With the merger of CBS and Viacom now complete, the combined company is preparing to overhaul its subscription streaming service CBS All Access with a rebranding and a relaunch this summer.

With the merger of CBS and Viacom now complete, the combined company is preparing to overhaul its subscription streaming service CBS All Access with a rebranding and a relaunch this summer.

“We believe audiences want their entertainment on demand and their news, sports and events live, and our expanded offering will be the service that gives them what they want, how they want it all in one place and then a great value,” ViacomCBS CEO Bob Bakish told investors during a quarterly results conference call on Thursday.

The relaunched service will be dramatically larger than the current CBS All Access, adding content from Smithsonian TV and Viacom’s various cable networks including BET, Comedy Central, Logo, MTV, Nickelodeon, Pop TV, and the Paramount Network. The new streaming platform will also integrate more closely with Viacom’s free-to-view, advertiser-supported Pluto TV and Showtime, CBSViacom’s premium pay movie channel.

Subscribers will not have to wait until summer to see some changes on the All Access platform. Paramount added over 100 movie titles to the service earlier this week.

Currently, CBS All Access and Showtime together boast about 10 million subscribers, with ads-included All Access priced at $6 per month and Showtime at $11. Viacom’s advertising-supported streaming service Pluto TV, which Viacom bought in January 2019 for $340 million, has attracted almost 20 million monthly users.

Bakish believes the new ViacomCBS service will be as robust as competitors like Hulu or Disney+. It will enter a marketplace already dominated by Netflix (167 million subscribers), Amazon Prime (150 million subs), Hulu (30.7 million subs), Disney+ (28.6 million subs), ESPN+ (7.6 million subs), Starz (6.3 million subs) and YouTube TV (2 million subs). It will also have to compete against newly launched Apple TV+ and the forthcoming debuts of HBO Max and Peacock.

CBS All Access currently includes live streams of local CBS affiliates, streaming news network CBSN, and a variety of live and on-demand entertainment and sports programming. Its content library currently includes CBS TV network shows and a long-standing selection of evergreen off-network shows including Perry Mason, the original Hawaii 5-0, and The Brady Bunch.

Subscribe

Subscribe

CBS and Viacom are one important step closer to merging under the CBS name, creating one of the country’s largest programming and broadcasting powerhouses.

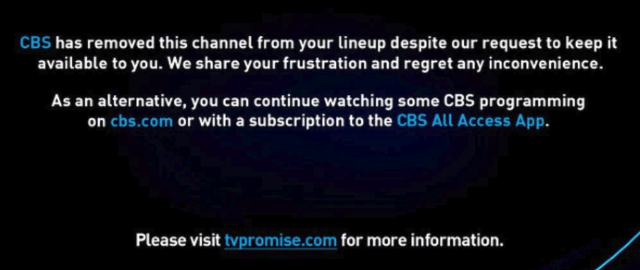

CBS and Viacom are one important step closer to merging under the CBS name, creating one of the country’s largest programming and broadcasting powerhouses. AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services.

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services. AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.

AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.