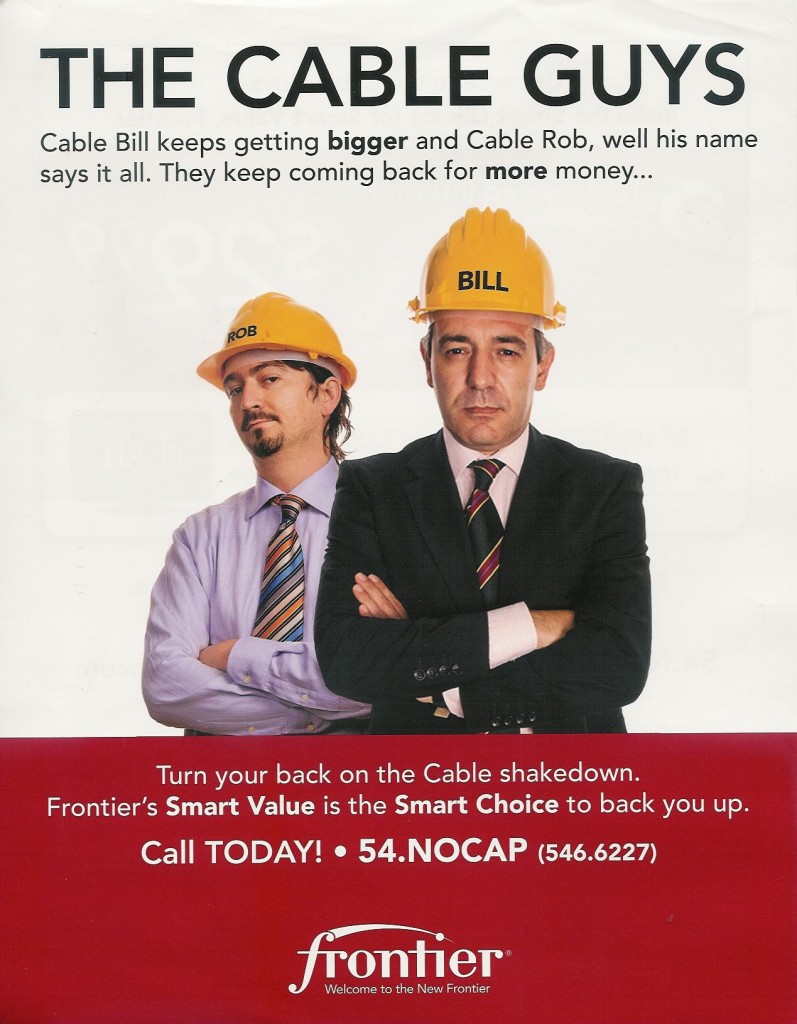

Frontier used Time Warner Cable’s usage cap experiment against them in this ad to attract new customers in the spring of 2009.

Frontier Communications has filed a rare objection with the Federal Communications Commission opposing the merger of Comcast and Time Warner Cable, citing concerns the merger would further harm competition and prevent Frontier and other competitors from getting fair access to programming owned by the combined cable companies.

“Comcast’s appetite for market control threatens the competitiveness of the video market,” wrote Frontier. “Comcast is already the largest Internet provider and largest video provider in the United States. If approved, Comcast’s video subscriber base would be approximately 52-times the size of Frontier’s video subscriber base.”

As Stop the Cap! wrote in its own objections to the merger, would-be competitors can and will be deterred from competing for video subscribers if they cannot obtain reasonable wholesale rates for popular cable programming. Currently, the largest providers extend the best volume discounts to the country’s largest satellite and cable operators. They make up those discounts by charging smaller customers higher rates. Frontier, as we noted in our filing, has already experienced the impact of volume discounting in its adopted FiOS TV areas in Indiana and the Pacific Northwest. Losing volume discounts originally obtained by Verizon, Frontier faced substantially higher programming costs as an independent provider — costs so great the company began asking customers to drop its own fiber television product in favor of third-party partner DISH, a satellite provider.

“Small multichannel video programming distributors (MVPDs) like Frontier cannot achieve the scale necessary to drive down programming costs, which are based upon an MVPD’s subscriber totals, to the same levels that Comcast can with this transaction,” noted Frontier. “Further, Comcast would own an enormous share of the “must have” programming that customers demand and could exercise its market dominance to either outright deny such programming to its competitors or to functionally deny the programming by charging exorbitant rates for content.”

“While Frontier continues to grow its subscriber base organically by delivering a quality product in its markets and also by acquiring AT&T’s wireline assets in Connecticut, the cost of content for video programming remains staggering for new entrants that lack the scale and scope of cable companies like Comcast and Time Warner Cable individually, let alone that of the merged entity,” said Frontier. “It is no mere coincidence that AT&T announced its proposed acquisition of DirecTV shortly after Comcast announced its intention to purchase Time Warner Cable. AT&T recognized the need to improve its subscriber scale in order to compete with Comcast on video programming pricing.”

Frontier noted the Federal Communications Commission also expressed grave concerns over Comcast’s ability to affect video competition during its acquisition of NBCUniversal. That merger was approved only after Comcast agreed to several conditions to avoid anticompetitive abuse in the marketplace. But Frontier complained a further acquisition of Time Warner Cable would only exacerbate competition concerns, even as Comcast argues the FCC should not contemplate any further investigation of the subject during its current merger review.

Subscribe

Subscribe