The Canadian Radio-television and Telecommunications Commission has given approval to Shaw Communications for its acquisition of Hamilton-based Mountain Cablevision, Ltd., a small independent cable operator in southern Ontario. The $300 million dollar transaction brings 41,000 cable customers, 29,000 Internet subscribers, 30,000 digital phone lines, and 135 Mountain Cablevision employees into the Shaw family, making the Calgary-based cable company Canada’s largest.

“This is a great move for us to come in there and be able to start being around that market. We always said that […] we want to be in Alberta, British Columbia, and Ontario,” Shaw chief executive Jim Shaw said Friday.

“Rogers had passed on the acquisition so we decided to go in there,” Shaw told analysts. “This is a great move for us, being around that market.”

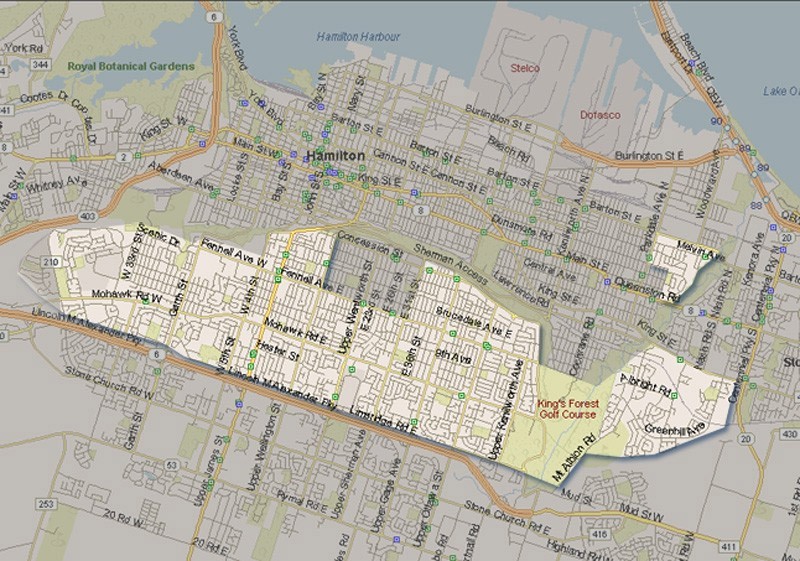

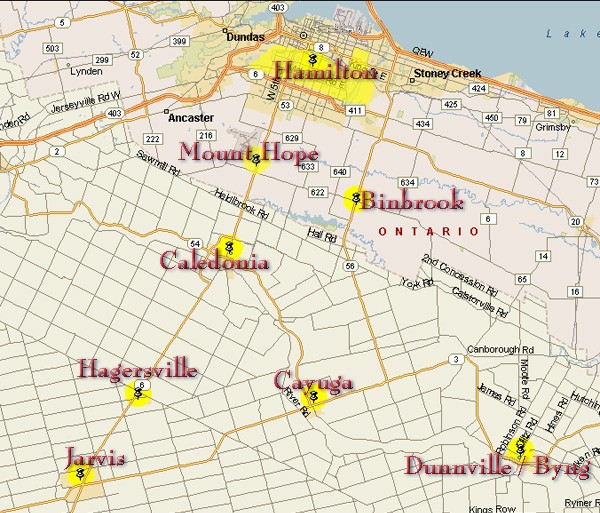

Mountain Cablevision serves a small part of Hamilton and surrounding communities in southern Ontario

Shaw’s entry into Ontario upset Rogers Communications, eastern Canada’s dominant cable provider. Rogers sued Shaw in an Ontario court, claiming the purchase violated a near-decade long agreement made personally between Ted Rogers and Jim Shaw to stay out of each other’s territories — Shaw stays out of eastern Canada if Rogers moves no further west than Ontario.

Canadian courts aren’t compelled to recognize handshake deals made over dinner, and the court ruled against Rogers.

With the agreement swept away, some analysts predict Rogers will investigate acquisition opportunities in western Canada, probably in the more populated regions.

Shaw claims it will upgrade Mountain Cablevision’s small cable footprint, which serves only a portion of greater Hamilton – Hamilton Mountain and East Hamilton, as well as the communities of Mount Hope, Caledonia, Hagersville, Jarvis, Dunnville/Byng, Cayuga and Binbrook, all in Ontario. The company promises better broadband, cable, and telephone service after the upgrades are complete. Shaw also says it will expand the Mountain Cablevision system into several unserved neighborhoods and townships. That’s an important distinction, because it indicates Shaw has no intention of competing head to head with Rogers or Ontario’s other dominant cable company Cogeco.

The deal comes during challenging times for Shaw, who announced a 6% decline in profits in the fourth quarter, with gains only from new digital cable additions. More than 110,000 Shaw customers signed up for digital cable in the third quarter, up from 23,000 in the third quarter a year ago.

In other areas, Shaw lost customers — 5,000 canceling broadband, 4,500 dropping Shaw’s direct to home satellite service, and nearly 9,000 disconnecting their Shaw digital phone line.

Shaw’s next product introduction will likely be its new cell phone service. The company spent $190 million dollars last year acquiring 18 airwave licenses in northern Ontario, Manitoba, Saskatchewan, Alberta, and British Columbia.

But Shaw is taking a “very cautious approach” to wireless mobile services, according to the company. It has refused to set a timetable when service would begin. Shaw faces a growing number of wireless competitors introducing service in Canada late this year and into early 2010. DAVE Wireless, Wind Mobile, and Public Mobile are all poised to launch in major Canadian cities, expecting to put competitive pressure on pricing and bring about lower priced, more generous service plans.

Shaw claims it’s not concerned, telling The Financial Post, “If they’re in there, we don’t really care. We already have a relationship with customers and they have zero,” Shaw said. “We have 3.4 million customers we have a relationship every month with.”

Telecommunications companies are increasingly concerned with offering customers “bundles” of telecommunications services from video, broadband, wired phone lines, and now increasingly wireless data and mobile phone services. Customers purchasing bundles tend to remain loyal to the companies offering them.

Subscribe

Subscribe