This week’s finding from the Pew Internet & American Life Project:

This week’s finding from the Pew Internet & American Life Project:

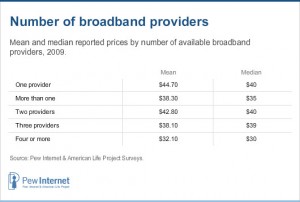

Where competition exists in broadband, prices are significantly lower than in areas where competition does not exist or is limited.

This is, of course, common sense. But it underlines the importance of broadband competition to control pricing and overcharging schemes. Broadband prices have been increasing in the United States, along with the number of customers, the revenues earned from those customers, and the loyalty customers to their broadband service.

What has decreased, despite the growth in broadband pricing, revenues, and customers, is some providers’ investments in their own networks to keep up with that growth. In 2008, Time Warner Cable’s annual report showed interesting results:

“In 2007, TW made $3,730 Million, on high speed data alone, and then had to turn around and spend $164 Million to support the cost of the network. 2007 total profit on high speed data: $3.566 Billion”

“In 2008, TW made $4,159 Million, on high speed data alone, and then had to turn around and spend $146 Million to support the cost of the network. 2008 total profit on high speed data: $4.013 Billion”

“It cost TW 11% less money in 2008, to keep their network running, than in 2007.”

These numbers illustrate the folly of crying poverty when asked why network upgrades aren’t being performed to support evolving growth in usage. Instead, the meme of “heavy downloaders are costing light users money and slowdowns” is part of the Re-education campaign to justify Internet Overcharging.

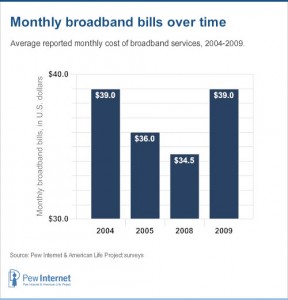

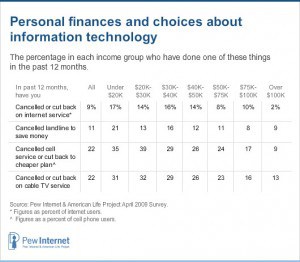

Yet broadband prices are continuing to climb even with reduced investments by many providers. Pew found pricing up across all classes of broadband service, significantly so between 2008 and 2009. Pressure on revenues from the video side of the cable business are partly responsible as investor demands for profits demand results. Consumers, responding to a poor economy, have been cutting back on their cable TV package, especially premium channels, pay-per-view, and add-ons of extra channels. A few are abandoning cable/satellite TV altogether, relying on their broadband connection and online video, a prospect that terrifies those providing traditional cable-like programming packages.

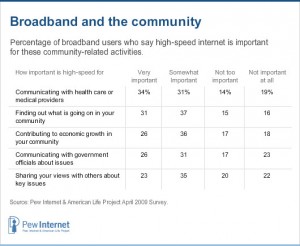

Some 84% of home broadband users see their fast connection as “somewhat important” or “very important.” This increasing reliance on broadband is turning a convenience into a necessary utility. Yet the industry that provides it is under very little scrutiny and has largely been deregulated, with only limited oversight possible.

Some 84% of home broadband users see their fast connection as “somewhat important” or “very important.” This increasing reliance on broadband is turning a convenience into a necessary utility. Yet the industry that provides it is under very little scrutiny and has largely been deregulated, with only limited oversight possible.

The results have been mixed. Americans living in areas lucky enough to experience robust competition have fast, reliable service at low prices, with only limited efforts to impose Internet Overcharging schemes.

In areas with more limited competition, particularly when those competitors do not provide an equivalent level of service consistently across their service area (fast consistent cable modem service vs. variable, speed-challenged DSL), mischief by the dominant provider is increasingly common. “Experiments” to increase prices, limit use, require customers to purchase or rent equipment, or impose annual or bi-annual service contracts, and/or limited advancements in speed are not atypical.

Rural communities, in particular, remain exposed to many challenges — high prices for installation and service, slow/uneven speeds, contracts, and usage allowances are all commonplace.

Rural communities, in particular, remain exposed to many challenges — high prices for installation and service, slow/uneven speeds, contracts, and usage allowances are all commonplace.

The Obama Administration intends to spend tens of millions of dollars to improve broadband in the United States. Unfortunately, many worthwhile projects and ideas are up against schemes from less worthy providers and groups that have teams of lobbyists and connected “interest groups” proposing spending that carries few limitations, little oversight, and loads of loopholes. In some cases, needed project funds could even be diverted away from new projects altogether.

The Pew Study summarized its findings:

Home broadband adoption stood at 63% of adult Americans as of April 2009, up from 55% in May, 2008.

The latest findings of the Pew Research Center’s Internet & American Life Project mark a departure from the stagnation in home high-speed adoption rates that had prevailed from December, 2007 through December, 2008. During that period, Project surveys found that home broadband penetration remained in a narrow range between 54% and 57%.

The greatest growth in broadband adoption in the past year has taken place among population subgroups which have below average usage rates. Among them:

- Senior citizens: Broadband usage among adults ages 65 or older grew from 19% in May, 2008 to 30% in April, 2009.

- Low-income Americans: Two groups of low-income Americans saw strong broadband growth from 2008 to 2009.

- Respondents living in households whose annual household income is $20,000 or less, saw broadband adoption grow from 25% in 2008 to 35% in 2009.

- Respondents living in households whose annual incomes are between $20,000 and $30,000 annually experienced a growth in broadband penetration from 42% to 53%.

Subscribe

Subscribe