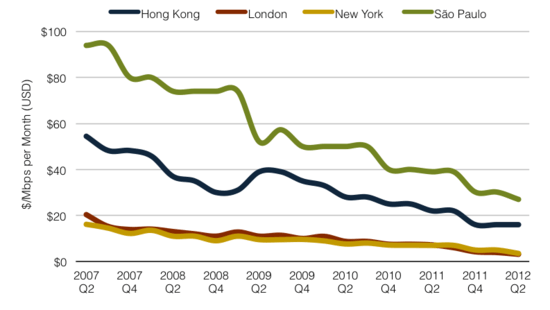

Broadband transport costs continue to decline, at an accelerating pace, according to researcher Telegeography.

Prices to move data across the Internet continue to decline throughout the world. According to new data from TeleGeography’s IP Transit Pricing Service, price declines in most locations accelerated over the past year, at an accelerating pace. But none of those savings are showing up on customer bills. In fact, while providers have been increasing broadband prices over the past three years, their costs to provide the service continue to plummet.

“IP transit prices have reached extremely low levels in developed markets, but remain high in many developing markets and in countries that are remote from major IP transit hubs,” said TeleGeography analyst Erik Kreifeldt. “Nevertheless, few places remain where transit prices exceed $100 per Mbps. As carriers expand into emerging markets and establish new price floors in developed markets, global IP transit prices will continue to fall.”

The median monthly lease price for a full GigE port in London dropped 57 percent between Q2 2011 and Q2 2012 to $3.13 per Mbps, compared with a 31 percent decline compounded annually from Q2 2007 to Q2 2012. In New York, the comparable price dropped 50 percent to $3.50 per Mbps over the past year, and 26 percent compounded annually over the five-year period. Pricing for short term promotions and high capacities have dropped below $1.00 per Mbps per month.

DSL Prime‘s Dave Burstein says that translates to Internet backbone wholesale pricing of less than $0.50 per broadband customer per month in New York or London.

Burstein also notes router and switch prices are also matching the predicted pace of Moore’s Law, declining 25-40 percent per annum. With competition for backbone connectivity robust in North America, the reduced costs are passed along to large broadband providers, but not to customers.

Burstein reports that while Internet traffic continues to expand at “ferocious rates,” your broadband provider’s net cost has been generally flat or even down. In fact, he estimates that when providers add up the cost of backbone transport costs and moving traffic from their network to individual customers, they end up spending less than $1 per month on traffic per customer. But they charge you $40-50 or more for the service.

Burstein also notes that broadband usage has almost no impact on provider costs, whether they offer 3Mbps or 1,000Mbps service, have caps of 50GB, 500GB, or no caps at all.

“With bandwidth costs this low, we’re talking dimes or at most a couple of dollars per month to handle any likely traffic flow,” Burstein reports.

Even accounting for perennial predictions of data tsunamis from equipment manufacturers like Cisco, their own data shows the primary cost of Internet traffic per customer is falling, according to Burstein, even as data consumption increases.

Subscribe

Subscribe

1. Transit costs are not the same as access costs. The difference is similar to the difference between being a long-distance provider and being a local telephone company. The two are entirely different.

2. If the access business was as cheap as this story implies, everybody would be getting into it.

3. @Danny Burstein: ask google how cheap are their access costs in KC. Again, if it were cheap, everyone would be doing it.

I know you know perfectly well the reason why everyone is not getting into the ISP business: the initial start-up infrastructure costs. The cable and phone companies benefit from the fact their outside plant has been already built and in most cases paid for. The biggest costs are wiring the last mile. Verizon is the one company willing to massively upgrade that last mile in larger populated segments of their service area and they were pummeled for it on Wall Street, and now the grand upgrade is largely over. The larger point here is there is absolutely zero justification for… Read more »

No doubt the initial infrastructure start-up costs are high — but not so high as to stop google from entering the market.

Obviously the $1 doesn’t include the “cost of business” to operate a ISP and is just the transit, nor as Phillip pointed out is it accurate for smaller ISP’s – especially those not located near large distribution points with access to cheaper transit. A smaller ISP may be paying anywhere from $10 to $80 per Mbps, compared to the quoted $3.50 rate for the big guys which carry the majority of the traffic over their own fiber or free peering agreements. What it does show is the declining and low cost of the large corporate Cable and Telco’s that do… Read more »

Part of what this shows, I’m sure, is that in the US, the actual cost of providing the service is only a fraction of the cost of running the business. I am not defending the major US ISPs… the US pays more for less than most developed countries, and that is deplorable. For example, the cost of crude oil is between 1/3 and 1/2 of the cost of gasoline, the rest is refining, transportation, overhead, and so on. I would love to see a cost breakdown of the US major ISPs, cable, wireless, telco, and others, that shows what fraction… Read more »

Phil Thanks for including me in your reporting. The comments are right – the costs I’m covering in this article are for the bandwidth itself, as well as ferrying it from the Internet access point to the neighborhood DSLAM. There’s plenty more involved in the cost of delivering the service, which has a marginal cost of $5-10 at any large carrier and a fully-loaded cost that’s of course higher. The bandwidth costs (transit/peering + provider’s backhaul to DSLAM) are a crucial number because that is the only difference in cost between slow service and the fastest service your local loop… Read more »

I think we’re both on the same page here although I may have tried to simplify the concept for readers to the point of fuzzing the distinction. I realize the piece I wrote only speaks about transport/bandwidth costs. It does not talk about infrastructure, construction, maintenance, marketing, et al. Last I had seen Verizon had gotten FiOS fiber builds down closer to the $700 level, but that is probably because of vicious control of their vendor costs, quantity buys, experience, etc. The larger point I am making is the ludicrousness of slapping caps and consumption billing for the traffic element… Read more »

Dave writes: “The overall conclusion on costs is that the change the last few years has been modest. That means that changes in prices are primarily due to something else. My impression is that competition is the key driver.” I appreciate the fact that Dave draws a distinction between costs to the carrier and prices to the end-user. Far too many pundits toss those two terms around as if they were the same thing, which they are not. Costs are costs and don’t change just because new competitors enter the market. And as Dave notes, putting fiber in the ground… Read more »

“DSL Prime‘s Dave Burstein says that translates to Internet backbone wholesale pricing of less than $0.50 per broadband customer per month in New York or London.” I’ve always been critical of how ISPs add up their expenses. What surprises me about this is that it seems that when you divide their backbone bill among all their customers, one comes to such a low number. I’ve always considered that this is where the prices were conditionally justified. Two networks will peer and, on a scoundrel’s handshake, agree to bill each other an astronomical amount of money per gigabyte, minus credit for… Read more »