At least Verizon is honest about it. As providers contemplate slapping customers with usage limits, overlimit fees, and other tiered pricing systems, they’ve typically said they’re justified because of the strain they claim heavy users place on their broadband networks. One network that doesn’t face that problem is Verizon’s robust fiber optic FiOS network, which is on the way to upgrading from the ridiculously fast current speeds to the “next generation” of FiOS speed: delivering 10 Gbps downlink and 2.5 Gbps uplink, shared among 32 locations. That makes the cable modem competition, which shares slower speeds among many more customers wilt at the prospect. DSL instantly becomes the dial-up service of the decade in comparison.

Make no mistake, Verizon tells all who ask: Fiber to the Home is near-infinitely upgradeable for decades to come, simply by swapping out some hardware at each end of the pipe.

Yet Verizon began making noises about ending its all-you-can-eat broadband buffet this past September, when Verizon Chief Technology Officer Dick Lynch said Verizon was in favor of consumption-based billing, too.

But why should Verizon FiOS, often priced higher than the cable competition, opt for Internet Overcharging schemes when it has a network that is nowhere near capacity and will increase its speeds even further next year?

As GigaOm’s Stacey Higginbotham found out, the answer is – because they can:

Brian Whitton, executive director of access technologies at Verizon did acknowledge how valuable broadband has become—precious enough that people will pay for premium access to it, especially those using up a disproportionate amount of network assets. “Ultimately this is the fairest cost-recovery model, and with a tiering plan or a meter everyone is paying their fair shares to finance the network,” Whitton said. Unlike other ISPs, Verizon doesn’t view heavy bandwidth users as hogs, but it does view them as potentially high-end customers.

Yet Verizon already does charge users a fair share to finance their network, based on the speed tier that customer chooses. Those high-end customers are already paying Verizon premium prices for the fastest available speeds on Verizon’s fiber optic system. Verizon’s ability to recoup their investment becomes easier and easier as costs decline to construct the fiber optic systems that will protect Verizon’s viability for decades to come, unlike those traditional phone companies sticking with copper wire lines until the last customer out the door turns the lights out for good. Verizon’s average revenue per subscriber has never been higher with its ability to market video programming, speeds that make most cable operators blush, and an infinitely more reliable telephone network, all on one bill. That helps achieve subscriber loyalty, particularly when offering service that keeps customers happy.

Creating Internet Overcharging schemes for your broadband service simply to monetize consumption does not keep customers happy. Verizon sees the cream rising to the top — charging broadband enthusiasts more while promising nothing for customers who use the service less. With average consumption per broadband user rising, there’s going to be a lot more cream to skim, charging an increasing number of customers more money for the exact same level of service.

No consumption billing scheme to date has ever provided customers with a “fair share” system, because none of them result in no charge for no consumption or charge a flat fee per gigabyte. Instead, customers are allocated a pre-determined allowance for usage, charged whether they use it or not. If they exceed it, punishing overlimit fees are always the result, unless a provider takes another step towards monetizing broadband by inventing overpriced “insurance plans” to protect consumers from overage fees. The cost of delivering that data is already built-in to the price of today’s broadband plans, and those costs continue to decline.

Higginbotham adds another factor in the equation: with insufficient competition, those “fair share” schemes can inflate prices and lower allowances at a whim, as most customers lack a wide variety of competitors to choose from, which could help keep the greed factor in check.

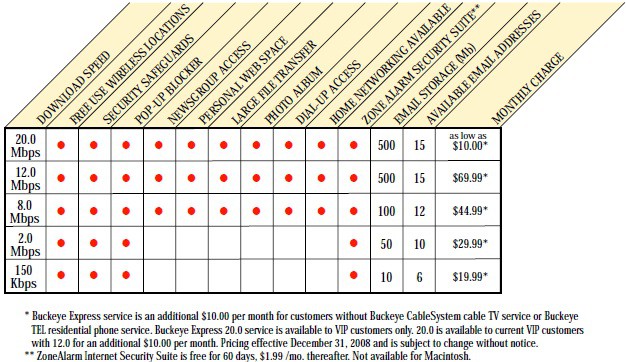

Most places have two providers that offer slightly different sets of services and plans, making it hard to compare prices. I don’t mind paying more for a better network (I do so for my cell phone), but most consumers lack that option when it comes to wired access. Comcast—which competes against Verizon in about 12% of its footprint—is rolling out faster broadband to ensure that customers don’t leave the cable provider for Verizon’s fiber. But in other areas of the country, such as here in Austin, Tex., folks must choose between DSL (with some U-verse) and cable that hasn’t been upgraded to the faster DOCSIS 3.0 speeds.

Austin was one of the test markets for Time Warner Cable’s reviled “consumption billing experiment” this past April. In other test cities, it’s more of the same. In Rochester, New York broadband service is realistically available from two major players — Time Warner Cable and Frontier Communications. The former has apparently passed over Rochester for DOCSIS 3 upgrades because the cable operator sees little need to upgrade service in an area whose only primary competitor believes DSL service is good enough, one that has stubbornly kept an Acceptable Use Policy defining an appropriate amount of usage at a piddly five gigabytes per month, and thinks fiber is for breakfast cereals, not for Flower City residents.

Verizon’s words help call out the fiction that some providers have used to peddle Internet Overcharging schemes on their customers. It’s not about “fairness,” it’s not about “exafloods and Internet brownouts,” nor is it about “expanding networks.” It’s about profit, pure and simple. When you have a duopoly in place for broadband and almost no regulation governing that service, the sky is the limit for price increases and limits on usage.

[flv width=”480″ height=”284″]http://www.phillipdampier.com/video/Verizon Whitton On Telecom Delivery 2-25-09.flv[/flv]

Verizon’s Executive Director of Access Technologies Brian Whitton speaks about the future of telecommunication delivery technologies with Kimberlie Dykeman of Web2point0.tv at The Future of Television East conference in New York (February 25, 2009 – 11 minutes)

Subscribe

Subscribe