Broadband will be critically impacted by any merger of Comcast and Time Warner Cable in New York. The two companies could not be more different in their philosophies regarding access, pricing, and speeds.

This merger will have an especially profound impact on broadband service in upstate New York, largely left behind out from getting Verizon’s fiber upgrades. New York’s digital economy critically needs modern, fast, and affordable Internet access to succeed. Verizon has not only ceased expansion of its FiOS fiber to the home network in New York, it has virtually capitulated competing for cable customers in non-FiOS areas by agreeing to sell Time Warner Cable service in its wireless stores.[1] In cities like Rochester, served by Frontier Communications’ DSL, Time Warner Cable is the only provider in town that can consistently deliver broadband speeds in excess of 10Mbps.

This merger will have an especially profound impact on broadband service in upstate New York, largely left behind out from getting Verizon’s fiber upgrades. New York’s digital economy critically needs modern, fast, and affordable Internet access to succeed. Verizon has not only ceased expansion of its FiOS fiber to the home network in New York, it has virtually capitulated competing for cable customers in non-FiOS areas by agreeing to sell Time Warner Cable service in its wireless stores.[1] In cities like Rochester, served by Frontier Communications’ DSL, Time Warner Cable is the only provider in town that can consistently deliver broadband speeds in excess of 10Mbps.

Time Warner Cable has never been the fastest Internet provider and had a history of being slower than others to roll out speed increases. But it is also the only cable provider in the country that experimented with usage caps and consumption billing and shelved both after subscribers bitterly complained in market tests in cities including Rochester.[2]

Then CEO Glenn Britt announced the end of the usage cap trial just two weeks after it became public.[3] Britt would later emphasize that he now believed there should always be an unlimited use plan available for Time Warner Cable customers who do not want their Internet use metered.[4] In study after study, the overwhelming majority of customers have shown intense dislike of limitations on their Internet usage, whether from strict usage caps Comcast maintained for several years or usage allowances that, when exceeded, would result in overlimit fees.[5] Just this month, the Government Accounting Office confirmed these findings in a new study that reported near-universal revulsion for usage caps on home wired broadband service:[6]

In only two groups did any participants report experience with wireline UBP [usage-based pricing].

However, in all eight groups, participants expressed strong negative reactions to UBP, including concerns about:

- The importance of the Internet in their lives and the potential effects of data allowances.

- Having to worry about data usage at home, where they are used to having unlimited access.

- Concerns that ISPs would use UBP as a way of increasing the amount they charge for Internet service.

Time Warner Cable has learned an important lesson regarding consumer perception of usage-based billing and usage caps on Internet service. In 2012, the company introduced optional usage caps for customers interested in a discount on their broadband service. Out of 11 million Time Warner Cable broadband customers, only a few thousand have been convinced in enroll such programs.[7]

Despite results like that, Comcast has not learned that lesson and has twice imposed unilateral, compulsory usage limits on their broadband customers, starting with a nationwide hard usage cap of 250GB per month introduced in 2008. Violators risked having their broadband service terminated by Comcast.[8] Today, for some that would be comparable to losing electricity or telephone service. The threat has profound implications in areas where Comcast is the only broadband provider.

Comcast temporarily rescinded its cap in May 2012, but has gradually reintroduced various forms of usage-related billing and caps with market trials in several Comcast service areas[9]:

Nashville, Tennessee: 300 GB per month with $10/50GB overlimit fee;

Tucson, Arizona: Economy Plus through Performance XFINITY Internet tiers: 300 GB. Blast! Internet tier: 350 GB; Extreme 50 customers: 450 GB; Extreme 105: 600 GB. $10 per 50GB overlimit fee;

Huntsville and Mobile, Alabama; Atlanta, Augusta and Savannah, Georgia; Central Kentucky; Maine; Jackson, Mississippi; Knoxville and Memphis, Tennessee and Charleston, South Carolina: 300 GB per month with $10/50GB; XFINITY Internet Economy Plus customers can choose to enroll in the Flexible-Data Option to receive a $5.00 credit on their monthly bill and reduce their data usage plan from 300 GB to 5 GB. If customers choose this option and use more than 5 GB of data in any given month, they will not receive the $5.00 credit and will be charged an additional $1.00 for each gigabyte of data used over the 5 GB included in the Flexible-Data Option;

Fresno, California, Economy Plus customers also have the option of enrolling in the Flexible-Data Option.

Comcast customers in these areas do not have the option of keeping their unlimited-use broadband accounts. Despite the fact Comcast executive vice president David Cohen refers to these as “data thresholds,” they are in fact de facto limits that carry penalty fees when exceeded.[10]

Comcast customers in these areas do not have the option of keeping their unlimited-use broadband accounts. Despite the fact Comcast executive vice president David Cohen refers to these as “data thresholds,” they are in fact de facto limits that carry penalty fees when exceeded.[10]

Cohen predicts these usage limits will be imposed on all Comcast customers nationwide within the next five years.[11] Time Warner Cable has committed not to impose compulsory limits on its broadband customers. Verizon has never attempted to place limits on its home broadband customers. Frontier shelved a usage limit plan of 5GB per month attempted in 2008 and currently provides unlimited service.

Comcast CEO Brian Roberts sat for an interview with CNBC in June in which he implied usage growth was impinging on the viability of its broadband business, justifying usage caps. At the end of the interview, Time Warner Cable ran advertising emphasizing it has no usage caps.[12] Both companies have highly profitable broadband services, as do other providers across the country.[13]

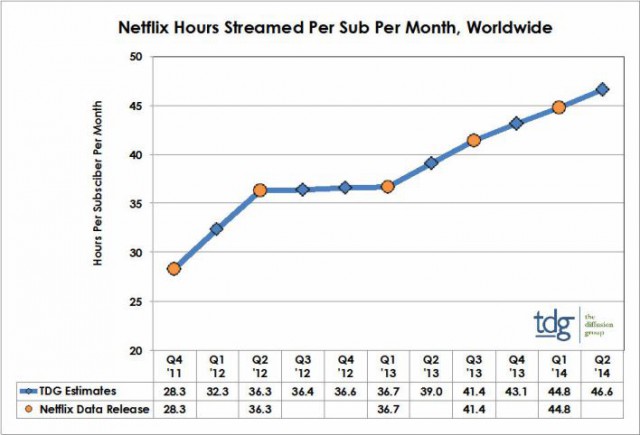

As our group has found, usage caps and consumption billing on cable Internet and DSL are little more than a transparent rate increase and anti-competitive maneuver to restrict the growth of the industry’s biggest potential competitor: online video. If a consumer can stream all of their video programming over a broadband account, there is no reason to retain a cable TV package. Comcast’s usage cap provides a built-in deterrent for customers contemplating such a move.

While a Comcast representative offered (without any independent verification) that the average Comcast broadband user consumes fewer than 20GB of data per month, Sandvine released evidence in its Global Internet Phenomena Report 1H2014 study that cord-cutters in the U.S. – at least those whose usage indicates the use of streaming as a primary form of entertainment – now consume about 212GB of data per month (with 153GB of that going toward “real-time entertainment usage”).[14]

That would put many customers perilously close to Comcast’s current market tested usage allowance.

Approving the transfer of franchises from Time Warner Cable to Comcast has the potential of saddling the majority of New York residents with usage caps and/or consumption billing with little or no savings or benefit to the consumer while introducing a major impediment to potential online video competition to help curtail cable television pricing.

—

[1]http://www.verizonwireless.com/wcms/page-unavailable.html?e=404&req=/home-services/twc.html

[2]https://www.reuters.com/article/us-timewarnercable/time-warner-cable-shelves-broadband-usage-billing-idUSTRE53F6EQ20090416

[3]http://stopthecap.com/2009/04/16/we-won-time-warner-killing-usage-caps-in-all-markets/

[4]https://newsroom.charter.com/

[5]

[6]

[7]http://stopthecap.com/2014/03/13/time-warner-cable-admits-usage-based-pricing-is-a-big-failure-only-thousands-enrolled/

[8]https://arstechnica.com/uncategorized/2008/08/its-official-comcast-starts-250gb-bandwidth-caps-october-1/

[9]

[10]

[11]https://techcrunch.com/2014/05/14/comcast-wants-to-put-data-caps-on-all-customers-within-5-years/

[12]http://stopthecap.com/wp-content/uploads/2014/04/nocaps.png

[13]https://gigaom.com/2014/02/12/comcast-and-time-warner-cable-forget-tv-it-is-all-about-broadband/

[14]http://www.multichannel.com/news/technology/cord-cutters-gobble-down-bits-sandvine-study/374551#sthash.JYFP7o69.dpuf

Subscribe

Subscribe Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans.

Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans. AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi.

AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi. Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.

Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.

This merger will have an especially profound impact on broadband service in upstate New York, largely left behind out from getting Verizon’s fiber upgrades. New York’s digital economy critically needs modern, fast, and affordable Internet access to succeed. Verizon has not only ceased expansion of its FiOS fiber to the home network in New York, it has virtually capitulated competing for cable customers in non-FiOS areas by agreeing to sell Time Warner Cable service in its wireless stores.[1] In cities like Rochester, served by Frontier Communications’ DSL, Time Warner Cable is the only provider in town that can consistently deliver broadband speeds in excess of 10Mbps.

This merger will have an especially profound impact on broadband service in upstate New York, largely left behind out from getting Verizon’s fiber upgrades. New York’s digital economy critically needs modern, fast, and affordable Internet access to succeed. Verizon has not only ceased expansion of its FiOS fiber to the home network in New York, it has virtually capitulated competing for cable customers in non-FiOS areas by agreeing to sell Time Warner Cable service in its wireless stores.[1] In cities like Rochester, served by Frontier Communications’ DSL, Time Warner Cable is the only provider in town that can consistently deliver broadband speeds in excess of 10Mbps. Comcast customers in these areas do not have the option of keeping their unlimited-use broadband accounts. Despite the fact Comcast executive vice president David Cohen refers to these as “data thresholds,” they are in fact de facto limits that carry penalty fees when exceeded.[10]

Comcast customers in these areas do not have the option of keeping their unlimited-use broadband accounts. Despite the fact Comcast executive vice president David Cohen refers to these as “data thresholds,” they are in fact de facto limits that carry penalty fees when exceeded.[10]

Stop the Cap! has talked with more than a dozen customers in Comcast’s test markets about their experiences with Comcast’s “data usage policy.” Although the company claims it is seeking customer reactions, it never asks whether those customers want usage limits or not, only what kind.

Stop the Cap! has talked with more than a dozen customers in Comcast’s test markets about their experiences with Comcast’s “data usage policy.” Although the company claims it is seeking customer reactions, it never asks whether those customers want usage limits or not, only what kind.