President Biden

Large cable and telephone companies are applauding the Biden Administration’s compromise $65 billion broadband infrastructure plan, designed to reduce the number of rural Americans without access to broadband service.

Many industry lobbyists and Wall Street analysts were wary of earlier plans by the Administration to spend $100 billion or more on internet infrastructure expansion, because amounts that high were seen to likely attract major proposals from municipalities to construct their own independent broadband projects, some in direct competition with cable and phone companies. The Biden Administration had sought preferential treatment to fund public broadband projects, suggesting the direct competition they could bring would lower prices. Unlike for-profit phone and cable companies, municipal projects were “less pressured to turn profits” and would have a natural incentive to commit to serve entire communities.

Heavy lobbying from for-profit phone, cable, and wireless companies, largely directed at Republicans in the Senate, sought a much lower budget for broadband expansion in the $35 billion range and a commitment to discourage municipal broadband.

Last week the Administration and a small group of Senate Republicans settled on a $65 billion compromise measure, with many of the details still unavailable early this week. But big ISPs are already breathing a sigh of relief, convinced a slimmed-down compromise measure will choke off any existential competitive threat from municipal providers invading their turf.

Wall Street analysts predict the compromise measure will be too small to provide funding for competing major city municipal broadband networks and would continue the tradition of targeting funds on unserved, high-cost rural areas. Historically, this has resulted in funding going to nearby cable and telephone companies to subsidize expansion of existing networks into areas currently deemed too unprofitable to wire for service. But ample funds are still likely to be awarded to rural telephone and electricity co-ops to expand internet access.

Analysts expect the final measure will include a requirement to offer service at minimum speeds of 100 Mbps, which would be a challenge for wireless companies and rural phone companies seeking to expand DSL service. Most providers would likely have to use fiber optics to build networks consistently capable of delivering that speed. If the compromise measure only insists on 100 Mbps download speed, expect the cable industry to be relieved. If the minimum speed requirement is substantially relaxed to as low as 25 Mbps, that would also benefit wireless ISPs offering fixed wireless access.

Also unknown is whether the compromise measure still contains language overriding state laws that restrict or prohibit municipal broadband projects.

Subscribe

Subscribe

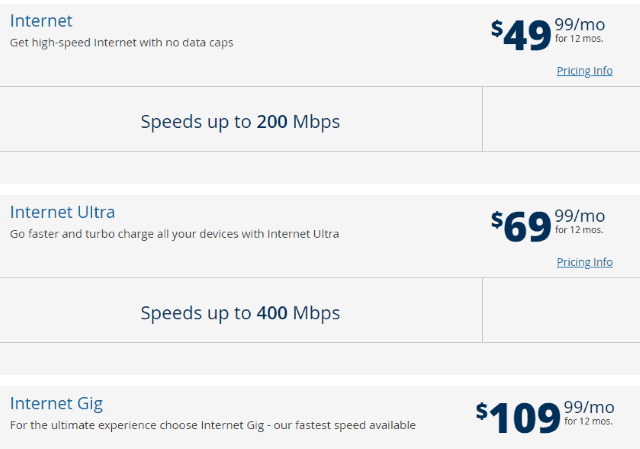

Frontier Communications told a federal court judge last week that the DSL service it sells across much of its service area in New York State is not remotely “high-speed broadband service” and is not fit for purpose if New York’s Affordable Internet Law takes effect next week and requires Frontier to deliver at least 25/3 Mbps service to state residents.

Frontier Communications told a federal court judge last week that the DSL service it sells across much of its service area in New York State is not remotely “high-speed broadband service” and is not fit for purpose if New York’s Affordable Internet Law takes effect next week and requires Frontier to deliver at least 25/3 Mbps service to state residents. Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

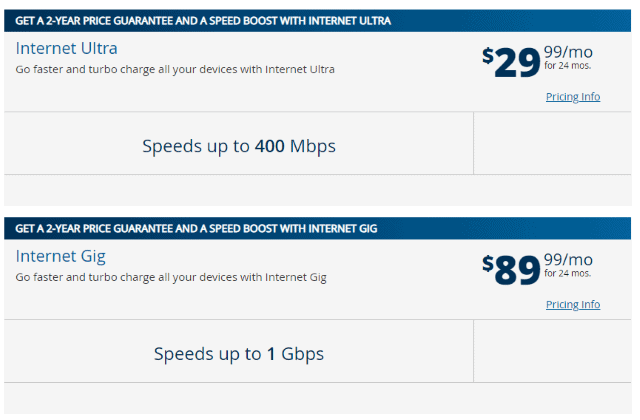

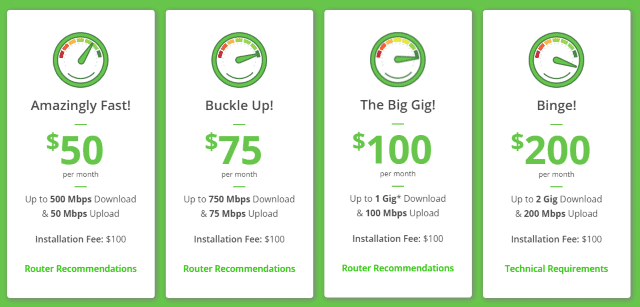

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

AT&T CEO John Stankey is still looking to wring costs out of the business, and the company’s rural landline customers are next to take the cut.

AT&T CEO John Stankey is still looking to wring costs out of the business, and the company’s rural landline customers are next to take the cut.