Phillip 'Not Picking Up What Moffett Puts Down' Dampier

Tech, business, and even a few mainstream media outlets have been booking Sanford Bernstein’s Craig Moffett as an independent observer of all-things-broadband, without revealing he literally has a vested interest in boosting profits for the telecommunications industry.

The latest of Moffett’s heavily-slanted ideas appeared over the weekend on ZDNet, where Larry Dignan’s Between the Lines column used one of Bernstein’s “research notes” to provoke readers into a discussion about Internet Overcharging:

Metered broadband access is inevitable and may even be good for adoption of speedy Internet access.

That’s the argument from Bernstein analyst Craig Moffett in a research note. Moffett sets the scene:

- The FCC’s open Internet push allows for metered broadband.

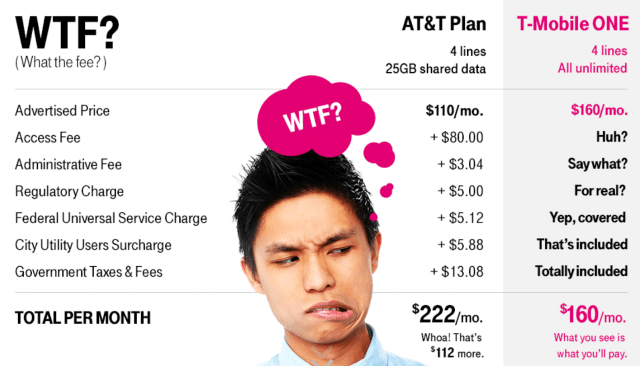

- AT&T has introduced usage caps across its wireline business. DSL customers are limited to 150 GB of monthly consumption. U-Verse subscribers get 250 GB, or the same as Comcast. Users will be charged an extra $10 a month if they exceed the cap and it’s $10 per 50 GB after that.

- AT&T has already introduced tiered wireless plans.

- Time Warner Cable has a few usage based pricing pilots underway.

Moffett

Nowhere in Dignan’s column does he disclose Moffett is a paid Wall Street analyst working for the interests of investor clients of Sanford Bernstein who want to maximize the value of their telecommunications stocks. Moffett’s long history of statements about industry pricing reflect those interests, which are often very different from those of most consumers. Moffett’s world view: anything that brings in more revenue is good for shareholders (rate hikes, metered billing), anything that drives down shareholder value is not (infrastructure upgrades, pricing cuts, customer defections).

On that basis, Moffett has been called a “cable stock fluffer” by our friends at Broadband Reports for his relentlessly pro-cable industry commentary, even while ridiculing transformational projects like Verizon’s FiOS fiber to the home network for being “too expensive” and not delivering enough return on shareholder investment. Consumer Reports delivers the opposite view: high marks for Verizon FiOS, mediocre to lousy marks for most of the nation’s cable operators.

While there is nothing inherently wrong with Moffett doing his job on behalf of his paying clients, using his views outside of that context — particularly when those interests go undisclosed — is journalistic malpractice.

Oh, and Time Warner Cable abandoned their usage-based pricing pilots in 2009 after customers declared war on the cable company. Those darn customers, ruining the industry’s plans!

The rest of Moffett’s research note doesn’t get much better in the “true facts”-department:

The goal of moving to usage based pricing is not to undermine competition from Netflix (or anyone else… although it certainly wouldn’t be good news for Internet video). And it is most decidedly not to simply “raise prices for broadband” as Public Knowledge or New America would have it (although it might well do precisely that, too). Instead, it is nothing less than to re-align the entire business model of today’s infrastructure providers with the next generation of communications… so that broadband providers might stop fighting against the tide and embrace it instead.

With usage based pricing, broadband providers, and Cable operators in particular, can create an “iso-profit” curve, where the amount they make from a physical connection is about the same whether someone uses that connection for linear video or, alternatively, web video. The goal is not to stifle competition, but instead to create indifference not just to the end state of video by-pass, but indeed for all points along the way. The adoption of usage based pricing would be transformational to the debate for Cable operators, inasmuch as it would essentially indemnify them against all potential outcomes.

Moffett represents his interests, not yours.

Yet some of Moffett’s earlier statements would seem to argue with himself.

For instance, back in March Moffett was making plenty of noise about AT&T’s caps precisely targeting video providers like Netflix:

Moffett believes usage caps have everything to do with stopping the torrent of online video. He notes AT&T’s caps are set high enough to target AT&T customers who use their connections to watch a considerable amount of video programming online.

“Only video can drive that kind of usage,” Moffett writes.

Moffett has repeatedly predicted any challenge to pay television models from online video will be met with pricing plans that eliminate or reduce the threat:

“[I]f consumption patterns change such that web video begins to substitute for linear video, then the terrestrial broadband operators will simply adopt pricing plans that preserve the economics of their physical infrastructure,” Moffett said. “Of course, any move to preserve their own economics has far-ranging implications. Any move towards usage-based pricing doesn’t just affect the returns of the operators, it also affects the demand of end users (the ‘feedback loop’).”

The only thing usage-based pricing indemnifies is the industry’s confrontation with revenue-eroding cable-TV cord-cutting. And Moffett knows this, although he would probably give rave reviews to bringing similar usage-based-billing to cable television packages, which would charge you for every show you watched on top of your monthly bill.

These pricing models, already firmly rooted in Canada, have done nothing to bring the “next generation of communications” to our neighbors to the north. Indeed, Canada’s ranking in broadband continues its decline as large cable and phone companies pocket the profits instead of committing to wholesale upgrades of their networks to deliver the kind of service increasingly common in Europe and Asia.

But the real laugh out loud moment comes last: Moffett’s prediction that AT&T’s usage pricing will increase broadband adoption. Perhaps that’s true if you prefer telecommunications companies abuse you, but as we’ve documented over the past three years, these pricing schemes never save anyone money — they just increase the price of your service while decreasing the value of it.

Subscribe

Subscribe