It’s back again. For at least the last decade, the trade press has speculated about whether Cablevision would survive as an independent cable operator in an increasingly concentrated industry, where the big players get bigger, and the smaller operators exit the cable business.

The Dolan family, which has owned Cablevision since its founding on Long Island, is routinely said to be cash crunched, looking for a healthy cash bonanza on the way out the door, or dealing with internal family dramas which pit those advocating a sell off against those who wish to keep the business running. When Cablevision launched its Voom HD satellite service, which turned out to be a disaster and money pit, the intensity of speculation achieved a fever pitch, and that was several years ago. The Dolan family still runs Cablevision.

The New York Times sports page, of all places, is the latest home of pondering a sell off of Cablevision’s remaining cable systems to Time Warner Cable to raise cash for the Dolan family’s sports ventures, including ownership of the Rangers, Knicks, and Madison Square Garden. It was all borne from a single line in the latest earnings report from Cablevision, which indicated the company intended to “explore the spinoff of its Madison Square Garden business.”

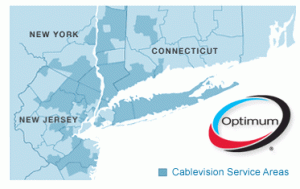

Cablevision’s bread-and-butter business is supplying cable television, broadband lines and Internet phone service to 3.1 million subscribers in the New York metropolitan area. The company, based in Bethpage, N.Y., has faced stiff competition from Verizon, which has spent heavily to build a fiber-optic network that competes with it and Time Warner Cable.

Industry analysts have speculated that Cablevision may eventually sell the entire company to Time Warner Cable, or sell its sports entertainment group to raise cash to compete in the cable business.

“Cablevision watchers [and we’d put ourselves in that category] have long pondered possible endgames, and the notion that the Dolans would retain ownership of MSG and the New York sports teams long after the rest of the assets had been divested has always been viewed as among the most likely outcomes,” Craig Moffett, a senior analyst at Bernstein Research wrote in a report after Cablevision’s earnings release Thursday morning.

People have grown old pondering questions like this. Cablevision is positioned to compete just fine with Verizon FiOS after completing an aggressive rollout of DOCSIS 3. Cablevision does not compete with Time Warner Cable at all. Industry boosters have traditionally cheered on consolidation efforts, so it’s no surprise even the smallest tidbit will restart the Spec-U-Plex all over again. Should Cablevision decide to sell, Time Warner Cable would almost certainly be the buyer, because their largest cluster of systems are adjacent to existing Time Warner franchise areas. But I wouldn’t be in a hurry to shove the Dolan family out the door.

Subscribe

Subscribe

Stop the Cap got a nice link on CNN.com’s Tech Blog today.

http://scitech.blogs.cnn.com/2009/05/07/can-i-borrow-some-bandwidth/