“Comcast isn’t looking to make a $50 billion purchase.”

Stephen Burke, Comcast Chief Operating Officer

Now that Comcast has been freed from that pesky provision of the 1992 Cable Act, authorizing the Federal Communications Commission to set a maximum size for large corporate cable operators, the nation’s largest cable operator is now considering breaking out the checkbook and going on a shopping spree. That is likely to spark a merger and acquisition frenzy among several players in the industry which could dramatically reduce America’s choices for telecommunications services.

Bloomberg News this evening quotes Stephen Burke, Comcast’s Chief Operating Officer, that it will consider buying other cable operators at a “good price.”

“If there is a way to acquire cable systems for what we consider a good price, ones that are well managed, we would certainly look at whatever is out three,” Burke, 51, said today at a Bank of America Corp. conference in Marina del Rey, California. Still, the company “isn’t waking up every morning” evaluating how it can become bigger, he said.

The Wall Street Journal calls the decision by the U.S. Court of Appeals in Washington, freeing Comcast from its limits, the start of “the coming cable consolidation.”

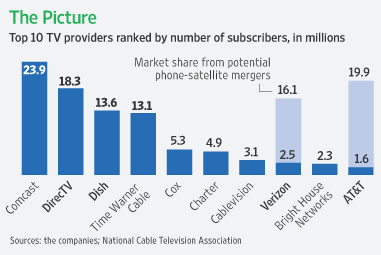

Martin Peers, writing for the Journal, said that when the dust settles, phone companies might own satellite TV providers and cable companies might end up consolidating into one or two super-sized providers blanketing the entire country with service.

Consumers would be left with a handful of providers for all of their communications needs, from telephone to broadband to television, if the courts open the door with more decisions favorable to the industry and antitrust reviews aren’t aggressively undertaken.

Starting with Comcast, Burke thinks Comcast’s first priority might be to buy up more programmers. Comcast already has ownership interests in several cable networks, and Burke feels “content channels are good businesses, and we wouldn’t be doing out job if we didn’t try to figure out a way to get bigger in those businesses.”

With Comcast and Cablevision joining forces to sue their way out of the cable network exclusivity ban, owning and controlling those networks, and what competitors get access to their programming, could be an important asset in an ever-consolidating marketplace. Imagine if U-verse or FiOS was denied access to ESPN, The Weather Channel, CNN, and other popular cable channels. Would subscribers be compelled to switch providers if they could no longer get the channels they want to watch?

The Journal ponders the coming consolidation frenzy:

Comcast and other cable companies will probably need to consider more consolidation — if not now, in the next couple of years. They are still losing market share to satellite and phone rivals. Comcast lost nearly 700,000 basic subscribers in the year to June. Time Warner Cable has fallen to No. 4 among TV providers, behind satellite firms DirecTV Group and Dish Network.

Cable operators are more than offsetting video losses by selling phone and Internet-access. Eventually, though, those opportunities will peter out. And phone companies’ competitive threat in video could be enhanced by a combination with satellite TV.

The newspaper speculates about this kind of marketplace in the near future:

AT&T DirecTV: The Journal ponders an AT&T buyout of DirecTV resulting in a reduction in AT&T’s investment in U-verse, pushing consumers to its newly-acquired satellite service and redirecting investment into the overburdened AT&T mobile phone network.

VerizonDISH: A Verizon buyout of DISH would allow the phone company to push more rural customers to DISH satellite service, and reduce the expense of wiring all but the nation’s largest cities with fiber optics.

Comcast (formerly Comcast & Time Warner Cable, if not others): A supersized Comcast absorbs Time Warner Cable and becomes an even more dominant cable operator, leveraging its investment in Clearwire to offer a wireless data option to stay competitive with the mobile phone companies like AT&T and Verizon Wireless.

That would leave most Americans with just three choices for telecommunications services capable of bundling multiple products together. Wouldn’t such a merger-mania trigger antitrust implications and government review?

The Journal doesn’t think so:

Would such a deal pass antitrust scrutiny, even absent the ownership cap? There is a good chance, say several antitrust lawyers. A major focus of antitrust law is whether a merger reduces competition in a way that could raise prices or otherwise hurt consumers. As cable operators generally don’t compete with one another, merging wouldn’t cut competition.

But what kind of benefits would be found for consumers? If one resides in a city too small to be judged worthy of fiber optic deployment, consumers could be told to get the satellite television service and live with the copper wiring the phone companies provide today.

Cable operators would be in a fine position to compete, as they traditionally have, against satellite television because of the technical limitations of satellite service, ranging from consumer objections to having a dish on their home, to a limit on the number of sets that can be wired, to the inability to get a clear view of the satellite because of nearby trees or other obstructions.

Who pays for the debt likely incurred from a bidding war during a merger frenzy? Guess.

Subscribe

Subscribe