Rosenworcel

WASHINGTON (Reuters) – Jessica Rosenworcel, a champion of broadband access for low-income American households, is President Joe Biden’s choice for permanent chair of the Federal Communications Commission, the White House confirmed on Tuesday.

A Democrat who already serves as acting FCC chairwoman under Biden, she is expected to win U.S. Senate approval for a new term on the five-member telecoms regulator. Biden announced he intends to nominate her for a new term and a White House official said Biden will tap her to become the first woman to serve as permanent FCC chief.

Biden has waited more than nine months to make nominations for the FCC, which has not been able to address some issues because it currently has one vacancy and is divided 2-2 between Democrats and Republicans.

For the open seat, the White House confirmed to nominate Gigi Sohn, a former senior aide to Tom Wheeler, who served as an FCC chairman under President Barack Obama, a Democrat.

Rosenworcel has overseen the FCC’s temporary $3.2 billion broadband subsidy program created by Congress in December that provides discounts on monthly internet service and on the purchase of laptops or tablet computers to more than 6 million lower-income American households or people afflicted by COVID-19.

She has said the lack of broadband access leads to a “homework gap” for lower-income Americans because most teachers assign homework that requires internet access.

The White House also confirmed Biden will nominate Alan Davidson, a senior adviser at Mozilla, as director of the Commerce Department’s National Telecommunications and Information Administration, the executive branch agency principally responsible for advising the White House on telecommunications and information policy issues. NTIA is also expected to oversee tens of billions of dollars in funding from Congress to expand internet access.

Last month, a group of 25 U.S. senators wrote to Biden in support of Rosenworcel, a former Senate staffer, for a new term and the chair role. They wrote “further delays will unnecessarily imperil our shared goal of achieving ubiquitous broadband connectivity.”

Rosenworcel and her staff did not respond late on Monday to requests for comment on the announcement expected as soon as Tuesday. Without being confirmed to a new term, Rosenworcel would need to leave the FCC at the end of the year.

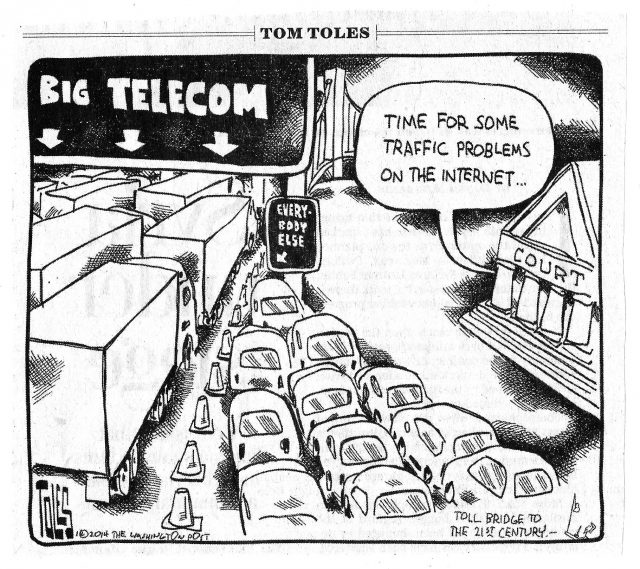

She has said the FCC decision under then-Republican President Donald Trump in 2017 to overturn net neutrality rules had put the FCC “on the wrong side of history, the wrong side of the law, and the wrong side of the American public.”

The FCC under Obama, Trump’s predecessor, adopted the net neutrality rules in 2015 barring internet service providers from blocking or throttling traffic, or offering paid fast lanes.

Supporters of net neutrality say the protections ensure a free and open internet. Broadband and telecoms trade groups contend their legal basis from the pre-internet era was outdated and would discourage investment.

Reporting by David Shepardson; Editing by Howard Goller and David Gregorio

Subscribe

Subscribe WASHINGTON (Reuters) – The U.S. Federal Communications Commission voted 3-2 on Tuesday to maintain its 2017 repeal of Obama-era net neutrality rules, even after a federal court directed a review of some provisions of the repeal.

WASHINGTON (Reuters) – The U.S. Federal Communications Commission voted 3-2 on Tuesday to maintain its 2017 repeal of Obama-era net neutrality rules, even after a federal court directed a review of some provisions of the repeal.

In fact, many broadband providers elected to curtail investment even before the COVID-19 pandemic arrived. Charter, Comcast, AT&T, and Verizon have all reduced investment in residential wired broadband services, in part because of a lack of competitive marketplace. Pai, a former lawyer for Verizon, has spent the last four years making life very comfortable for the country’s largest internet service providers. He eliminated mandated competition in set-top boxes, did nothing to stop data caps, eliminated net neutrality protections, and helped enact new rules allowing mobile providers to place future cell towers and other equipment in places that have never been acceptable before.

In fact, many broadband providers elected to curtail investment even before the COVID-19 pandemic arrived. Charter, Comcast, AT&T, and Verizon have all reduced investment in residential wired broadband services, in part because of a lack of competitive marketplace. Pai, a former lawyer for Verizon, has spent the last four years making life very comfortable for the country’s largest internet service providers. He eliminated mandated competition in set-top boxes, did nothing to stop data caps, eliminated net neutrality protections, and helped enact new rules allowing mobile providers to place future cell towers and other equipment in places that have never been acceptable before. Pai’s tenure as chairman has been four years of smug arrogance and a complete disinterest in the input of consumers. Millions have told the FCC to leave net neutrality policies in place. Pai and his Republican colleagues ignored them. The Republican commissioners have delivered speeches at some of the most partisan right-wing groups imaginable, but won’t respond to ordinary Americans looking for actual evidence of competition and consumer protection. For much of this year, Pai’s two Republican colleagues have spent much of their time on Twitter pursuing their own agendas. Commissioner O’Rielly has made closing down low power community pirate radio stations his obsession. At least that is covered under the FCC’s mandate. Commissioner Carr has spent his time on Twitter complaining about people being mean to President Trump on social media, his obsession with China and freedom of speech, and his suspicions about the World Health Organization (WHO).

Pai’s tenure as chairman has been four years of smug arrogance and a complete disinterest in the input of consumers. Millions have told the FCC to leave net neutrality policies in place. Pai and his Republican colleagues ignored them. The Republican commissioners have delivered speeches at some of the most partisan right-wing groups imaginable, but won’t respond to ordinary Americans looking for actual evidence of competition and consumer protection. For much of this year, Pai’s two Republican colleagues have spent much of their time on Twitter pursuing their own agendas. Commissioner O’Rielly has made closing down low power community pirate radio stations his obsession. At least that is covered under the FCC’s mandate. Commissioner Carr has spent his time on Twitter complaining about people being mean to President Trump on social media, his obsession with China and freedom of speech, and his suspicions about the World Health Organization (WHO). The cable industry’s public affairs network — C-SPAN, gave a friendly reception to a top telecom industry lobbyist over the weekend, responding to soft ball questions about rural broadband and telecommunications public policy debates.

The cable industry’s public affairs network — C-SPAN, gave a friendly reception to a top telecom industry lobbyist over the weekend, responding to soft ball questions about rural broadband and telecommunications public policy debates. AT&T mobile customers can watch AT&T-owned HBO Max without fearing any impact on their data allowances, despite the fact competing services like Amazon Prime Video, Disney+, Hulu, and Netflix will not be given similar treatment.

AT&T mobile customers can watch AT&T-owned HBO Max without fearing any impact on their data allowances, despite the fact competing services like Amazon Prime Video, Disney+, Hulu, and Netflix will not be given similar treatment.