Cablevision customers get very attractive promotions in the highly competitive northeastern United States, while Suddenlink customers in more rural areas pay more.

The majority of Cablevision and Suddenlink broadband customers want speeds of 100 Mbps or greater from the Altice-owned cable operators, and average monthly data usage by those customers is now reaching 200 GB per month.

Those statistics were part of a quarterly financial results presentation by Altice USA executives about how the company is doing in the United States.

Altice’s cable holdings include Cablevision, serving a generally affluent customer base in and around the New York City area where Verizon FiOS is its biggest competitor, and Suddenlink, which serves in less competitive markets where local economies are often challenged and phone company DSL still has a significant presence.

Regardless of whether customers receive broadband from Cablevision or Suddenlink, Altice USA CEO Dexter Goei made it clear consumers want faster internet service and are consuming exponentially more data than ever before.

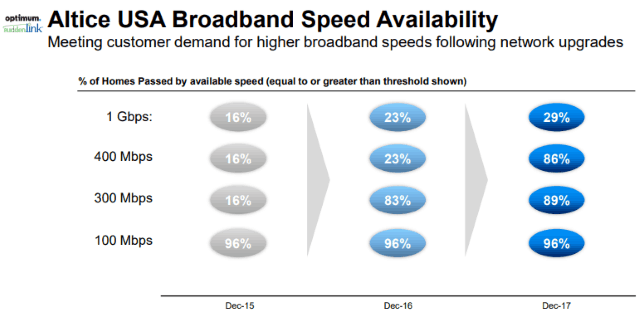

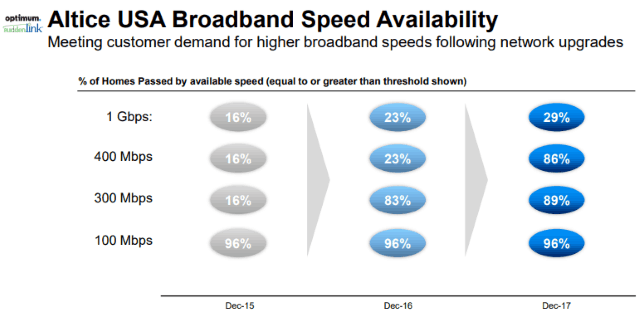

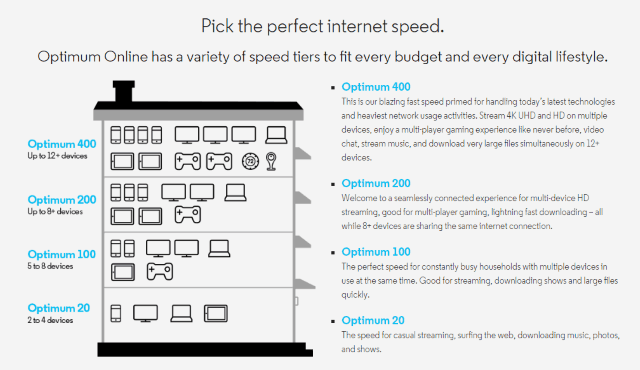

Goei said Altice will continue to increase internet speeds over its existing hybrid fiber-coax network (HFC) even as it builds out its fiber to the home replacement network in some areas. At least 95% of Cablevision customers can now subscribe to 400 Mbps broadband on the company’s legacy HFC network. Around 72% of Suddenlink customers can get similar speeds today. Gigabit speed is available to 29% of Altice USA customers.

Goei said 90% of new Cablevision and Suddenlink customers now choose internet plans featuring 100 Mbps or faster broadband. The average data use of those customers “is now reaching about 200 GB” per month, Goei reported. For customers on HFC systems, Goei said the maximum speed Altice’s implementation of DOCSIS 3 can support is around 600 Mbps, depending on how many customers are sharing the connection. As customers transition to fiber service in the northeast, faster speeds are planned. In fact, Goei wants Cablevision to offer speeds even faster than Verizon FiOS, its chief competitor.

“In terms of the speed capabilities, we’ll have the ability to do higher speeds than the competition,” Goei said.

Altice USA’s fiber-to-the-home (FTTH) deployment is “well underway” in New York, New Jersey, and Connecticut, with plans to connect several hundred thousand customers to the new network starting later this year. Goei told investors Altice was accelerating the rollout this year with the hope of further reducing network and customer operation costs related to servicing the older coaxial network.

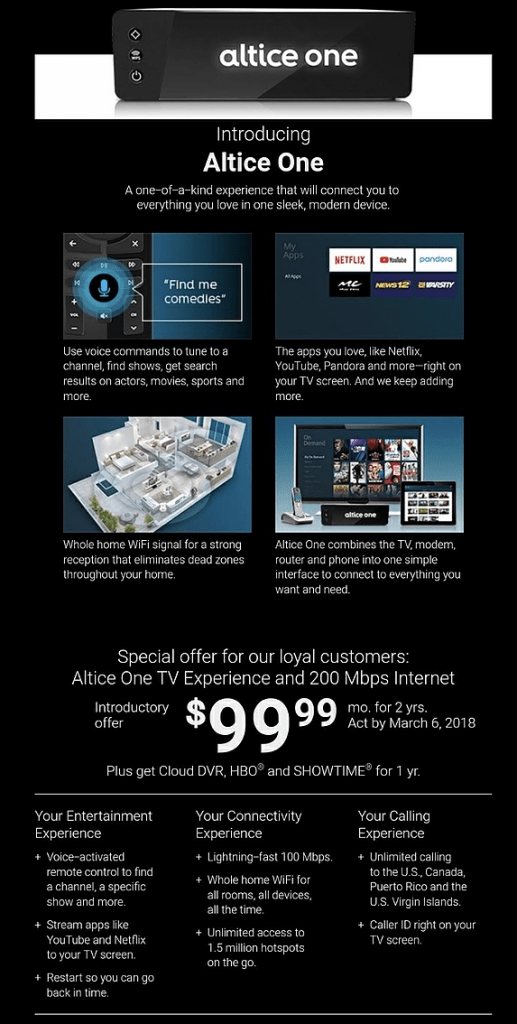

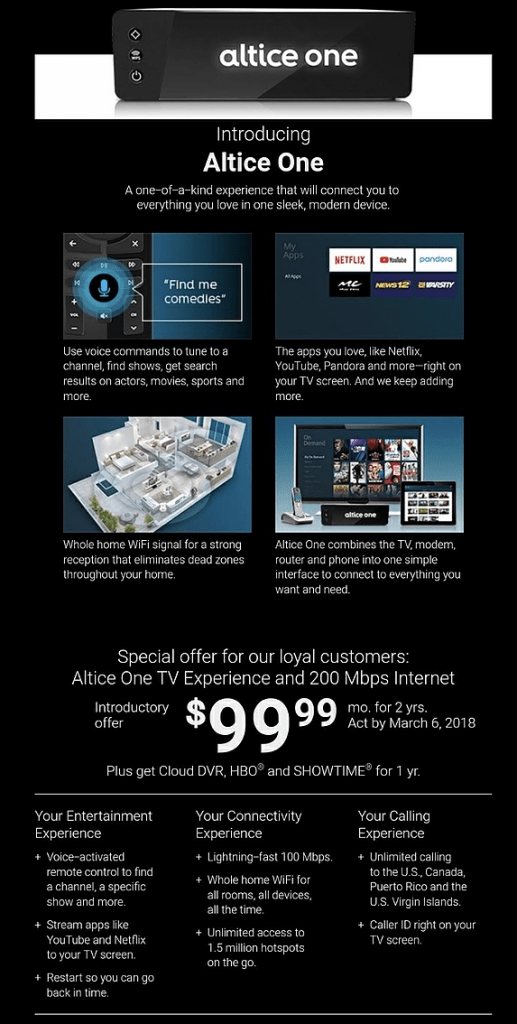

Cablevision and Suddenlink will gradually be rebranded as Altice, and the company has begun familiarizing customers with the new brand name in various ways, including the rollout of its new deluxe set-top box, called Altice One.

“This is our new entertainment platform with an all in one box, including TV, internet, Wi-Fi, integrated apps such as Netflix and a voice activated remote control,” said Goei. “The service includes an improved Wi-Fi experience […] as many TV boxes double up as Wi-Fi repeaters around the home. This is a key part of our strategy of enhancing the customer experience and we’ll have the capacity for ongoing upgrades and the addition of new apps as they become available.”

But that new platform comes at a cost. Currently, Cablevision customers can pay as much as $10 for each set-top box and $5 for a cable modem. Altice One is regularly priced at $25 a month — $10 more for a customer that has one television set-top box and cable modem. That makes Altice’s box among the most costly in the cable industry. The company is trying to hide the cost of its box by bundling it into promotions targeting price sensitive new customers.

In fact, the cost of service is increasingly becoming a factor, especially for Suddenlink customers. Over the last two years, Altice has been “harmonizing” Suddenlink’s rate plans, which used to be set based on the technical capabilities and performance of each cable system. Goei said Suddenlink comprised “five or six different customer bases” — each served by cable systems with different capabilities and rate plans. In the last two years, Suddenlink customers have been introduced to new rate plans, and some are paying considerably higher rates than before, especially for equipment and surcharges.

“All of that activity was probably more than we ever wanted to or anticipated as harmonizing all the different variables is not that easy,” Goei said. “And so we made a very concerted effort to not implement a usual or industry like price increase at the end of 2017, given all the various changes that happened over both customer bases as we harmonized them.” But Goei added the reprieve from rate hikes won’t last forever, promising a “rate event” strategy sometime this year, different from rate changes in past years.

Altice is emphasizing the progress it is making boosting internet speeds at its Cablevision and Suddenlink cable systems.

What Suddenlink and Cablevision charge for service is very dependent on what the competition is offering in Altice’s various markets. Goei paradoxically noted that some of the most attractive rates go to customers living in the most affluent areas of the New York Tri-State Area because of intense competition from Verizon FiOS. Prices have remained so low historically that, in Goei’s view, “it makes it very difficult for third parties to come into these markets” and compete with attractive offers that can match Cablevision. That also explains why Cablevision customers do not deal with data caps while Suddenlink customers often do.

Goei

Conversely, in Suddenlink service areas where less capable competitors exist, prices can be higher and service is considered less affordable. As a result, financial analysts have noted Suddenlink’s broadband growth has been anemic since Altice bought the company, presumably because would-be customers cannot afford the service or have chosen a more economic package sold by the phone company, even if it less capable.

Goei promised Altice would be more “nimble” in the future about targeting pricing in different service areas, taking current conditions on the ground into account when setting rates.

In more general terms, Altice is dealing with the same challenges most cable operators are facing these days. Cord-cutting continues to result in reduced numbers of video subscribers. The company also recently endured a multi-week programming dispute with Starz that cost the company video subscribers in the Cablevision service area. The dispute eventually ended with a new multi-year affiliation agreement that allows Altice systems to carry Starz and Starz Encore networks, on-demand services, and online access for several years.

But Altice clearly sees broadband as its key product going forward, which is why the company is upgrading its Cablevision and Suddenlink systems to support faster internet speeds.

Subscribe

Subscribe Cable and satellite companies are notorious for baiting customers with cheap offers for internet, phone, and television service and then shocking them when the first much-higher-than-expected bill arrives, but Altice’s Optimum/Cablevision takes the bait and switch promotion to a whole new level.

Cable and satellite companies are notorious for baiting customers with cheap offers for internet, phone, and television service and then shocking them when the first much-higher-than-expected bill arrives, but Altice’s Optimum/Cablevision takes the bait and switch promotion to a whole new level.

Altice, which operates Cablevision’s Optimum brand cable service in New York, New Jersey, and Connecticut, has informed regulators of a broad-based “rate event” that will take effect on June 1, 2018. Unless a customer is currently enrolled in a price-locked promotion, these new rates generally affect all customers, except as noted.

Altice, which operates Cablevision’s Optimum brand cable service in New York, New Jersey, and Connecticut, has informed regulators of a broad-based “rate event” that will take effect on June 1, 2018. Unless a customer is currently enrolled in a price-locked promotion, these new rates generally affect all customers, except as noted.