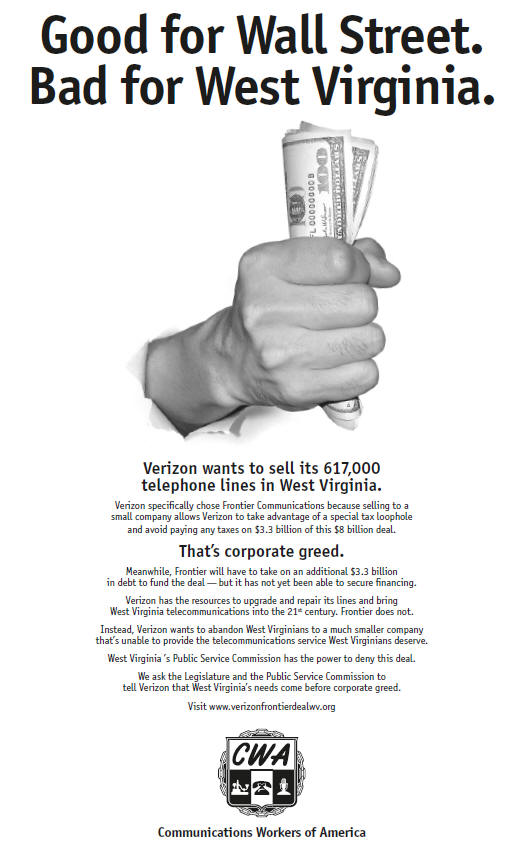

This newspaper ad is running across West Virginia opposing the sale of the state's phone business to Frontier Communications

Opposition to the sale of Verizon’s landline business to Frontier Communications in 13 states continues to increase, particularly in Ohio and West Virginia, where several employee unions have argued the deal represents a win for Wall Street and company executives, but a raw deal for millions of consumers.

The Communications Workers of America and the International Brotherhood of Electrical Workers, who also warned state regulators in New England about the consequences of approving the sale of Verizon’s operations in Maine, New Hampshire, and Vermont to FairPoint Communications, continue to warn consumers and state officials that a similar deal between Verizon and Frontier Communications could spell major problems for telephone customers. They call on state officials to reject the deal and force Verizon to invest some of their substantial profits earned in these communities into providing better service instead of dumping customers overboard.

The CWA says the sale would put $3.3 billion dollars into Verizon’s coffers — tax free — and leave Frontier buried in debt, which could impact both new and existing Frontier Communications customers, including hundreds of thousands of those in Rochester, New York, Frontier’s biggest service area.

“Verizon Communications has been divesting assets to smaller, less stable corporations in order to reap large, tax-free, profits,” CWA International Representative Elaine Harris said. “Verizon proposes to repeat that formula, and its disastrous effects, with the sale of all of its wireline operations here in West Virginia to Frontier.”

The CWA considers the transaction based primarily on corporate greed, not the best interests of phone customers.

“The only winner in all of these deals has been Verizon Communications and especially Verizon’s corporate executives,” Harris said. Verizon CEO Ivan Seidenberg is the highest paid executive in the telecom industry, with $24.31 million dollars in annual compensation from Verizon.

“His salary could have funded the entire network of senior services in West Virginia last year and he still would have had $8 million in his pocket,” Harris said.

The deal will leave Frontier Corporation with a total of $8 billion dollars in debt. “The West Virginia consumers will experience the effects of converting more than 617,000 aging access lines to a smaller, debt-ridden company,” Harris said. “The public will be forced to pick up the pieces if Frontier follows Verizon’s other buyers and files for bankruptcy.”

“We’ve closely watched the failures of the companies that purchased Verizon’s assets and we don’t need a crystal ball to figure out what will happen if Verizon tries the same scheme in West Virginia. There’s absolutely no reason to gamble West Virginia’s telecommunication’s future just to increase Verizon’s bottom line,” Harris added.

The CWA is running radio ads across the state of West Virginia opposing the deal.

Audio Clip: Communications Workers of America Radio Ad (1 minute)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Verizon spokesman Harry Mitchell said Verizon wants to sell its access lines so the company can focus on its wireless and broadband business. Mitchell told The Charleston Gazette the union has opposed the deal from day one.

“They’re spending their members’ dues on advertising in an effort to cloud the issue,” he said.

Frontier Communications has protested accusations that their purchase of Verizon assets will result in the same kinds of colossal failures impacting other Verizon sell-offs. Company officials claim Frontier already has a successful customer support operation in DeLand, Florida, and billing and operating systems in place.

In West Virginia, those existing operations serve 144,000 Frontier customers. If the deal is approved, Frontier will take on the responsibility of serving 1.3 million landlines across the southeastern U.S. alone.

The International Brotherhood of Electrical Workers, integrally involved in fighting the FairPoint transaction in New England, says the Frontier deal is reminiscent of what happened with FairPoint:

Regulators in the 14 states where Verizon now proposes to sell its landlines to Frontier face an almost identical situation as New England regulators did last year. Frontier Communications is proposing to buy Verizon’s entire wire line operation in West Virginia – as well as Verizon’s scattered landlines across 13 other states – in a similarly structured deal.

In both cases, Verizon chose a much smaller company in order to take advantage of an obscure tax loophole. With the Frontier sale, Verizon will avoid paying any taxes on the $3.3 billion it will receive from Frontier. Frontier will have to cope with three times more employees, three times more access lines and a 75 percent increase in its debt from $4.5 to $8 billion.

Verizon has a very poor track record in these sales. Verizon sold its Hawaii operations to Hawaiian Telcom in 2005 and it filed for bankruptcy. Customers, service and employees have suffered as a result.

Frontier – just like FairPoint – is a making promises that it may not be able to meet. Like FairPoint, state regulators are being asked to approve a deal where a small company will attempt to simultaneously run a much larger operation, pay off billions of dollars more in debt, integrate Verizon’s computer systems and spend more money to expand broadband.

In the end Verizon will profit but consumers, workers and communities are put at real risk.

Expanding broadband access is an especially critical factor for all rural areas. But Frontier has failed to make any specific commitments, set any timeline or offer a plan for its broadband buildout.

Union leaders believe that states shouldn’t risk their telecommunications’ future just so Verizon can fatten its bottom line. Regulators shouldn’t approve this sale because the risks are too great. Instead, our legislators, regulators and the Governor should require Verizon to meet its service responsibilities. Verizon shouldn’t be allowed to walk away with $3.3 billion tax free, and leave the fate of its customers in the hands of a company with a lot less resources. If Frontier should falter, customers and the public would be required to pick up the pieces – not Verizon!

The track record for Verizon spinoffs has hardly been one of success.

FairPoint Communications, the company to which Verizon sold its Maine, New Hampshire and Vermont operations in 2008, is foundering as it tries to integrate operations and is choking on the debt it incurred to finance the transaction Since the deal was announced, FairPoint’s stock price has declined by about 95%, and the company has been forced to suspend dividend payments.

Hawaiian Telecom, the company to which Verizon sold its Hawaii operations in 2005, filed for bankruptcy. Verizon sold its 715,000 access lines in Hawaii. Since then, Hawaiian Telcom has experienced significant transition issues that resulted in major financial and customer service problems. In three years, the company lost 21% of its customers. In December 2008, Hawaiian Telcom filed for bankruptcy.

The yellow pages company that Verizon spun off also filed for bankruptcy. In November 2006, Verizon spun off its yellow pages directory business to Verizon shareholders, loading the new company, Idearc, with about $9.5 billion in debt and extracting a cool $9 billion in cash and debt reduction. Last year, interest payments alone on Idearc’s debt accounted for almost one-quarter of its total revenues! Representing something of a Verizon failing company “hat trick,” Idearc filed for bankruptcy in March 2009.

[flv]http://www.phillipdampier.com/video/WSAZ Huntington Frontier CWA Fight 10-14-09.flv[/flv]

WSAZ-TV Huntington, West Virginia reported on the growing opposition to the Frontier sale by employee groups on October 14th. (3 minutes)

In Washington State, IBEW Local 89, outside Seattle, says the sale could cripple one of America’s most tech-savvy regions.

“We’ve always been a leader in communications in this part of the country,” said Ray Egelhoff, business manager of IBEW Local 89. “If this happens, we’re afraid businesses won’t move in, and some may even move out.”

Egelhoff, along with more than 1,500 Verizon workers who may become Frontier employees, deluged officials with letters and e-mails expressing their concerns. More than 500 have gone out so far to senators, house members, governors and business leaders. The workers worry Frontier —at about the a third the size of Verizon—won’t be able to absorb the huge Verizon assets, won’t be able to keep customers happy and, eventually, will have to shed staff.

Robert Erickson, International Representative in the IBEW’s Telecommunications Department said, “The deal poses risks to consumers and employees. Frontier is making all kinds of promises about synergy and how they’ll expand broadband. FairPoint Communications made the same grand claims and now they can’t meet their commitments and fulfill the promises they made. It’s clear that Frontier will be in a similar situation and not have the resources to fulfill the commitments they are making.”

Consumer groups are also raising objections to the sale.

The National Association of State Utility Consumer Advocates urged the Federal Communications Commission, which is reviewing the proposed transaction, to reject the deal.

“The merger proposed by Frontier and Verizon is not in the public interest,” said David Springe, president of the consumer advocate group. “The failure of the companies to offer adequate consumer benefits or protections puts customers at risk of being served by a company without enough financial strength to make necessary improvements to local telephone facilities and widen the deployment of broadband access.”

Free Press, a nonpartisan group that works to reform the media, also raised concerns about the sale in a filing with the FCC. Free Press cited Verizon’s sale of lines in New Hampshire, Maine, and Vermont to FairPoint, which subsequently acquired substantial debt, was unable to accommodate the increased service area, and is now on the edge of bankruptcy.

“This trend has the potential to leave rural areas with ill-equipped companies offering inadequate service at high prices,” says the Free Press report. “This is in direct contrast to the stated intent of Congress and the Obama Administration to foster universal broadband to all Americans.”

[flv]http://www.phillipdampier.com/video/WCHS Charleston Verizon Sale Fight 10-14-09.flv[/flv]

WCHS-TV in Charleston, WV talked with the CWA and company officials about the sale of Verizon operations to Frontier Communications. (1 minute)

Subscribe

Subscribe

Fantastic Post! I hope the people in West Virginia realize what’s going on before it’s too late. It’s going to be FairPoint times 100 if this mega-deal goes through and a total nightmare for all the customers who rely on Verizon. Verizon/ Frontier are serving up the same lies New England heard in 2007 with the FP deal. It wouldn’t be so bad for customers in other states, where Verizon/Frontier is just a small part of service and they can choose from a number of other providers if service is awful. But in WV it will be most people’s ONLY… Read more »