Peer to peer traffic no longer represents the largest single source (by application) of broadband traffic on the Internet. Cisco’s Visual Networking Study now finds online video streamed from websites like Hulu and Netflix to account for more than one-quarter of all broadband traffic, displacing file swapping from the number one position.

Peer to peer traffic no longer represents the largest single source (by application) of broadband traffic on the Internet. Cisco’s Visual Networking Study now finds online video streamed from websites like Hulu and Netflix to account for more than one-quarter of all broadband traffic, displacing file swapping from the number one position.

File sharing activity has routinely been used by providers dreaming of Internet Overcharging as an excuse to introduce usage limits and throttled speeds for their broadband customers. Peer to peer software allows customers to exchange pieces of files back and forth until everyone manages to secure their own copy. Cable operators, in particular, have complained this network traffic saturates their shared broadband lines because customers upload far more data than they would without this software. Up to 44 percent of all upstream traffic from residential accounts comes from peer to peer traffic, according to Cisco.

Providers and their friends have started to give up on their scare stories of peer-to-peer “exafloods” and data tsunamis triggered from too many online users engaged in file swapping. As we’ve argued for two years now, the glory days of growth in peer to peer are behind us for a variety of reasons:

- Downloading copies of TV shows and movies, always popular on file sharing networks, has declined now that content producers are finally serving the growing market for on-demand video programming;

- The growing popularity of downstream delivery direct to consumers has reduced wait times for downloading to near nothing — to the point where some users are abandoning peer-to-peer altogether;

- An increasing amount of fake files filled with viruses and spyware has made peer to peer-sourced files from underground websites more risky;

- Copyright enforcement and other legal actions have made file trading less palatable for some.

While peer-to-peer traffic is still growing along with other online usage, online video is growing far faster.

Now some want to move the goal post — blaming online video for “forcing their hand” to implement overcharging schemes.

Broadband Traffic by Application Category, 3rd Quarter – 2010

| Traffic Share | |

| Data* | 28.05% |

| Online Video* | 26.15% |

| Data Communications (Email and Instant Messaging) | 0.28% |

| Voice and Video Communications* | 1.71% |

| P2P File Sharing | 24.85% |

| Other File Sharing | 18.69% |

| Gaming Consoles* | 0.16% |

| PC Gaming | 0.65% |

- The marked categories contain video.

Karl Bode at Broadband Reports writes that he found Sanford Bernstein analyst and cable stock fluffer Craig Moffett telling CNET that if customers cut the cord, cable broadband companies will simply turn around and begin metering broadband customers’ bandwidth. In fact, Karl adds, Moffett goes so far as to insist ISPs will have “no choice” in the matter as streaming services like Netflix gain popularity.

Instead of simply raising prices on cable broadband, Moffett said it’s more likely that cable operators would move toward usage-based pricing. That way consumers who use more bandwidth to stream movies and TV shows end up paying more per month for service than people who may be getting their video from the traditional cable TV network. Time Warner has tested usage-based billing, but the company faced a huge backlash from consumers. Still, Moffett said that broadband service providers may have no choice as bandwidth-intensive video streaming services like Netflix become more popular.

CNET’s Marguerite Reardon calls that scenario a “heads we win; tails we win” situation, especially for cable companies.

Would you tell this man you are dropping your Comcast video package to watch everything online for free? (Neil Smit, president - Comcast's cable division)

Last quarter, some companies saw the number of subscribers actually drop for the first time ever. Now Comcast reports in its latest earnings call the same thing is happening to them — losing 56,000 TV package subscribers during the third quarter. Comcast surveyed some of their customers calling to fire their cable company. Most of them are not switching to a pay TV competitor, said Neil Smit, president of Comcast’s cable division. Comcast characterized them as “going to over the air free TV,” but would you tell your cable company you are dropping their video package to watch everything on their broadband service for free? For a lot of cable customers, that would be tantamount to calling them up and saying you are now getting free HBO on your TV.

Both companies are still denying online video is cutting into their cable TV package business, but it’s an argument some stock analysts have begun to make as they watch cable profits struggling to hit targets. Watching extra fat profits bleed away because “broadband piggies are watching all of their TV online for free” just won’t do for folks like Mr. Moffett, who will be among those leading the call to slap limits on broadband usage to protect industry profits. Why leave good money on the table?

But before Moffett encourages cable companies to install coin slots and credit card readers on cable modems, he has another idea: jack up the prices of broadband higher than ever while cutting video pricing, making it pointless for customers to jump ship:

“Cable’s broadband dominance opens the door for renewed share gains in the adjacent video market,” Moffett said in his report. “Cable companies could simply increase their a la carte broadband prices (since in most markets, households have no other choice for sufficiently fast broadband) and simultaneously drop their video pricing, leaving the price of the bundle unchanged, to recapture video share.”

He pointed to an example of this in Albany, N.Y., where Time Warner Cable raised its broadband price by 10 percent for its Internet-only customers to a rate just $2 below its promotional bundled rate for both services. The Internet-only price increased to $54.95 from $49.95. The 12-month promotional rate for video and data was $56.95.

Of course, Albany has Verizon FiOS breathing down Time Warner’s neck. In late October, Verizon announced it was launching its video FiOS service in Scotia, just outside of nearby Schenectady. Bethlehem, Colonie, Schenectady and Guilderland already have FiOS phone and Internet services available, so getting a TV franchise to deliver competition to Time Warner Cable isn’t a big leap.

In Rochester (where Frontier Communications idea of video is a satellite dish), a similar promotional package from Time Warner runs $84.90 a month.

Highlights of the Cisco Report

Highlights of the Cisco Report

- The average broadband connection generates 14.9 GB of Internet traffic per month, up from 11.4 GB per month last year, an increase of 31 percent;

- “Busy hour” traffic grew at a faster pace than average traffic, growing 41 percent since last year. Peak-hour Internet traffic is 72 percent higher than Internet traffic during an average hour. The ratio of the busy hour to the average hour increased from 1.59 to 1.72, globally;

- Peer-to-peer (P2P) file sharing is now 25 percent of global broadband traffic, down from 38 percent last year, a decrease of 34 percent. While still growing in absolute terms, P2P is growing more slowly than visual networking and other advanced applications;

- Peer-to-peer has been surpassed by online video as the largest category. The subset of video that includes streaming video, flash, and Internet TV represents 26 percent, compared to 25 percent for P2P;

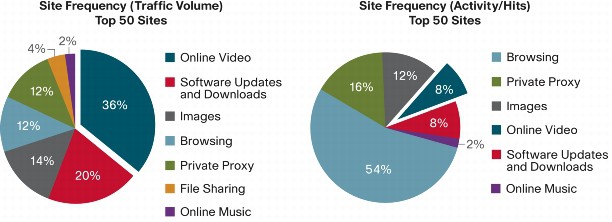

- Over one-third of the top 50 sites by volume are video sites. There is a high degree of diversity among the video sites in the top 50, including video viewed on gaming consoles, Internet TV, short-form user-generated video, commercial video downloads, and video distributed via content delivery networks (CDNs). Video sites appeared more frequently than any other type of site in the top 50.

Subscribe

Subscribe

I am interested in the “Other File Sharing” Category.

At over 18% that’s a large slice of the Pie, what does that consist of?

People are tired of their cable bill going up to pay 8 figure executive salaries

You are missing my point.

Around 25% of the Pie is P2P sharing.

Around 18% is “other file sharing”.

That makes 43% for file sharing.

Phil’s point is that File Sharing is dead and replaced by Video downloads.

Just asking.

Just noticed that 18% of site visits is private proxies…

Does this mean that Public file sharing went private?

When I saw this “other file sharing” I was a bit curious as well so I sent over a request for more information. It turns out “other file sharing” means “one-click file hosting,” which I suspect means Rapidshare and Megaupload and some backup services. These are file storage sites that share content (legal and otherwise) or allow people to privately share large files. They are not P2P because there is very little upstream load, except when uploading the original file to be shared. I did not say file sharing is dead, by the way. As I note, it is still… Read more »

What I do not understand… Cable is not required to carry netflix

and can block P2P and also block streaming..

Why all this fuss day after day?

If I thought something was costing me so much I would

get rid of it.