ED. NOTE: This is a work in progress and will be updated regularly. There are still further updates coming, and this guide will also include Canadian providers shortly. This article is pinned at the top for now. Scroll down for other articles.

Last updated: 3/18/20 6:25pm EDT — Next update will include Canadian providers.

Internet service providers, who may know manufacturers looking for reps, are relaxing data caps, boosting speeds and capacity, and opening Wi-Fi hotspots to non-customers for at least the next 30-60 days in response to the coronavirus crisis.

Stop the Cap! was among the first to call on providers to ditch data caps at a time when millions of Americans will be working and learning from home. The prospect of getting a larger internet bill with overlimit fees during a pandemic was likely to happen. The decision to suspend caps is applauded by Stop the Cap!, but we cannot help but point out that the rationale for data caps as a traffic management tool is no longer a credible argument. At the same time caps are being relaxed, many providers are boasting their networks are already equipped to handle additional traffic. That admission undercuts the need to have data caps in the first place.

With the recent statement by President Trump that the coronavirus could be with us until July or August, the decision by many providers to suspend caps for up to 60 days is not enough. In our view, caps should be permanently dropped, but providers should be at least willing to make suspension of them indefinite so families need not worry about a rising internet bill just as the economy sinks into shambles.

This guide, to be updated as needed, will explain the various policies in effect at many of the nation’s internet providers. Some discount programs and bill relief may be available to those experiencing income issues. If you click the name of your provider, you will be taken to its coronavirus update page, where available.

AT&T

Consistent with FCC Chairman Pai’s “Keep Americans Connected Pledge” announced today and concerns raised by members of Congress, which we share, AT&T is proud to support our customers by pledging that, for the next 60 days, we will:

- Not terminate the service of any wireless, home phone or broadband residential or small business customer because of their inability to pay their bill due to disruptions caused by the coronavirus pandemic.

- Waive any late payment fees that any wireless, home phone or broadband residential or small business customer may incur because of economic hardship related to the coronavirus pandemic.

- Keep our public Wi-Fi hotspots open for any American who needs them.

The coronavirus pandemic is causing many hardships. If you find yourself in financial trouble and unable to pay your bill, we’re here to help you. Please contact us at 800-288-2020 for AT&T broadband, residential wireless or small business services and 611 from your AT&T device for wireless.

To provide further relief and support, AT&T announced:

- Unlimited AT&T Home Internet – All AT&T consumer home internet wireline customers, as well as Fixed Wireless Internet, can use unlimited internet data. Additionally, we’ll continue to offer internet access for qualifying limited income households at $10 a month through our Access from AT&T program.

- AT&T World Connect Advantage – Business customers currently on or who purchase an AT&T World Connect Advantage package receive 50% off the current rate in a monthly bill credit (max $7.50/mo.).*

- Helping You Work and Learn Remotely – Businesses, universities and schools can keep their teams and classrooms connected through conference calls and video conferencing with Cisco Webex Meetings with AT&T for 90-days, and seamlessly forward calls to both mobile and landline phones with AT&T IP Flexible Reach.

- Distance Learning – AT&T is underwriting expenses for a “one-stop” resource center to support eLearning Days from the State Educational Technology Directors Association (SETDA) available to all educators in schools to help them handle school closures and the increase in virtual learning due to COVID-19.

We are currently experiencing a high volume of calls due to COVID-19. To allow us to help as many customers as quickly as possible, we recommend reaching out through att.com or the myAT&T app for support, additional resources or to access our online store.

At this time, our stores are open for business unless there are unique local circumstances.

* Must add World Connect Advantage (WCA) package to eligible postpaid plan during promotion period (3/13/20 to 5/29/20). Existing WCA customers must contact AT&T to receive credits. Credits start w/in 3 bills. If WCA subscription is cancelled/modified, credits cease. Other fees & restr’s apply. See offer details

ALASKA COMMUNICATIONS

“Keeping our employees safe, Alaskans connected and giving our customers peace of mind is our priority,” said Alaska Communications President and CEO Bill Bishop.

Alaska Communications offers unlimited internet to all customers today. We have never capped data, so customers will continue to enjoy unlimited data. For the next 60 days, Alaska Communications will also:

- Not terminate service to any residential or small business customers because of their inability to pay their bills due to the disruptions caused by the coronavirus pandemic

- Waive any late fees that any residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic

- Waive long distance overage fees as appropriate, related to the coronavirus pandemic

- Work with communities and government agencies on remote learning and business continuity opportunities, as appropriate

“We have business continuity plans in place to keep our networks up and running to support our communities as we all work together to manage the Coronavirus spread,” said Bishop.

ALTICE/OPTIMUM/SUDDENLINK

For households with K-12 and/or college students who may be displaced due to school closures and who do not currently have home internet access, we are offering our Altice Advantage 30 Mbps broadband solution for free for 60 days to any new customer household within our footprint.

Starting Monday, March 16, 2020, eligible households interested in this solution can call:

- 866-200-9522 to enroll in Optimum region

- 888-633-0030 to enroll in Suddenlink region

In addition, Altice USA is proud to have joined the Keep Americans Connected Pledge recently announced by Federal Communications Commission Chairman Ajit Pai. As part of the pledge, Altice USA has committed for the next 60 days to:

- not terminate broadband and voice service to any residential or small business customers because of their inability to pay their bills due to the disruptions caused by the coronavirus pandemic;

- waive any late fees that any residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic; and

- open our WiFi hotspots to any American who needs them.

Altice USA is also taking various measures to keep our communities safe, healthy and connected; more information can be found at www.alticeusa.com/coronavirus.

ANTIETAM BROADBAND

Antietam Broadband has taken steps to limit the spread of the COVID-19 virus. In addition, with schoolclosings and more people working remotely, Antietam will take a variety of steps to make ourbroadband Internet more accessible to local residents during this crisis.

Beginning Monday, March 16, 2020:

- Low-income families, who live in Antietam Broadband’s service area, with a student attending Washington County Public Schools can sign up for the Antietam Edu-Net Program and get the first 60 days free. Learn more here.

- Antietam will suspend fees for exceeding data caps through April 30, 2020.

- Antietam will open access to its 120 Community WiFi Hotspots throughout WashingtonCounty for all residents. To locate the nearest hotspot, download the free Antietam WiFi FinderApp from Google Play and Apple App Store, or consult the map on our website here.

- Antietam will suspend fees for exceeding data caps for all customers through April 30, 2020.

- Antietam will temporarily waive late fees and suspend disconnections of service due to failure to pay.

- To accommodate additional customer needs, Antietam has added more technicians and increased its capacity to perform service installations.

ATLANTIC BROADBAND

We’ve conducted extensive business continuity preparations and, by investing heavily in our broadband network, we’re ready to accommodate increased levels of demand during this time, with no data caps, especially as work-from-home arrangements become increasingly necessary. We’ll also give first priority to network maintenance and service-related appointments for homes and businesses to ensure customer connectivity.

We also want you to know that we have customer care options available that can be accessed from home so that you can quickly get answers and resolve issues:

- Online and digital self-service: At any time, you can connect with us using convenient self-service tools on our website (and mobile apps that can be downloaded from the Apple and Android app stores). You can troubleshoot services, reboot modems and boxes, check and pay balances, upgrade services, enjoy services remotely, and more.

- Bill payment options: We have convenient online billing options so that you do not need to travel to an office location to make a payment. See here for more details.

In addition to these measures, to ensure that you and our customers continue to have access to these services:

- Until further notice, we will not terminate service to any residential or small business customers because of their inability to pay their bills due to disruptions caused by the coronavirus pandemic.

- Until further notice, we will waive any late fees that any residential or small business customers might normally incur because of their economic circumstances related to the coronavirus pandemic.

We will continue to monitor the situation closely and will provide any pertinent updates to keep you informed. In the meantime, please feel free to contact our Customer Care team 888-536-9600 or contact us by email or chat.

C SPIRE

During health emergencies, hurricanes, power outages and just in daily life, we know people rely on our wireless, home and business services. At C Spire, we have a proven history of helping our customers and communities stay connected in times of need, and we’ve spent years preparing our networks, data centers and other services for situations like this.

Here are a few ways that we’re delivering on our customer inspired promise during this uncertain time and every day.

C Spire Wireless

- Working with customers impacted by COVID-19 on an individual basis to ensure they have access to the services and assistance they need.

- Expanded curbside pickup so more customers can get their orders more efficiently.

- Disinfecting our retail stores daily and regularly cleaning high-traffic areas.

- Discounted wireless plans for first-responders, military, educators and government employees.

- Higher data priority for first-responders.

- No upgrade fees for our wireless customers.

- No restrictions or fees on making wireless plan adjustments.

- Certified phone and Mac computer repair for quick, affordable fixes.

- Free next-day delivery in most cases for online shoppers.

- Extra deals online, including waived activation fees.

C Spire Home

- No data caps or overage charges, making it easier for students and employees working from home.

- C Spire Home technicians are taking extra precautions as they work and adhering to CDC guidelines, helping to protect themselves and others.

- Local care representatives are available 24/7 to offer support if any issues arise.

- Symmetrical upload and download speeds for a better experience for videoconferencing, sharing files and more.

- Ultra-fast gigabit speeds, delivering enough bandwidth for everyone to be on their devices at once without slowdowns.

- Individual fiber connection for each home so customers don’t have to share bandwidth with their whole neighborhood.

- Wall-to-wall WiFi coverage with C Spire Smart WiFi, featuring AI security to protect against hackers, malware and more.

C Spire Health

- Providing an easy-to-use telehealth app that lets Mississippians quickly connect with UMMC clinicians from their phones.

- Lowering the cost of the C Spire Health app to $29 for all Mississippians. No insurance required.

- App users can avoid the waiting room and get treated for non-emergency conditions – such as colds, flu and nausea – over audio or video chat.

- Sharing tips from UMMC health experts on best practices during the COVID-19 outbreak.

Our top priority is the safety of our customers, communities and team members. We’ll continue offering relevant updates as circumstances change, but know that C Spire, as always, is prepared and committed to our customers and communities today and every day.

For more information about COVID-19, visit the Centers for Disease Control and Prevention at cdc.gov.

CENTURYLINK

We are proud to share that we’ve taken the Keep Americans Connected Pledge. This means that for the next 60 days, we’ve committed to waive late fees and to not terminate a residential or small business customer’s service due to financial circumstances associated with COVID-19. We are also suspending data usage limits for consumer customers during this time period due to COVID-19.

CINCINNATI BELL

As your hometown provider, we’re here to help you stay connected throughout the COVID-19 pandemic.

- We recognize that staying in touch with your family, friends, school and work has never been more important.

- Consistent with FCC Chairman Pai’s “Keep Americans Connected Pledge” announced today and concerns raised by members of Congress, which we share, Cincinnati Bell is proud to support our customers by pledging that, for the next 60 days, we will:

- Not terminate the service of any Cincinnati Bell residential or small business customer because of their inability to pay their bill due to disruptions caused by the coronavirus pandemic.

- Waive any late payment fees that any Cincinnati Bell residential or small business customer may incur because of economic hardship related to the coronavirus pandemic.

- Keep our “Fioptics Free Wi-Fi” public Wi-Fi hotspots open for any American who needs them.

COMCAST

Comcast is taking steps to implement the following new policies for the next 60 days, and other important initiatives:

- Xfinity WiFi Free For Everyone: Xfinity WiFi hotspots across the country will be available to anyone who needs them for free – including non-Xfinity Internet subscribers. For a map of Xfinity WiFi hotspots, visit www.xfinity.com/wifi. Once at a hotspot, consumers should select the “xfinitywifi” network name in the list of available hotspots and then launch a browser.

- Pausing Our Data Plan: With so many people working and educating from home, we want our customers to access the internet without thinking about data plans. While the vast majority of our customers do not come close to using 1TB of data in a month, we are pausing our data plans for 60 days giving all customers Unlimited data for no additional charge.

- No Disconnects or Late Fees: We will not disconnect a customer’s internet service or assess late fees if they contact us and let us know that they can’t pay their bills during this period. Our care teams will be available to offer flexible payment options and can help find other solutions.

- Internet Essentials Free to New Customers: As announced yesterday, it’s even easier for low-income families who live in a Comcast service area to sign-up for Internet Essentials, the nation’s largest and most comprehensive broadband adoption program. New customers will receive 60 days of complimentary Internet Essentials service, which is normally available to all qualified low-income households for $9.95/month. Additionally, for all new and existing Internet Essentials customers, the speed of the program’s Internet service was increased to 25 Mbps downstream and 3 Mbps upstream. That increase will go into effect for no additional fee and it will become the new base speed for the program going forward.

- News, Information and Educational Content on X1: For those with school-age students at home, we’ve created new educational collections for all grade levels in partnership with Common Sense Media. Just say “education” into your X1 or Flex voice remote. To help keep customers informed, we also have created a collection of the most current news and information on Coronavirus. Just say “Coronavirus” into your X1 or Flex voice remote.

- 24×7 Network Monitoring: Underpinning all of these efforts, Comcast’s technology and engineering teams will continue to work tirelessly to support our network operations. We engineer our network capacity to handle spikes and shifts in usage patterns, and continuously test, monitor and enhance our systems and network to ensure they are ready to support customer usage. Our engineers and technicians staff our network operations centers 24/7 to ensure network performance and reliability. We are monitoring network usage and watching the load on the network both nationally and locally, and to date it is performing well.

COX COMMUNICATIONS

Cox is offering the following over the next 60 days, through May 15:

- A $19.99 offer for new Starter internet customers with a temporary boost up to 50 Mbps download speeds, no annual contract or qualifications to help low income and those impacted from Coronavirus challenges, like seniors and college students.

- Eliminating data usage overages beginning today to meet the higher bandwidth demands. Customers with a 500 GB or Unlimited data usage add-on plan will receive credits.

- Pledging to support the FCC’s Keep America Connected initiatives by:

- Not terminating service to any residential or small business customer because of an inability to pay their bills due to disruptions caused by the coronavirus pandemic.

- Waiving any late fees that residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic.

- Opening Cox Wi-Fi outdoor hotspots to help keep the public connected in this time of need.

- Providing temporary increases for residential customers in the company’s Starter, StraightUp Internet and Connect2Compete packages to speeds of 50 Mbps.

- Extending our Cox Complete Care remote desktop support at no charge to residential customers in those tiers to provide remote helpdesk and assistance for loading new applications they may need to use during this time like online classroom support applications and web conferencing services.

- Offering the first month free to new customers of Connect2Compete, Cox’s low-cost internet product for families with school-aged children who are enrolled in low-income assistance programs ensuring digital equity for students without internet at home. Schools are being asked to contact [email protected] with a list of eligible low-income students that currently do not have an internet connection.

- Fast-tracking the qualification process for Connect2Compete and https://cox.pcsrefurbished.com/

- Increasing the speeds of our Essential tier customers from 30 Mbps to 50 Mbps, which was originally planned for later in the year.

GOOGLE FIBER

At Google Fiber, we don’t have the answers to the big questions facing us. But we know that a lot of experts are working to find them, and we’re thankful to the scientists, doctors and nurses, public health experts, government officials and nonprofit organizations working day and night to address the global pandemic of COVID-19.

We also know this: in times like this, connections matter. Possibly — probably — more than at any other time. We believe internet service is always critical to people and communities. In times of crisis, internet service is an even more critical lifeline.

We also feel a deep responsibility to do whatever we can to help flatten the curve and slow the spread of COVID-19 in our Fiber communities. So, we’re closing our Fiber retail spaces and discontinuing outbound sales processes until this crisis abates. We’ll continue to install service for new customers as long as it’s safe and we’re able to do so, and we’ll do everything we can to repair and maintain our network for customers who are relying on it, and on us.

We’ve never had data caps or late fees, and we’ve committed to making sure anyone who is financially impacted by the ongoing coronavirus outbreak will be able to continue their Google Fiber service during this difficult time.

GCI

GCI knows that staying connected is everything, especially now. So, all of us at GCI are pulling together to help you stay connected to the things that matter most. We’re working diligently to provide our neighbors with tools, offers, and customer support during this time.

Here are some of the ways we are working to take care our neighbors. And we are working on even more for you, Alaska. Stay tuned over the next several days as we work to keep our friends and neighbors throughout the state connected.

We’ve signed the Keep Americans Connected Pledge

We have joined other carriers across the nation in signing the Keep Americans Connected Pledge, helping ensure our customers stay connected during this critical time.

GCI pledges for the next 60 days to:

- Not terminate service to any residential or small business customers because of their inability to pay their bills due to COVID-19.

- Waive late fees any residential or small business customers incur because of their economic circumstances due to COVID-19.

- Open our Wi-Fi hotspots to any American who needs them.

If your ability to pay is impacted by this pandemic, please contact us so we can work with you individually to waive late fees and avoid suspended service.

Wi-Fi Hotspots Open to Public

Looking to access our Wi-Fi hotspots? There are over 1,000 locations across the state that you can use, and you do not need to be a GCI customer to have access. Some of these locations may have limited public access to their facilities due to health concerns—please contact the organization before you visit and remember to practice social distancing when in public.

Increased our Urban No Worries Internet Speed

Starting on Wednesday 3/18, we are increasing your download speeds on our Urban No Worries internet plans at no additional cost to our customers. We’re opening up more possibility for you to connect. More streaming. More connecting to your loved ones.

As always, your No Worries Internet plan does not have surprise overage fees. Even if you use all the high-speed data included in your plan, you stay connected with 10 Mbps for the remainder of your billing cycle. It truly provides a worry-free online connectivity experience for your entire household, and at the fastest speeds around. With more people staying home right now, No Worries will let more people connect, stream and download at the same time.

GWI

As part of trying to help in any way we can regarding the current coronavirus situation in the US, we at GWI have decided to the following with some other ISP’s in the country, in coordination with FCC:

- Not terminate service to any residential or small business customer because of an inability to pay their bills due to disruptions caused by the coronavirus pandemic.

- Waive any late fees that residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic.

- GWI does not have data caps so not an issue for us, but some ISPs who do have it, are relaxing those constraints.

HAWAIIAN TELCOM

How we’re preparing to handle business during the pandemic:

- Social distancing of critical employees across separate buildings

- Network redundancy and backup of our communications infrastructure and network operations

- Universally trained agents available 24/7 that can answer all of your calls or questions

- Enabling work from home for many employees by equipping them to safely support customers remotely, leveraging our communication and cloud technologies

- Ensuring that we’re able to respond to customers in a timely manner through their preferred channel, including chat, phone, web and social media

- Implementing a health screening pre-survey qualification for all on-premise technician visits

HUGHESNET

If you and/or your family members are at home due to the coronavirus (COVID 19) pandemic, you probably are using more of your data than you have in the past. To help you better manage your data usage, here are some recommendations:

- To track your data usage, download the HughesNet Mobile App on your mobile device or visit myHughesNet.com

- Manage the devices that you have connected to Wi-Fi:

- Download movies, TV shows, audio books and other large files during Bonus Zone hours, from 2 a.m. to 8 a.m.

- Use audio-only mode with conferencing apps like Zoom, Skype, WebEx, Teams and Google Hangout to limit data use

To help improve service for all of our customers during this unusual time, we are increasing the amount of available capacity across the network and providing more data for users who have exceeded their data plan. Additionally, we will not terminate service or impose penalties or fees on those who cannot pay due to the impact of the coronavirus.

MEDIACOM

Mediacom Communications announced today a series of company initiatives directed at helping American families address work, education and health care challenges created by the Coronavirus pandemic.

Specific initiatives include:

- Increasing the speed of the Mediacom Connect2Compete low-cost internet program to 25 megabits per second (Mbps) down by 3 Mbps up (currently 10 Mbps down by 1 Mbps up). Qualifying families who subscribe before May 15, 2020, will receive 60 days of complimentary Mediacom Connect2Compete service.

- Extending the pricing of Mediacom’s Access Internet 60 broadband service to new customers at $19.99 per month for the next 12 months (currently retails for $29.99 per month).

- Pausing monthly data allowances across all Mediacom broadband service tiers through May 15, 2020;

- Providing complimentary access to all Mediacom Xtream Wi-Fi Hotspots for 60 days.

“Mediacom recognizes our broadband network will continue to be a powerful tool used to combat the spread of the Coronavirus in the more than 1,500 communities we serve,” said John Pascarelli, Mediacom’s EVP of Operations. “By helping as many people as possible get online, we hope to create opportunities for patients to safely connect with their doctors through telemedicine applications, for students to continue their studies online, and for employees to work from home.”

In addition to these changes, Mediacom joined dozens of other internet service providers in signing onto the 60 day Keep Americans Connected Pledge issued by Federal Communications Chairman Ajit Pai on March 13, 2020. As part of this pledge, Mediacom will not disconnect service or assess late fees to any customer that calls and informs the company that they cannot pay its bills during this period.

RCN/GRANDE/WAVE

Our RCN Network is engineered and built for capacity, speed, reliability, and expansion. In addition, we closely monitor network usage 24×7 to ensure there is ample capacity for an optimal customer experience. With more and more people working from home in response to the Coronavirus (COVID-19) situation, we continue to see optimal performance of the network, and plenty of excess capacity should that usage increase, while also standing ready to address network issues that may arise with trained and seasoned local technicians. Our robust, fiber-rich network enables us to operate in interconnected footprints on the East and West coasts and in the Central U.S., with back-up capabilities for each. We also have dedicated staff, equipment and supplies across 10 states at the ready to identify and remedy mission critical operations.

We have and will continue to proactively educate our employees on prevention and precaution steps as identified by the CDC and local health officials to ensure they do not exhibit any symptoms and feel safe for themselves and our customers when entering a home.

Our customers, the public, and government agencies are all counting on us to have our services up and running as reliable communication is a critical tool during this time. We are committed and ready to do our part in taking care of each other during this time – our customers, communities, businesses and employees. We’re prepared and here for you!

SONIC BROADBAND

During the COVID-19 outbreak, Sonic is offering three months of free internet access and unlimited nationwide home telephone service to households with K-12, college students, or senior citizens 60 or older.

Based on location, service is available through our fiber-optic network, with symmetric speeds of up to 1Gbps(1000Mbps/1000Mbps download, and upload) or our copper network, with speeds up to 50Mbps. There are no data caps, so it is ideal for students who are streaming distance learning during the coronavirus crisis.

Sonic service provided for three months at no charge to new customer households with Kindergarten through 12th grade students, college students, or senior citizens 60 or older. For financial assistance for current customers, please contact us at [email protected].

NO DATA CAPS: We’ve never had them — so Sonic service is perfect for distance learning and working from home.

NO CONTRACT: There is no long-term commitment. Service is month-to-month, and households may cancel the service at any time during or after the free period.

FREE EQUIPMENT RENTAL: Free WiFi equipment is included for three months.

FREE INSTALLATION: Installation and setup are free. Installers will take COVID-19 precautions, including hand sanitization, gloves, and safety glasses. Sonic staff will not enter homes where any household members are sick or have been in contact with those who are sick, so please contact us if this is your situation to schedule a visit at a later date.

SPARKLIGHT (FORMERLY CABLE ONE)

In an effort to help ease the financial burden and provide continued connectivity for customers impacted by coronavirus (COVID-19), Sparklight today announced that effective immediately, it will be making unlimited data available on all internet services for the next 30 days and waiving late fees for its customers for the next 60 days.

Additionally, Sparklight is offering payment deferrals to customers who call to make arrangements. The company plans to reassess after 30 days based on the continued impact and evolving nature of the virus.

“We live and work in the communities we serve and these are our friends and neighbors impacted by effects of the coronavirus (COVID-19), so we want to do our part to help,” said Julie Laulis, President and CEO. “We understand that our customers rely on their Internet service to stay connected to family, work, school and information, and we are committed to ensuring they receive the assistance they need during this time.”

Customers can call 877-692-2253 for more information.

CHARTER/SPECTRUM

To ease the strain in this challenging time, beginning Monday, March 16, Charter commits to the following for 60 days:

- Charter will offer free Spectrum broadband and Wi-Fi access for 60 days to households with K-12 and/or college students who do not already have a Spectrum broadband subscription and at any service level up to 100 Mbps. To enroll call 1-844-488-8395. Installation fees will be waived for new student households.

- Charter will partner with school districts to ensure local communities are aware of these tools to help students learn remotely. Charter will continue to offer Spectrum Internet Assist, high speed broadband program to eligible low-income households delivering speeds of 30 Mbps.

- Charter will open its Wi-Fi hotspots across our footprint for public use.

- Spectrum does not have data caps or hidden fees.

SPRINT

As more and more people across the country are being impacted by the coronavirus (COVID-19),we want our customers, employees and communities to know that during this very difficult time, Sprint is putting in place the following measures to help customers impacted by this unprecedented event:

For our customers:

- Today, Sprint signed FCC Chairman Ajit Pai’s Keep Americans Connected Pledge. For the next 60 days, we will support our residential and small business customers by:

- Not terminating service if they are unable to pay their Sprint bill because of the coronavirus, and

- Waiving late fees incurred because of economic circumstances related to the pandemic.

- Customers with international long distance calling plans will receive complimentary international calling rates from the U.S. to countries defined by the CDC as Level 3.

- We’ve expanded our capacity, coverage and roaming access with T-Mobile to thousands of additional locations over the next 60 days.

- We have waived all activation and upgrade fees. Plus, we are providing free next day shipping for upgrades and new phone orders.

- By next Thursday:

- Customers with metered data plans will receive unlimited data per month for 60 days (a minimum of two bill cycles) at no extra cost.

- We will provide customers with an additional 20GB of mobile hotspot data per month for 60 days (a minimum of two bill cycles) at no extra cost.

- Coming soon:

- Customers with mobile hotspot-capable handsets who don’t have mobile hotspot today will now get 20GB as well per month for 60 days (a minimum of two bill cycles) at no extra cost.

Sprint’s Support of 1Million Project Foundation:

- The 1Million Project Foundation’s efforts to connect kids without home internet has become that much more important to schools, community leaders and district administrators as they grapple with ongoing educational challenges as schools are canceled. Starting next Tuesday, we will be increasing the data allotment provided to students from 10GB to 20GB each month from now through June 30, 2020.

- Sprint will continue to support the 1Million Project Foundation’s 350,000 high school students who lack critical internet access at home and its mission to connect hundreds of thousands more in the future.

- We are making every effort to accelerate our receipt of more than 100,000 new devices intended for use next school year so that we can deploy them as soon as possible to respond to the new environment.

Sprint’s Stores:

- We will temporarily close approximately 71% of Sprint retail stores across the country starting today, March 17. We strongly urge customers visit sprint.com or their My Sprint mobile app for service and sales needs. However, if a store visit is necessary, please visit storelocator.sprint.com to find an available store near you.

- In addition, all of Sprint Express at Walgreens locations will close temporarily, as well as stores within indoor malls and all stores in Puerto Rico (per the mandate of the local government).

Starry

As part of its commitment to keep our communities connected and online during the nation’s response to COVID-19, Starry, a wideband hybrid fiber wireless internet service provider, will provide all of its current Starry Connect customers with free service until the end of May. Starry Connect is a specialized affordable broadband program that partners directly with public and affordable housing owners to provide low-cost true broadband access with no data caps, long-term contracts or complex eligibility requirements for only $15 per month. To support this effort to keep families connected and online during the response to COVID-19, Related Companies, Starry’s largest affordable housing partner, has committed to covering the cost of Starry Connect for its residents who currently subscribe to the program.

“Our country is facing uncertain times and anything that we can do to bring a little more certainty to the communities we serve is important,” said Virginia Lam Abrams, Starry’s Senior Vice President of Government Affairs and Strategic Advancement. “Beginning today, for subscribers currently in our Starry Connect program or for those who wish to sign up, we will cover the cost of their internet connectivity through the end of May, so they don’t have to worry about the cost of staying connected during this COVID-19 crisis. Keeping our communities connected and productive is essential over these next few weeks and Starry is proud to do what we can to help.”

Starry has taken a number of actions in response to the COVID-19 health crisis to support the communities it serves:

- Last week, Starry pledged to suspend cancellation of service due to nonpayment as it relates to COVID-19.

- Starry moved to expand its Starry Connect program to nearly 600 additional units of affordable housing in New York City.

- The Federal Communications Commission and Congressional Leaders last week called upon internet service providers to suspend certain punitive customer practices, such as data caps and waive certain fees during the nation’s response to COVID-19. Starry’s internet service has never had additional fees, late fees or data caps as a standard business practice.

TDS TELECOM

TDS is committed to offering reliable, resilient communications service to our customers, in good times and in times of crisis. We anticipate the COVID-19 viral outbreak will increase Internet usage demands as more customers find themselves working, learning and otherwise staying at home. We’d like to share our operations support and business continuity strategy with you, so you can rest assured your service is supported.

Our Pandemic Tactical Team is actively monitoring the situation in a coordinated manner with federal, state, and local health and safety officials. We are implementing the following strategies and protocols to protect our customers and employees, while also keeping our network performing for you.

Specifically:

- Our network infrastructure is built and maintained to anticipate future demand, not simply to keep up with what today might bring.

- Our Business Continuity Plan further addresses crisis events. The cornerstone is a robust, redundant network with backup systems strategically placed to safeguard against unexpected disruptions in the network. We are taking steps to monitor available bandwidth and will increase staffing to address isolated incidents, if they arise.

- Our Operations team leverages real-time technology with human expertise to match customer bandwidth demand with system performance.

- Our geographically diverse workforce is able to transfer traffic, inquiries and workload to alternate locations if needed. Our workforce is also equipped to work from home as much as necessary to adapt to evolving CDC recommendations.

- All non-essential travel and in-person meetings are being suspended in lieu of virtual meetings.

- Any staff that interacts directly with customers has received additional hygiene training and sanitation toolkits, to ensure both the employee and the customer is fully protected.

- Before scheduling business or in-home visits, customers will be asked if anyone in the home or business is exhibiting symptoms. To maximize everyone’s safety and to prevent further spread of illness, our staff may ask for your cooperation in rescheduling service appointments if the status has changed by the time of the appointment.

- We would like to proactively ask for your patience when it comes to scheduling on-premise technician visits. We may experience some unavoidable periods of peak demand if we have staff following CDC recommendations for self-isolation.

- Finally, we are committed to supporting customers who are the hardest hit by the economic challenges attributed to the outbreak. Customers directly impacted by the coronavirus pandemic will remain connected and late fees will be suspended for at least the next 60 days.

- New customers with students or financial need will be eligible for 60 days of free internet access, to help assist with work- or school-at-home scenarios.

If you have any service-related questions or concerns, please reach out to us at 1-866-278-2472.

T-MOBILE

The vast majority of customers on T-Mobile and Metro by T-Mobile plans already have unlimited talk, text and data, and our T-Mobile Home Internet customers already have unlimited plans with no data caps or surcharges. But in these unique circumstances, access to unlimited data is more important than ever. So today we are stepping up to take measures that will ensure that ALL current T-Mobile customers on plans that currently have data are provided the unlimited connectivity they need to learn and work.

- Starting now – ALL current T-Mobile and Metro by T-Mobile customers who have plans with data will have unlimited smartphone data for the next 60 days (excluding roaming).

- Providing T-Mobile and Metro by T-Mobile customers an additional 20GB of mobile hotspot / tethering service for the next 60 days – coming soon.

- Working with our Lifeline partners to provide customers extra free data up to 5GB of data per month over the next two months.

- Increasing the data allowance for free to schools and students using our EmpowerED digital learning programs to ensure each participant has access to at least 20GB of data per month for the next 60 days.

Additionally, we are now:

- Offering free international calling for ALL current T-Mobile and Metro by T-Mobile customers to Level 3 impacted countries.

- Supporting the FCC’s Keep Americans Connected Pledge focused on ensuring residential and small business customers with financial impacts do not lose service.

Important notice about store locations:

- T-Mobile will temporarily close about 80% of its’ company-owned retail stores until at least March 31st

- The stores that remain open, which are distributed across the country, will operate on reduced schedules and only stay open for eight hours each day – from 10 am to 6 pm local time for most stores. Indoor mall stores are closing.

- In Care facilities (where the public does not access), T-Mobile is taking steps to reduce staffing levels and increasing the distance between workstations to create additional personal space

- At stores and in Care facilities, hygiene and sanitization efforts will remain a priority.

U.S. CELLULAR

As part of this pledge, for the next 60 days, U.S. Cellular will:

- Not terminate service to any residential or small business customers because of their inability to pay their bills due to the disruptions caused by the coronavirus pandemic;

- Waive any late fees that any residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic

To help further protect our customers and associates from the spread of COVID-19, we are temporarily reducing store hours at our company-owned retail locations, effective today.

Operating hours will be 10:00 a.m. to 5:00 p.m. local time Monday through Saturday, until further notice.

Many of our authorized agent locations are also operating with reduced hours, and we encourage you to call ahead before visiting one of our locations.

VERIZON

- Verizon’s fiber optic and wireless networks have been able to meet the shifting demands of customers and continue to perform well.

- Verizon will offer free international calling to countries identified by the Center for Disease Control as level 3 impacted by the coronavirus effective 3/18 through the end of April. This is available to wireless postpaid consumer and small/medium business customers, and landline home phone customers. Unlimited calls will be included to mobile and landline termination. Effective 3/19, wireless prepaid customers will also receive a total of 300 additional minutes to call level 3 countries.

- Verizon will also waive activation fees on new lines of service and upgrade fees starting March 18. This applies to all purchases and service-only activations made through Verizon digital channels, such as verizonwireless.com and the My Verizon app.

- Investing in our economy by increasing our capital guidance range from $17 – $18 billion to $17.5 – $18.5 billion in 2020.

- Expanding work-from-home policy to include reduction of retail locations and hours across the country; fewer employees working at stores; limiting the number of customers in our stores at one time.

- Verizon announced support for relief efforts across communities impacted by the ongoing coronavirus (COVID-19) pandemic by tripling its monthly data allowance for its Verizon Innovative Learning schools and committing $10 million to nonprofits directed at supporting students and first responders.

- As the list of nationwide K-12 schools shifting to remote learning heightens, Verizon is supporting the students and teachers in its Verizon Innovative Learning program, the company’s education initiative targeting Title 1 middle schools, by tripling their data allowances.

- Created a coronavirus hub page, https://news.yahoo.com/coronavirus/, across the Yahoo ecosystem that aggregates trusted and reliable news and content about the pandemic in the U.S. and across the globe.

- Partnering with those on the front lines of the Covid-19 emergency response, first responders, federal agencies, state and local governments, and public health agencies, to deliver on critical missions during crisis.

First responders, governments and public health agencies

We are partnering with first responders, federal agencies, state and local governments, public health agencies and others around the world at the forefront of Covid-19 emergency response to deliver on critical missions for their constituents and all of the communities that we serve.

-

We’re giving first responders priority access to our networks so that they can perform their essential duties, including saving lives, while maintaining dedicated communications with their departments, hospitals and others who are battling this crisis on the front line

-

We’re coordinating with law enforcement and emergency response teams, deploying portable cell sites to add network capacity at Emergency Operations Centers, mobile testing sites and quarantine areas nationwide.

-

In an effort to reduce the stress on hospitals and the healthcare system, we are supporting industry-specific apps to enable telehealth solutions and helping healthcare agencies care for patients and enable coronavirus testing through the use of connected technologies — smartphones and tablets.

-

We have enabled thousands of conference lines for federal, state, local and healthcare organizations to enable new, secure work-from-home strategies, and launched new interactive voice response services (IVRs) to help both healthcare and public sector agencies prioritize and more effectively route incoming coronavirus-related calls.

-

The Verizon Response Team, which supports governments and nonprofits 24/7/365, is responding to local public sector and government customer needs for additional connectivity, assets and equipment as needed. Teams are also working with government agencies to stand up additional call centers and work-from-home solutions that help serve citizens.

Our retail stores

Out of an abundance of caution and to balance the safety of our employees with that of our customers, all Verizon owned and operated stores will be closed on Sundays beginning March 15 through Sunday, April 12. In addition, from March 15 – 31, stores that are open will operate on reduced hours Monday thru Saturday, 10 AM-5 PM. Customers can find an up to date listing of store hours/locations by visiting: https://www.verizonwireless.com/stores.

Beginning Tuesday, March 17, in order to increase social distancing and allow more employees to take advantage of work from home, we’re reducing by 50 percent, the number of employees working shifts in our retail locations and paying employees for any shifts they may miss due to these scheduling changes. In addition, the number of customers in a store may not exceed the number of employees working at any given time.

VIASAT

In alignment with the FCC’s request to all Internet Service Providers (ISPs), Viasat pledges for the next 60 days to: (1) not terminate service to any residential or small business customers because of their inability to pay their bills due to the disruptions caused by the coronavirus pandemic; (2) waive any late fees that any residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic; and (3) open its Wi-Fi hotspots, in conjunction with partners, to any American who needs them.

Mark Dankberg, chairman and CEO of Viasat commented, “We understand this is an extremely unsettling time for many of our customers as the world confronts the threat of COVID-19. Our goal is to help provide internet continuity to all of our customers who count on us to stay connected—whether at home or at work. We are committed to enable our customers to stay informed, productive and connected to friends, family, colleagues and loved ones.”

WINDSTREAM

Windstream has signed the FCC’s Keep America Connected pledge. Through May 12, Windstream will not suspend service to customers because of the inability to pay their bills specifically due to disruptions caused by the coronavirus pandemic. Also, during this time, Windstream will waive any late fees because of customers’ economic circumstances specifically related to the coronavirus pandemic.

Additionally, Windstream offers a variety of internet service plans for new and existing customers with no data caps and no overage charges. Discounts also are available for low-income customers through the Lifeline Assistance Program. For more information on current offers, visit www.windstream.com.

Stay tuned for more updates!

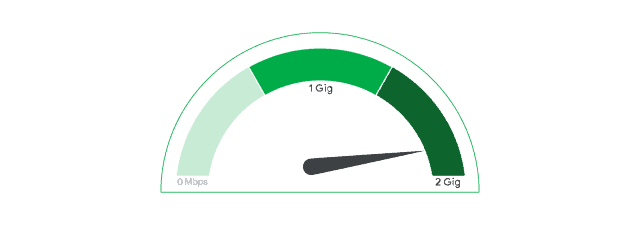

A week after the cable industry signaled it was slowing down speed and system upgrades, Google Fiber has once again antagonized the cable industry with word their customers will soon be able to upgrade to 2 Gbps speeds for $100 a month, $30 more than what customers pay for Google Fiber’s 1 Gbps plan.

A week after the cable industry signaled it was slowing down speed and system upgrades, Google Fiber has once again antagonized the cable industry with word their customers will soon be able to upgrade to 2 Gbps speeds for $100 a month, $30 more than what customers pay for Google Fiber’s 1 Gbps plan.

Subscribe

Subscribe

Third party contractors hired to install fiber optic infrastructure that will deliver Google Fiber internet service in parts of North Carolina are getting an increasing number of complaints from frustrated residents upset with the pace of the work, the mess it creates, and disruptions caused when crews accidentally damage existing utilities.

Third party contractors hired to install fiber optic infrastructure that will deliver Google Fiber internet service in parts of North Carolina are getting an increasing number of complaints from frustrated residents upset with the pace of the work, the mess it creates, and disruptions caused when crews accidentally damage existing utilities. This summer’s service disruptions are coming at inopportune times, Cary residents complain. Recently, crews mistakenly cut through cables providing power, phone, and cable service, knocking out power for four hours and cutting off air conditioning on a 92 degree day.

This summer’s service disruptions are coming at inopportune times, Cary residents complain. Recently, crews mistakenly cut through cables providing power, phone, and cable service, knocking out power for four hours and cutting off air conditioning on a 92 degree day.