Smartphone manufacturers are dealing with sluggish sales for the newest and greatest phone models because American consumers are increasingly resistant to paying for top of the line devices.

Smartphone manufacturers are dealing with sluggish sales for the newest and greatest phone models because American consumers are increasingly resistant to paying for top of the line devices.

Apple, Samsung, and others are facing some of their biggest challenges ever delivering upgrade features deemed useful enough to encourage consumers to spend the more than $600 that many high-end phones now command in the marketplace. As blasé new features fail to deliver a “must-have” message to consumers, many are hanging onto their existing phones and refusing to upgrade.

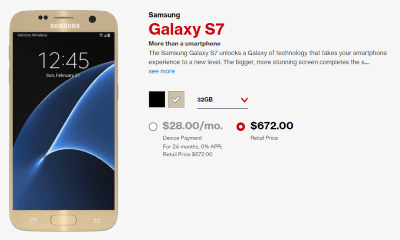

The decision by wireless providers to stop subsidizing devices backed by two-year contracts have delivered sticker shock to consumers looking for the latest and greatest. The Apple iPhone 7, expected to be announced this month, will likely carry a price of $650 — a serious amount of money, even if your wireless provider or Apple agrees to finance its purchase interest-free for 24 months. Despite the fact wireless providers charged artificially higher service plan rates to recoup the cost of the device subsidy over the length of the contract, consumer perception made it easier to justify paying $200 for a subsidized phone versus paying full retail price and getting cheaper service.

As a result, consumers are strategically holding on to their cell phones longer than ever and avoiding upgrade fever just to score a lower cell phone bill. The Wall Street Journal reports that since T-Mobile started the trend away from device subsidies in 2013, Citigroup estimates the smartphone replacement cycle has now lengthened to 29.6 months, considerably longer than in 2011 when upgrades were likely even before the two-year phone contract expired.

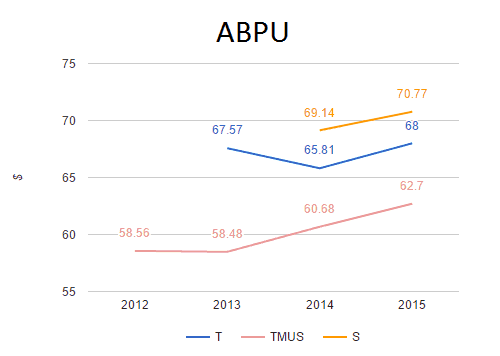

The average combined monthly revenue (in $) earned per subscriber from service and equipment installment plan fees is still rising, despite the alleged “price war.” (Image: Trefis)

Wireless providers don’t mind the change since they endured fronting the subsidy cost to phone manufacturers and slowly recouped it over the next two years. Not dealing with a subsidy would make the accounting easier. But AT&T and Verizon Wireless both understood the average consumer doesn’t have a spare $650 sitting around for a new device, much less the nearly $2,500 it would cost to outfit a family of four with a new top of the line smartphone every two years. So they entered the financing business, breaking the cost of the device into as many as 24 equal installment payments. Instead of paying $672 for a Samsung Galaxy S7, Verizon Wireless offers 24 equal installments of $28. That would be a distinction without much difference from the old subsidy system except for the fact some carriers are trying to sell their equipment financing obligations to a third-party, allowing them to move that debt off their books as well.

In fact, wireless providers are doing so well under the “no-contract/pay full price or installments” system, Wall Street analyst firm Trefis has started to ask whether the so-called wireless carrier “price war” is just a mirage. The firm notes (reg. req’d.) all the four major carriers are doing well and collecting an increasing amount of money from their customers than ever before. Much of that added revenue comes from customers bulking up data plans and being forced to pay for unlimited voice and texting features they may not need. But Trefis also points to reined in marketing spending at the carriers, who no longer have to entice customers into device upgrades as part of a contract renewal.

Things are looking worse for phone manufacturers that have relied on revenue based on the two-year device upgrade cycle in the United States. Apple is under growing pressure as its iPhone faces declining demand. In the U.S. alone, analysts predict iPhone sales will drop 7.1% this year. UBS predicts an even less optimistic 9% drop, followed by a 5% drop next year, even after iPhone 7 is introduced. AT&T has already reported some of the lowest upgrade rates ever during the first three months of 2016.

Another clue consumers are planning to hold on to their smartphones longer than ever — sales of rugged cases and screen protectors are up, as are smartphone protection/loss insurance plan sales, according to AT&T senior VP Steven Hodges. Parents even expect their children to give their phones better care.

Customers “realized it was a $500 to $700 device,” Hodges said at an industry conference held in June. “As such, they started taking care of them differently. You tell a kid this is only $49, the kid is going to use his phone as a baseball at times.”

Other customers are looking forward to benefiting from a dramatically lower bill after paying off their device in 24 months.

Kristin Maclearie has an iPhone 6 and she wants to keep it for the long term, if only to see her Verizon bill drop once she finishes her monthly payments. She told the Wall Street Journal as long as it keeps working, “I’ll just hang onto the one I have,” she said. “Unless something really cool comes out…but they’re always similar.”

Subscribe

Subscribe

What about another factor – as consumers have to pay outright for their devices used phones that are last year’s cool phone become more attractive. That is certainly the way I’m going with my family. This is after we had to replace a couple phones after mishaps and got quality devices for pennies on the dollar.