America's most creative taxing authority, charged with collecting the innovative taxes the state government dreams up

No state can be more innovative in finding new ways to tax, fee, and surcharge residents than New York. Once it becomes taxable in the Empire State, it’s only a matter of time before it becomes taxable in other states as well. Now consumers face the prospect of paying new sales taxes on broadband and other services they purchase online, even in cases where federal laws would seem to exclude such possibilities.

New York residents have endured the so-called “Amazon tax” since June 1, 2008 when the state government demanded large, out of state Internet retailers collect and remit sales taxes for online purchases should they result from online advertising. Although largely ignored by smaller online retailers, large high profile Internet retailers with so-called “affiliate programs” that pay independent websites for referring potential customers faced the choice of cutting ties with their “affiliates” in New York or imposing sales tax on New York customers.

Websites ranging from Overstock.com, Buy.com, Amazon.com, Newegg, and others were all targeted by the New York State Department of Taxation and Finance. Overstock and Newegg eventually threw their New York affiliates under the bus to preserve an “unofficial” tax-free shopping experience for New Yorkers. Buy.com and Amazon both complied with the state, although the latter filed suit challenging the constitutionality of out-of-state sales tax collection.

What made the New York sales tax law different from all the rest is that it delivered an end run around settled federal interstate commerce law. A Supreme Court decision found it legal for states to demand sales tax payments from businesses that operate within their state, but no such provision was made for businesses who don’t locate an office or store in a particular state. Buying a new hard drive from an online retailer inside your state? You’ll be charged sales tax. Order it from outside of the state, and the company typically won’t try to collect sales tax.

New York wants online businesses to get a new attitude. It wants sales tax money for orders placed by New Yorkers no matter where your business is located.

As the Great Recession wreaks havoc on state budgets, state lawmakers who don’t want to cut popular spending programs are instead sniffing for new ways to raise revenues. Some are declaring ‘I Love New York’ for blazing the trail to fatter sales tax coffers.

Colorado's legislature ignited a firestorm of controversy after passing an online sales tax bill into law

One recent example is Colorado, where state lawmakers borrowed liberally from New York’s tax law and passed their own — requiring large online retailers to start collecting sales taxes or provide a summary of residents’ web purchases in the state (so the Colorado taxing authority can pressure residents to declare those purchases and pay sales tax themselves.) The penalty for not doing so is a fine of several dollars per non-compliant transaction. Amazon.com, among others, yanked their affiliate program in the state, and some online retailers have declared they won’t comply. A few proclaimed they would throw away any fine notifications, suggesting the state has no authority to impose such fines for interstate commerce, which is regulated on the federal level.

Rhode Island passed its own sales tax law, and collected almost nothing from it, in part because online retailers outside of Rhode Island almost universally ignored it. Now the law faces repeal.

Other states like North Carolina and California have endured their own controversies over such legislation. In North Carolina, Amazon.com threw their affiliates under the bus. California Gov. Arnold Schwarzenegger vetoed a sales tax proposal last year. There are bills to impose sales taxes on all online purchases in Iowa, New Mexico, Vermont and Virginia.

Meanwhile, New York’s taxing authority has some new ideas on how to expand the scope of sales taxation to include a whole new range of online activities.

The E-Commerce Times reports the New York State Department of Taxation and Finance has declared doing practically anything online that involves the transfer of money in return for a service could be subject to New York sales tax:

This new position results in the imposition of sales tax on purchases of services provided over the Internet that would not be subject to sales tax if provided in person by a human being. For example, the purchase of an educational course is not taxable if provided by a live speaker, but the same course may now be considered taxable by the Department if the course is given online.

The Department has painted with a broad brush to conclude in a number of advisory opinions that, among other things, the following services or forms of entertainment are really sales of software when provided over the Internet:

- e-learning courses;

- information technology courses;

- mail-tracking services performed for airlines;

- loan origination and processing services;

- automobile insurance policy services;

- payroll processing services; and

- video games played on computers located at a business’ facility.

The logic used to justify taxation of online services illustrates the time and talent state workers are willing to extend to help fill New York’s dire budget pothole:

The Department is asserting that a purchaser of an online service is controlling the software on the provider’s server by clicking various icons on his or her own computer screen, and thus the purchaser has control over the software; hence the software has effectively been “transferred” to the purchaser. Accordingly, the Department is taking the position that the purchase of an online service is really the purchase of a license to use software, even though the software is being used by the service provider on its own server.

Critics of the taxing authority accuse it of exceeding its legislative mandate. In fact, the New York State legislature previously considered — and rejected — legislation that would have imposed sales tax on digital downloads like music and movies. The legislature has been resistant to taxing online activities in hopes of retaining high tech businesses in the state, who might consider locating out of state if it meant avoiding imposing sales tax on consumers.

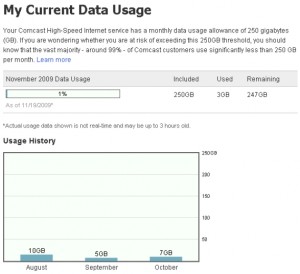

Of course, online buyers are technically subject to paying sales taxes for every taxable purchase, made in or out of state. But since most states ask taxpayers to voluntarily report such purchases, the compliance rate is notoriously low.

In New York, the taxing authority has a reputation best summed up as “we don’t play — padlock and seize first, ask questions later.” Aggressive enforcement against non-compliant retailers is likely, and E-Commerce Times suggests online retailers need to pay attention:

The sales tax is a transfer tax, and sellers collect the tax from purchasers and remit the tax to the Department. However, when a seller fails to collect and remit any tax due, the seller itself becomes liable for the tax, interest and possibly penalties. The Department has not been content simply to apply its new position going forward, but rather has been seeking to apply its position retroactively on audit as well.

There have been instances of the Department auditing online service providers and assessing sales tax as far back as 2005, even though the Department’s first clear administrative guidance with respect to its new position dates from November 2008 (and even though the Department issued administrative guidance in February 2006, that seems to conflict with its present position).

The Times predicts this will all come to a head when the taxing authority sues an online retailer or state resident for non-payment of taxes. Then it’s up to the courts to decide… when they get around to it. Remember the lawsuit Amazon.com filed against New York in 2008? The New York Supreme Court threw out the suit in January 2009, but an appeal was filed with the next court up the chain — the appellate court — July 13th. It’s still pending.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Online Sales Taxes 4-5-10.flv[/flv]

Here are three reports about the ongoing online sales tax controversy underway in three states (9 minutes):

- KMGH-TV in Denver reports on a local family running a campaign to repeal the so-called “Amazon tax” in Colorado which resulted in the end of the company’s affiliate program for Colorado residents.

- WCAX-TV in Burlington, Vermont discusses a proposed Vermont law that would extend sales tax to online purchases. Local merchants support the proposed law as a way to restore pricing fairness between online and brick and mortar retailers.

- WTVR-TV in Richmond, Virginia covers that state’s proposed online sales tax bill. George Peyton from the Retail Merchant’s Association reminds viewers whether or not an online retailer charges them sales tax, they still owe the state the tax — declared on your income tax return.

Subscribe

Subscribe