better tie stock awards to stock performance and limit executive compensation. It also wants to stop expensive windfall golden parachute packages, such as Seidenberg’s $33.1 million dollar bon voyage, which he receives if he’s fired or retires.

While a handful of Verizon executives fight to preserve their generous compensation packages, Verizon retirees are fighting to get their doctor bills paid. Jones’ group is strongly advocating new legislation to stop companies from walking away from their agreements with retired employees.

Bill Jones appeared on WOCA-AM Ocala, Florida in February to discuss the threat retirees face when companies walk away from their pension and health care plans for former employees. (28 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

<

p style=”text-align: center;”>

H.R. 1322, the Emergency Retiree Health Benefits Protection Act, was introduced into the 111th Congress by Rep. John Tierney and would:

-

Prohibit group health plans from making post-retirement reductions in retiree benefits;

-

Require plans to adopt provisions barring post-retirement cuts in retiree health benefits;

-

Require employers to restore benefits reduced after retirement;

-

Provide an exemption for employers who are unable to restore benefits because they would experience substantial business hardship to be determined by the Secretary of Labor; and,

-

Create a loan guarantee program to assist employers in restoring retiree health benefits.

[flv width=”560″ height=”336″]http://www.phillipdampier.com/video/The Association of BellTel Retirees Inc.mp4[/flv]

Bill Jones discusses his organization’s battles to protect pensions and health care benefits for Verizon retirees. (5 minutes)

Subscribe

Subscribe