Pai

In an effort to “streamline” procedural rules and paperwork at the Federal Communications Commission, FCC Chairman Ajit Pai is proposing to theoretically weaken the existing informal complaints process, leaving consumers with unresolved complaints only one firm option — paying a $225 filing fee to pursue a formal complaint at the Commission regarding their internet service provider.

“This Order streamlines and consolidates the procedural rules governing formal complaints against common carriers, formal complaints regarding pole attachments, and formal complaints concerning advanced communications services and equipment,” the FCC proposal reads. “We base these rule refinements on 20 years of experience adjudicating formal complaints and conducting mediations. We find that these rule revisions will eliminate inconsistencies among various complaint proceedings, promote a fully developed record in each case, foster disposition of formal complaints in a timely manner, and conserve resources of the parties and the Commission.”

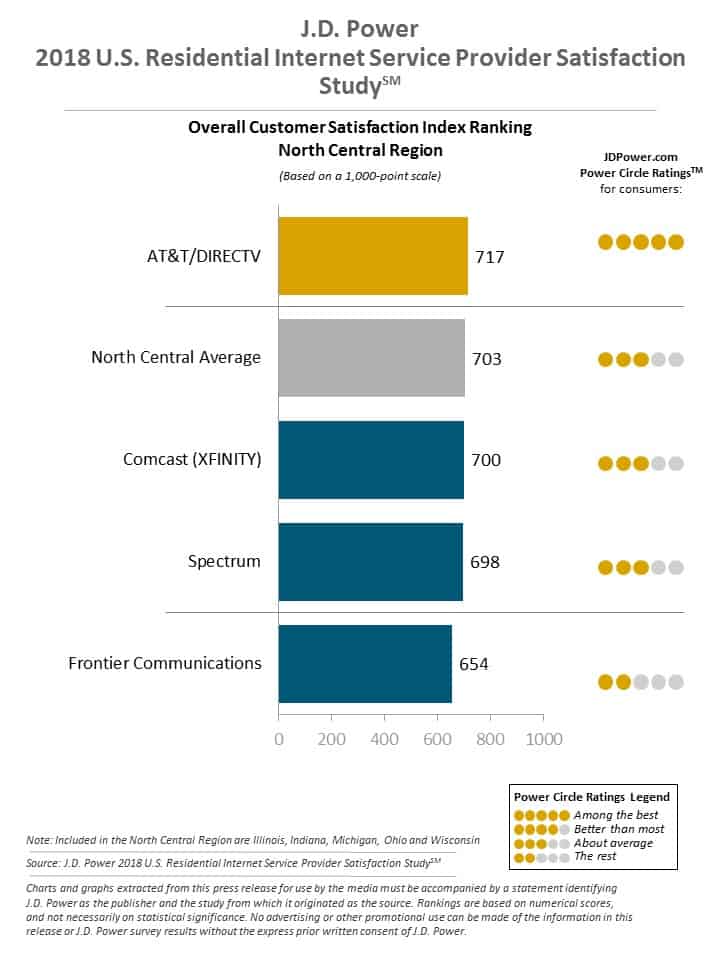

With thousands of informal complaints about the nation’s cable, phone, wireless, and satellite companies arriving at the FCC every week, and millions of comments to process on hot-button topics like net neutrality, the federal agency is trying to distance itself from being a government’s version of the Better Business Bureau. Under the Obama Administration, FCC Chairman Tom Wheeler invited consumers to bring their complaints about internet service providers to the FCC’s attention. In 2015, the FCC launched a Consumer Help Center that, like Pai’s latest proposal, also claimed to “streamline the complaint system.”

FCC’s online Complaint Center

“The first responsibility of the FCC is to represent consumers,” the agency noted in a 2015 blog post. “Facilitating consumer interface with the Commission is a major component of that responsibility.”

Three years ago, the FCC stepped up involvement in the consumer complaints process to keep an eye on the marketplace and its providers — to see whether consumers were being well-served and ferret out companies that were not responsive or “bad actors” in the industry. The best way the FCC determined that was to track and measure consumer complaints.

“The information collected will be smoothly integrated with our policymaking and enforcement processes,” the FCC wrote in 2015. “The result will be better results for consumers and better information for the agency. The insights we gain will help identify trends in consumer issues and enable us to focus Commission time, money, and resources on the issues that matter most.”

The proposed changes supported by Chairman Pai are subtle, but in the regulatory world, a few words can mean a lot — something the New York State Public Service Commission and Charter/Spectrum are debating right now. A single appendix in the 2016 Merger Order approving Charter’s acquisition of Time Warner Cable and the cable company’s interpretation of it led to threats by the PSC to de-certify the multi-billion dollar merger.

Matthew Berry, the FCC’s chief of staff, promptly attacked as “fake news” a partly specious article on the subject published by The Verge (which was substantially modified from the original this afternoon).

But Berry ignores the fact the proposal states up front it amends or changes current rules. Whether the FCC intends to make changes in its day-to-day operations as a result is a separate matter from the rules that govern the FCC’s work. The former can be changed almost at will, the latter cannot.

The section that has sparked controversy this week is: § 1.717 Procedure. It details what happens when the FCC receives an informal complaint from a consumer, either from a web-based complaint form or written complaint:

Current Language:

The Commission will forward informal complaints to the appropriate carrier for investigation. The carrier will, within such time as may be prescribed, advise the Commission in writing, with a copy to the complainant, of its satisfaction of the complaint or of its refusal or inability to do so. Where there are clear indications from the carrier’s report or from other communications with the parties that the complaint has been satisfied, the Commission may, in its discretion, consider a complaint proceeding to be closed, without response to the complainant. In all other cases, the Commission will contact the complainant regarding its review and disposition of the matters raised. If the complainant is not satisfied by the carrier’s response and the Commission’s disposition, it may file a formal complaint in accordance with § 1.721 of this part.

Proposed Language:

The Commission will forward informal complaints to the appropriate carrier for investigation and may set a due date for the carrier to provide a written response to the informal complaint to the Commission, with a copy to the complainant. The response will advise the Commission of the carrier’s satisfaction of the complaint or of its refusal or inability to do so. Where there are clear indications from the carrier’s response or from other communications with the parties that the complaint has been satisfied, the Commission may, in its discretion, consider a complaint proceeding to be closed. In all other cases, the Commission will notify the complainant that if the complainant is not satisfied by the carrier’s response, or if the carrier has failed to submit a response by the due date, the complainant may file a formal complaint in accordance with § 1.721 of this part.

At first glance, these two sections appear nearly identical. The subtle changes relate to defining, in writing, the exact responsibilities of the FCC. Weasel words like “may,” “advise,” “in its discretion,” and “consider” are red flags. When these kinds of words replace black letter words like “will,” the rules are weakened by making them discretionary. In such cases, a decision to pursue a matter is no longer a requirement, it’s an option.

At first glance, these two sections appear nearly identical. The subtle changes relate to defining, in writing, the exact responsibilities of the FCC. Weasel words like “may,” “advise,” “in its discretion,” and “consider” are red flags. When these kinds of words replace black letter words like “will,” the rules are weakened by making them discretionary. In such cases, a decision to pursue a matter is no longer a requirement, it’s an option.

In this case, Mr. Pai is proposing to reduce the FCC’s obligations to oversee an informal consumer complaint from the moment it is received to its ultimate disposition.

Under the current complaint rules, the FCC has collected a lot of information about the nature and resolution of consumer complaints. Let’s say Nancy Smith files a informal complaint against Comcast using the FCC’s online complaint center. Right now, the FCC requires Comcast to respond to Nancy’s complaint within 30 days. Comcast knows that the FCC will be monitoring the complaint and Comcast’s response. If Comcast were to ignore the letter or dismiss it, the FCC will be watching.

Consumers getting squeezed by reduced oversight.

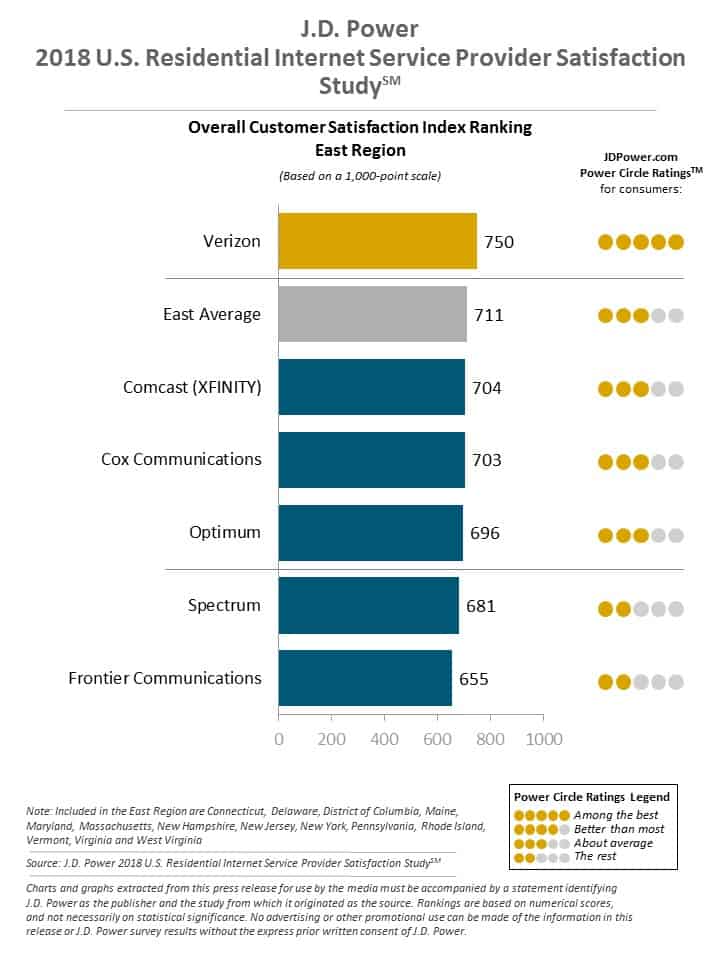

The high complaint rates earned by telecom companies have been fodder for regulators and politicians for years, so most companies refer complaints filed with the FCC to their highest level “executive customer service” personnel empowered to resolve complaints almost anyway they can. If Mrs. Smith is pleased with the response from Comcast, the cable operator knows the FCC sees that as well. Comcast is also sensitive to the fact the FCC might one day act on unresolved issues that generate the most complaints. Over time, statistics gathered by the FCC will reveal the companies least willing to cooperate with their customers and those most motivated to resolve issues. That could count if a company like Comcast sought a merger with another cable company with a lower complaint rate, for example.

Under the proposed informal complaint rules, the FCC’s role is effectively reduced to a complaint letter-forwarder. Nancy Smith’s letter sent to the FCC under the new rules will still be forwarded to Comcast and probably arrive with a 30 day deadline to respond, should the FCC choose to maintain that requirement. In a theoretical response to Mrs. Smith, the FCC can immediately notify her it has forwarded her complain to Comcast and regardless of the provider’s response (assuming Comcast sends one), her only recourse if she remains dissatisfied is to pursue a formal complaint — the one that involves a previously established $225 filing fee and comes with a mass of terms, conditions, and requirements comfortable only for lawyers and lobbyists.

The FCC attempts to explain away the changes in a footnote (emphasis ours):

We also clarify rule 1.717, which addresses informal Section 208 complaints. See 47 CFR § 1.717. In addition to wording revisions that do not alter the substance of the rule, we delete the phrase “and the Commission’s disposition” from the last sentence of that rule because the Commission’s practice is not to dispose of informal complaints on substantive grounds. We also add a rule memorializing MDRD’s staff-assisted mediation process, which enables parties to attempt to resolve their disputes before or after the filing of a formal complaint.”

A “practice” is not a “rule” or “requirement,” however. “Substantive grounds” is also undefined in the footnote and could be subject to interpretation. After all, Mr. Pai has also claimed that repealing net neutrality would have no substantive impact on the internet.

D.C.’s lobbyists routinely make regulatory language change suggestions on behalf of their clients.

Lobbyists are paid handsomely to urge adoption of similar, subtle modifications in regulatory rules and laws because they can establish loopholes large enough to drive a truck through. In virtually every proceeding, comments routinely focus on proposed language changes. This will be the core part of the discussion at the FCC before voting on the rule change proposal as early as tomorrow – July 12, 2018.

In practical terms, the changes are designed to subtly distance the FCC from involvement in consumer disputes with their providers. Oversight is weakened in this proposal, but more importantly, the focus of the FCC’s mandate changes from “the first responsibility of the FCC is to represent consumers” in 2015 to “if the complainant is not satisfied by the carrier’s response, or if the carrier has failed to submit a response by the due date, the complainant may file a formal complaint.” Only then, assuming a consumer successfully navigates a very complicated procedure to file a formal complaint and correctly follow notification requirements, will the FCC be compelled by the rules to stay involved with a complaint from start to finish.

Keep in mind companies that frequently have regulatory business before the FCC have staff attorneys and employees familiar with the FCC’s bureaucracy and rules. A $225 filing fee is an afterthought. For the average consumer, neither is probably true.

The likely result of the change will act as a deterrent for consumers relying on the FCC to help them resolve problems. Providers will also quickly recognize the FCC is no longer as willing to scrutinize customer complaints.

Ranking Member Rep. Frank Pallone, Jr. (D-N.J.) and Ranking Member of the Subcommittee of Communications and Technology Mike Doyle (D-Penn.), who both serve on the House Energy & Commerce Committee, quickly realized the implications of the FCC’s proposed rule changes and fired off a letter to Mr. Pai this week:

We are deeply concerned that the Federal Communications Commission (FCC) is poised to adopt a rule that would eliminate the agency’s traditional and important role of helping consumers in the informal complaint process. Too often, consumers wronged by communications companies face unending corporate bureaucracy instead of quick, meaningful resolutions. Historically, FCC staff has reviewed responses to informal complaints and, where merited, urged companies to address any service problems. Creating a rule that directs FCC staff to simply pass consumers’ informal complaints on to the company and then to advise consumers that they file a $225 formal complaint if not satisfied ignores the core mission of the FCC — working in the public interest.

At a time when consumers are highly dissatisfied with their communications companies, this abrupt change in policy troubles us.

After reviewing a lot of regulatory proceedings and comments over the last ten years of Stop the Cap!, it troubles us too.

Subscribe

Subscribe

At first glance, these two sections appear nearly identical. The subtle changes relate to defining, in writing, the exact responsibilities of the FCC. Weasel words like “may,” “advise,” “in its discretion,” and “consider” are red flags. When these kinds of words replace black letter words like “will,” the rules are weakened by making them discretionary. In such cases, a decision to pursue a matter is no longer a requirement, it’s an option.

At first glance, these two sections appear nearly identical. The subtle changes relate to defining, in writing, the exact responsibilities of the FCC. Weasel words like “may,” “advise,” “in its discretion,” and “consider” are red flags. When these kinds of words replace black letter words like “will,” the rules are weakened by making them discretionary. In such cases, a decision to pursue a matter is no longer a requirement, it’s an option.