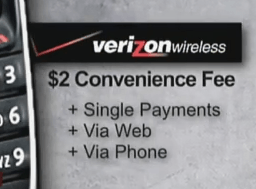

Verizon Wireless became the Bank of America of late 2011 when it attempted to impose a $2 “convenience fee” on select customers who prefer to pay their monthly phone bills online or through an automated telephone attendant. It’s just the latest experiment in customer gouging — the same kind of toe-in-the-water strategic experimenting that unleashed ubiquitous baggage fees on airlines, low balance fees on checking accounts, and the increasingly-common practice of charging customers extra to mail them their monthly bill.

Verizon Wireless became the Bank of America of late 2011 when it attempted to impose a $2 “convenience fee” on select customers who prefer to pay their monthly phone bills online or through an automated telephone attendant. It’s just the latest experiment in customer gouging — the same kind of toe-in-the-water strategic experimenting that unleashed ubiquitous baggage fees on airlines, low balance fees on checking accounts, and the increasingly-common practice of charging customers extra to mail them their monthly bill.

An entire industry of consultants pitch their creative talents to companies like Verizon who want “a little extra” from captive customers. These specialists sell their expertise identifying the most vulnerable (and least likely to leave), who will grin and bear just about any kind of abuse heaped on them. Many income and resource-challenged consumers are left feeling powerless to protest and reverse unwarranted extra charges.

The consultant gougers-for-hire made millions for large banks when they figured out how to score the biggest bounced check and overdraft fees (simply pay the biggest check first, opening the door to $39 bounced check fees for all the little checks that follow). Verizon’s $2 fee targeted customers who couldn’t afford to let the company automatically withdraw their monthly payment, or didn’t trust the company to do it correctly. Even more, Verizon’s fee would target more desperate past-due customers who needed to make a fast payment to avoid service interruption. Consumer advocates wondered if Verizon was successful charging these customers more, would they expand the fees to cover all online or pay-by-phone payments?

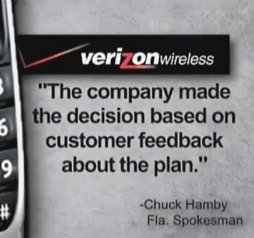

We’ll never know because the public outcry and intensive media coverage during a slow holiday week combined to force Verizon into a fourth quarter revenue retreat, rescinding the fee 24 hours after announcing it. But Verizon may be pardoned if they feel they were unfairly singled out. That is because other telecommunications companies have been charging certain customers bill payment fees of their own for years:

- Stop the Cap! reader Larry writes to share TDS Telecom, an independent phone company, charges a $2.95 “third party processing fee” when accepting payments by phone. “In its place you either have to revert to U.S. Postal Service, or agree to electronic billing for on-line payment access.”

- AT&T charges a $5 bill payment fee for “certain customers.”

- Sprint/Nextel not only has its own $5 bill payment fee for those paying at the last minute, it also forces customers with spotty credit to sign up for auto-pay to avoid a mandatory surcharge. Want a paper bill? That’s $2 extra a month.

- Comcast charges a $5.99 payment fee, but only in certain states.

- Time Warner Cable charges fees ranging from an “agent assisted payment” fee ($4.99) to a statement copy fee ($4.99) in some locations.

While Verizon has agreed to drop its latest new charge, the company’s carefully-named bill-padding extra fees attached to monthly bills remain. In addition to breaking out and passing along all government fees and surcharges, Verizon also bills customers administrative and regulatory recovery fees that, for other companies, would represent the cost of doing business. These latter two go straight into Verizon’s pocket, despite the implication they are third party-imposed mandatory surcharges.

Had Verizon called their new $2 “convenience” fee a “business efficiency accounting recovery fee,” would they have snookered enough consumers to get away with it?

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/WTVT Tampa Verizon cancels planned 2 bill-pay fee 12-30-11.mp4[/flv]

WTVT in Tampa says Verizon did a complete 180 on its $2 bill payment “convenience fee.” (3 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/CNN Verizon Dumps Fee 12-30-11.flv[/flv]

CNN hints the FCC’s potential involvement in Verizon’s business may have had something to do with the quick shelving of the $2 fee. (2 minutes)

Subscribe

Subscribe

I really am at a loss to understand Verizon’s decision. The announcement of a $2 “convenience fee” and its renouncement on the following day must be one of the dumbest business moves of 2011 in a very strong field. What were the Verizon guys thinking? This $2 fee looks to a customer exactly the way BofA’s $5 debit card fee did a couple of months ago when it caused a huge backlash, prompting the bank to quickly scrap it (but not before the damage to its reputation, such as it was, was already done). I would’ve expected no one to… Read more »