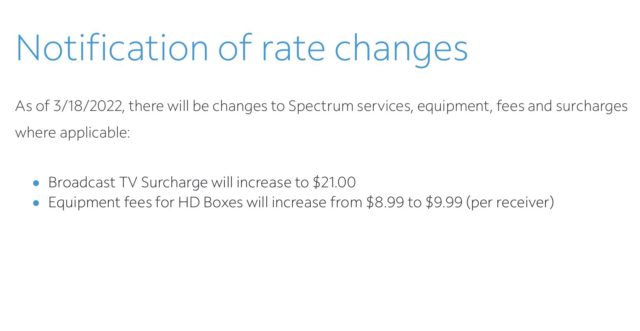

Effective March 18, 2022 the cost of Spectrum’s “Broadcast TV Fee,” charged to cable television customers, will increase $3, reaching an unprecedented $21 a month, just to cover the carriage of local, over the air television stations. The Broadcast TV Fee was last raised to $17.99 in June 2021. The summer before that, the fee increased by nearly $3 a month as well. This means the average surcharge for local, over the air stations, is going up an average of $36 a year at Spectrum.

Effective March 18, 2022 the cost of Spectrum’s “Broadcast TV Fee,” charged to cable television customers, will increase $3, reaching an unprecedented $21 a month, just to cover the carriage of local, over the air television stations. The Broadcast TV Fee was last raised to $17.99 in June 2021. The summer before that, the fee increased by nearly $3 a month as well. This means the average surcharge for local, over the air stations, is going up an average of $36 a year at Spectrum.

Equipment fees are also increasing by another $1 a month, to $9.99 per HD set-top cable box. Spectrum has been regularly increasing the cost of equipment rentals since its 2016 merger with Time Warner Cable. Charter Communications argued that one of the merger benefits was a promised reduction in the monthly cost of set-top equipment. Immediately after the merger deal was approved, the company charged $4.99 a month for each set-top box. But rates began rising almost immediately. In mid-2017, the rental price was raised to $5.99 a month, and in early 2018, it increased another $1 a month for $6.99. In 2020, the price went up another $1 to $7.99 a month, then yet another $1 to $8.99 a month in June 2021. This spring, the price rises another dollar to $9.99 a month.

Subscribe

Subscribe

A

A

The new $12.99 rate applies to new bundled subscribers beginning today, but existing customers will continue to pay $9.99. An additional home phone line (limit one) is also available for an extra $19.99/month. Customers only subscribing to home phone service from Spectrum will pay $29.99 a month.

The new $12.99 rate applies to new bundled subscribers beginning today, but existing customers will continue to pay $9.99. An additional home phone line (limit one) is also available for an extra $19.99/month. Customers only subscribing to home phone service from Spectrum will pay $29.99 a month.