There is bad, and then there is REALLY, REALLY BAD.

CableONE’s new residential broadband Internet Overcharging pricing achieves new lows among American broadband providers – low caps that is.

The company has boosted the speed of its residential broadband services, and lowered the allowance you receive each month to use it. The “Economy” package, if used to any degree for anything beyond e-mail and a smattering of web page viewing each month, will wreak havoc on any household budget. Providing just 1.5Mbps downloads and 150kbps uploads for $26 a month, your monthly usage allowance is just ONE gigabyte. Exceed that at your financial peril. The overlimit penalty is a whopping $10/GB, and that full $10 is billed whether you exceed your allowance by one byte or 999 megabytes. CableONE graciously limits their Money Party to a maximum $50 in overlimit penalties, putting your broadband service you thought you paid $26 for at the “reasonable” price of up to $76 a month.

But there is a way to steer clear of the overcharging, if you are a night owl. The company turns the “meter” off from 12 midnight until 12 noon the following day.

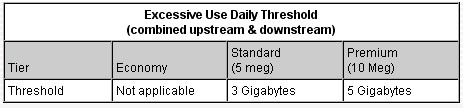

CableONE’s other residential plans now also have lower consumption allowances, designed to limit your day to day use of your broadband service. Instead of adopting a monthly maximum allowance, the company imposes daily limits that do not “roll over” from day to day. If you use your connection heavily one day, but not at all the next three, you could still find yourself over the limit.

Standard Service: 5Mbps/500kbps – $49/month – 3 GB Daily Usage Limit

Premium Service: 10Mbps/1Mbps – $59/month – 5 GB Daily Usage Limit

Going over your limit between one and 14 days per month will result in an automatic downgrade in your broadband speed to the next lowest tier. Exceed it more than 15 days per month, and your account will be terminated.

The company has suggestions for customers who want to reduce their usage to stay compliant. Right on top: stop watching those online videos.

Suggestions for Reducing Bandwidth

CableONE’s service counts bytes used during the peak usage period which is defined as 12 noon to 12 midnight.

The following types of usage consume high amounts of bandwidth and should be avoided during peak usage period:

- Movie downloads

- Streaming Video

- Picture downloads or uploads

- Leaving your browser open on pages that “refresh” automatically

Some of the programs you have installed will try to update themselves periodically by downloading files. You can typically set your program to schedule updates during off-peak times. Windows software can be set to update overnight as well. Updates and large downloads done between midnight and 12 noon do not count against your allocation.

Subscribers, particularly in southern Mississippi, have had an increasingly difficult relationship with CableONE. In March, a subscriber announced a lawsuit against the cable operator for gouging customers on set top boxes, required for digital cable viewing. CableONE charges its customers $11 a month for a regular Motorola cable box and $23 for its HD-DVR box. In June, a suspicious white powder was found in the Biloxi CableONE office, that was later determined to be harmless.

An unintentionally amusing CableONE ad follows the jump below.

Love that “hidden costs” mousetrap behind the second “testimonial.”

Subscribe

Subscribe

3GB daily limit? With speeds like those I’d wind up blowing through those in under 2 and a half hours. My connection here is typically saturated throughout the night from gaming, to YouTube, to others using the line, etc. But given caps like these, people, especially the torrent users will wind up saturating nodes for hours upon hours, bringing lines to a halt by using the cap free period.

Wow, that puts even the famous Sunflower limits (www.sunflower.com) to shame! It is ridiculous.

Average gamers could blow the 5GB in a week just by being on a server or trying to run a server. I guess they don’t gamers on their line either.

In this case, gamers had better hope that DSL is around for them, and it’s a decent provider 🙂

Most email providers have flash ad banners so if you check you’re mail you’re toast with these caps

I live just 70 miles east of a community that is served by CableONE…the Sioux City, Iowa metro area!! So, I have posted this article to my profile and the News page on my FB, and are sending this alert to ALL my FB friends who live in the Sioux City Metro area!! If I lived in Sioux City, I would AVOID CableONE LIKE THE PLAGUE!! I’ve never subscribed to their cable service before, but from what I’ve seen of their website, and what they offer on their digital cable in Sioux City, I think their digital cable service is… Read more »

Cable One can go fuck themselves.