Rogers’ attitude towards loyal customers seems to be summed up by what people encounter when visiting some of their retail locations: a locked door.

Rogers’ attitude towards loyal customers seems to be summed up by what people encounter when visiting some of their retail locations: a locked door.

Canada’s largest cable operator now requires customers visiting some of its store locations to ring a doorbell, produce a government-issued photo ID, remove any head coverings or masks, and wait to see if a store employee will unlock the front door.

“The safety of our team members and customers is of the utmost importance to us,” Rogers spokesperson Chloe Luciani-Girouard said in a statement to CBC Toronto. “Several measures have been put in place over the last few years to improve safety in the stores, including robust training, upgraded cameras, and enhanced door screening policy.”

Rogers quietly implemented the new security measures at a few store locations a few years ago but refuses to tell customers which of the growing number of store locations are affected. Most find out when they encounter a locked door and wait for a security guard to size them up using security cameras.

Some customers are unimpressed with the policy:

I was appalled to be faced with a locked door when I tried to enter the Rogers / Fido store on King west yesterday. They had to buzz me in as they have been attacked/robbed by the derelicts in the area

— Myxx (@myxxbyxx) December 27, 2019

@CRTCeng 1/2 Hey @Rogers went to your store at 6758 Kingston road, door closed, sec guard from inside points to the paper on the door with number to call, called inside rep asked me to take off mask look at camera then show ID to the sec guard who is still inside the locked door

— Emran (@DoneWithLibs) March 28, 2021

Rogers stores already have security guards in place as a theft deterrent, but the company obviously feels that isn’t enough to keep would-be thieves from swiping valuable cell phones.

Subscribe

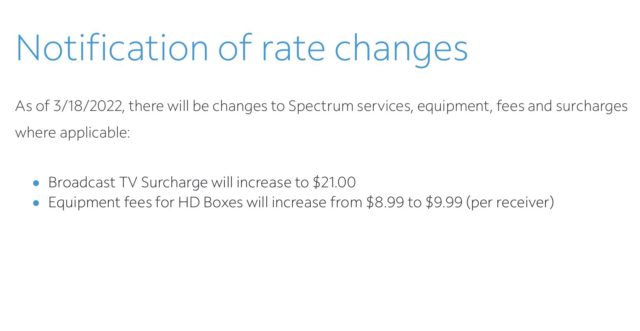

Subscribe Effective March 18, 2022 the cost of Spectrum’s “Broadcast TV Fee,” charged to cable television customers, will increase $3, reaching an unprecedented $21 a month, just to cover the carriage of local, over the air television stations. The Broadcast TV Fee was last raised to $17.99 in June 2021. The summer before that, the fee increased by nearly $3 a month as well. This means the average surcharge for local, over the air stations, is going up an average of $36 a year at Spectrum.

Effective March 18, 2022 the cost of Spectrum’s “Broadcast TV Fee,” charged to cable television customers, will increase $3, reaching an unprecedented $21 a month, just to cover the carriage of local, over the air television stations. The Broadcast TV Fee was last raised to $17.99 in June 2021. The summer before that, the fee increased by nearly $3 a month as well. This means the average surcharge for local, over the air stations, is going up an average of $36 a year at Spectrum.

The Federal Communications Commission today approved Verizon’s acquisition of low-cost carrier TracFone Wireless, which will bring a familiar brand for prepaid wireless service under the wireless giant’s corporate umbrella.

The Federal Communications Commission today approved Verizon’s acquisition of low-cost carrier TracFone Wireless, which will bring a familiar brand for prepaid wireless service under the wireless giant’s corporate umbrella. Hulu’s live streaming TV service, known as Hulu Live,

Hulu’s live streaming TV service, known as Hulu Live,