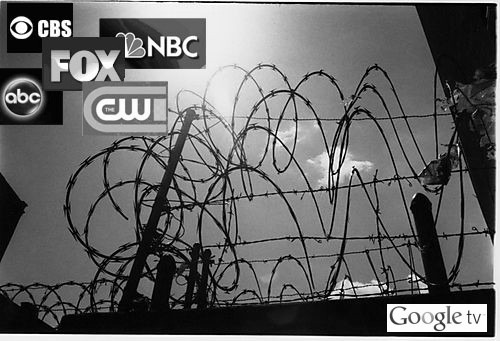

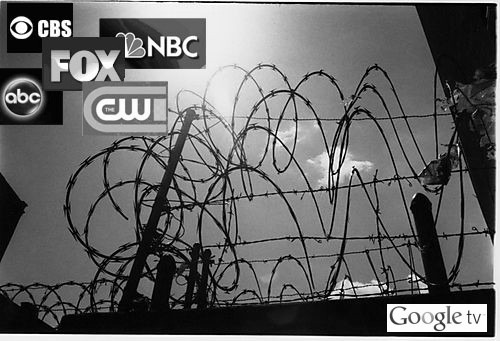

Early adopters of Google TV will find nothing but frustration if they want to watch ABC’s “Modern Family” and Fox’s “Glee” with the new broadband-driven TV service. They can’t, thanks to America’s content companies erecting Berlin Wall-like blockades of programming the service was supposed to provide.

Early adopters of Google TV will find nothing but frustration if they want to watch ABC’s “Modern Family” and Fox’s “Glee” with the new broadband-driven TV service. They can’t, thanks to America’s content companies erecting Berlin Wall-like blockades of programming the service was supposed to provide.

Google TV has already come under a state of siege from a coordinated campaign by the four major broadcast networks to keep programming off the new service until Google agrees to pay retransmission consent fees. Even Hulu, which delivers online access to hundreds of shows for free, has successfully manned the barricades to keep “unauthorized” Google TV out in the cold.

Some of the virtual barbed-wire fences have become so sophisticated, many wonder whether the biggest players in online video are spending more time and energy on innovating new ways to stop people from accessing content than on actually delivering it.

For a service trying to gain attention out of the starting gate, Google TV has remarkably little mainstream programming to show on it. To date, their most significant content partners are HBO’s Go service, available only to authenticated HBO subscribers, Turner’s TNT and TBS channels, also only available to current cable, satellite, or telco-TV video subscribers, and a CNBC “app.”

The spat between Google and the broadcasters is similar to the one between Cablevision and Fox in suburban New York City — until a company like Google agrees to pay a fee for the right to deliver content already given away for free online, the online portals that provide access will identify and block Google TV customers from accessing any of it.

Those fees are likely to be passed down to subscribers, and now some are wondering just how successful ventures like Google TV can be if consumers have to pay another monthly TV bill.

Wall Street is one, Variety notes:

Richard Greenfield, analyst for BITG Research, is a keen observer of the struggle for TV programmers to make money through Internet distribution of their high-priced programming. Amid the retrans battles for the major broadcasters, putting too much content online for immediate viewing, even with embedded advertising, undercuts their business and their rationale for seeking top dollar from subscription TV providers.

“We find it harder and harder to comprehend how broadcast television stations can demand retransmission consent fees from multichannel video providers, but at the same time place their content online for free,” Greenfield wrote in a research note titled “Broadcast TV Manifesto: If You Want to Be Paid Like Cable Nets, Start Acting Like Cable Nets on the Web.”

“While we acknowledge that the greatest value from retrans is access to sports programming (NFL, MLB, etc.) and other live events (‘American Idol’ finale, Oscars, etc.), none of which are streamed online for free, how can broadcast TV stations (and in turn broadcast networks) maximize value when so much content is being given away?”

That’s a major problem for any business plan, but excessive fees could also destroy interest in Google’s nascent entry into the world of online entertainment television. Consumers already face steep hardware costs up to $300 just to make Google TV work. Whether they would also part with a monthly subscription fee should not be too difficult for the folks in Mountain View to answer.

In fact, it’s the same answer Hulu’s owners are getting from viewers about its Hulu Plus pay-TV service, which delivers the same commercials as its free companion and charges $10 a month to watch them.

In fact, it’s the same answer Hulu’s owners are getting from viewers about its Hulu Plus pay-TV service, which delivers the same commercials as its free companion and charges $10 a month to watch them.

Subscribers to Hulu’s premium tier were promised access to entire runs of popular shows, programming not available on its free alternative, and a library of episodes that don’t expire and disappear after a few weeks. But many paying customers complain Hulu Plus still limits most of its shows and offers few exclusives. Even less-in-demand shows like Fox’s “COPS,” profiling the criminally stupid for more than 23 years, remain limited on the premium (and free) service to a single month of episodes.

But nothing causes more annoyance than Hulu’s recently-increased advertising load, dumped equally on both sides of the pay wall.

“Why should I pay $10 a month when I get (mostly) the same shows for free on Hulu, and have to watch the same ads?” asks our reader Stephanie. “It should be one or the other — ad-free pay or ad-supported free.”

Because Stephanie is hardly alone in asking that question, there are reports Hulu is about to slash its premium asking price in half to attract more subscribers.

Peter Kafka, who writes The Media Memo for All Things Digital, wrote Hulu is preparing to change its pricing as early as this week.

The idea is that paying subscribers get access to a deeper catalog of TV shows and movies than what the free service offers, as well as the ability to watch Hulu on devices like Apple’s iPhone and iPad, Microsoft’s Xbox 360 game machine and Internet-connected TVs from Samsung and Sony.

But a price cut would indicate that consumers haven’t bought in to the pitch. That shouldn’t be a shock, considering the other video options that consumers have, and the limits that Hulu’s content providers have placed on the service.

But even at half-price, many former Hulu Plus customers won’t be back.

Zwei, commenting on the rumored price change, said he dropped his subscription before the first month was up because of the Hulu’s byzantine rules and technical limitations over how premium shows can be accessed.

Watch it their way or not at all.

“You aren’t guaranteed the ability to stream to anything but your computer! “Fringe?” Not available to stream to my other devices. “Caprica?” Not available to stream to my other devices. Why the heck would I want to pay $10 a month if I still have to watch a lot of the content on my Mac,” he writes.

Paul notes it’s also hard to attract paying customers when most of your library consists of old shows already rerun into the ground:

“The problem is that they are cutting all the most appealing content from the service, Hulu Plus has a huge catalog of content, but it’s 95% leftovers from the 80’s. Give us current content when and how we want it (quickly and on the devices we want) and people will pay for it, even more than $10/mo. But if they give us 20 year-old content that we might not even have liked the first time, they shouldn’t expect our money,” Paul says. “It’s funny when they get worked up about piracy too. It’s just another market force — people only go to it when they don’t have other valid options, just like they’re doing here.”

Networks increasingly treat their programming as a valued commodity that can be sold, re-purposed, re-packaged, and re-sold again and again. Syndication, DVD box sets, online rental, cable company on-demand, and online ad-supported streaming each can fetch plenty of money, and many agreements include temporary restrictions on other distribution mechanisms to avoid “diluting” the programming’s value.

Consumers don’t care about these restrictions, because many will simply search out the shows they want regardless of the source — legal or otherwise, preferably for free.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Google TV 10-25-10.flv[/flv]

Two reports about Google TV — a review of the service from KSTU-TV Salt Lake City’s ‘Kurt the Cyberguy’ and a report from KTBS-TV in Shreveport, Louisiana (5 minutes)

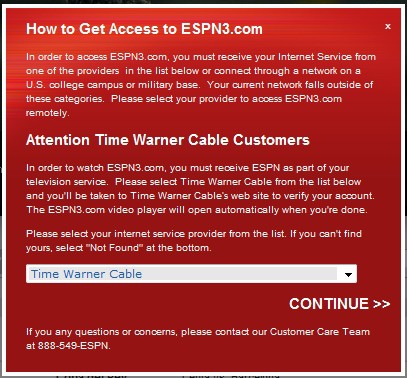

Time Warner Cable’s TV Everywhere authentication system went live today for customers, who can now access several channels of ESPN on their broadband connection, assuming they can prove they subscribe to a video package that includes ESPN.

Time Warner Cable’s TV Everywhere authentication system went live today for customers, who can now access several channels of ESPN on their broadband connection, assuming they can prove they subscribe to a video package that includes ESPN.

Subscribe

Subscribe